Consumer products giant Kimberly-Clark Corporation (NYSE:KMB) posted weaker-than-expected second-quarter 2017 results, wherein both earnings and revenues lagged the Zacks Consensus Estimate, probably due to softness in North America. Concurrent to the weak second-quarter results, the company anticipates soft earnings guidance for full year.

Adjusted earnings of $1.49 per share lagged the Zacks Consensus Estimate of $1.50 by 0.7% and year-ago adjusted results of $1.53 by 2.6%. Despite higher cost savings, earnings suffered due to lower sales and higher cost inflation.

Quarter in Detail

The company reported sales of $4.55 billion in the second quarter. Sales marginally lagged the Zacks Consensus Estimate of $4.56 billion by 0.2% and declined 1% from the prior-year quarter. Notably, currency did not impact second-quarter sales results.

Organic sales declined 1% from the prior-year quarter due to lower net selling prices. Softness in North American consumer products, higher competitive activity and less promotion shipments led to an organic sales decline of 2% in North America. Organic sales also declined 3% in developed markets outside North America. However, it increased 2% in developing and emerging markets in the quarter.

We note that apart from sluggishness in North America, Kimberly-Clark has been witnessing slower organic sales growth in developing and emerging markets over the last few quarters. We note that the company posted organic sales growth of 5% in each of the first and second quarters of 2016, which decelerated to 3% in the third quarter. Though it showed some improvement in fourth-quarter 2016 with organic sales growth of 4%, it remained flat in first-quarter 2017 and improved just 2% in second-quarter 2017.

Though the company has strong long-term growth prospects in these markets, the company expects only modest improvement in the overall environment in developing and emerging markets in 2017, particularly in the second half of 2017.

Operating profit in second-quarter 2017 declined 4.7% to $799 million. It was mainly impacted by lower sales and higher input costs of $75 million in the quarter due to increases in raw materials (mainly pulp). Nevertheless, the company generated $120 million of cost savings from the FORCE (Focused on Reducing Costs Everywhere) program during the quarter.

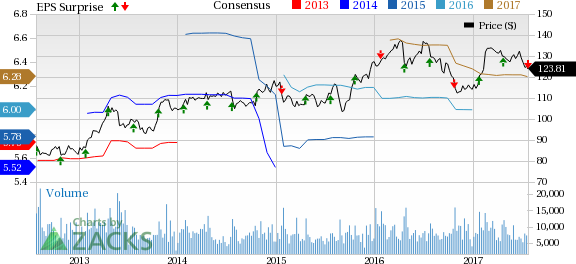

Share Price Movement

Kimberly-Clark’s shares have been underperforming the industry for the last one year. The stock has declined 6.4% in comparison to the industry’s decline of just 0.9%. Notably, the industry is part of the top 10% of the Zacks Classified industries (26 out of the 265).

Segment Details

Personal Care Products:The segment includes products like disposable diapers, training/ youth/swim pants, baby wipes, feminine and incontinence care products.

Segment sales of $2.3 billion declined marginally in the quarter as improved product mix was offset by lower selling prices. Sales improved in developing and emerging markets, but declined in two other regions of North America and developed markets outside North America.

Segment operating profit improved 3% to $467 million in the quarter driven by cost savings, partially offset by lower selling prices and input cost inflation.

Consumer Tissue:The segment includes bathroom tissue, paper towels, napkins and related products for household use.

Segment sales dropped 2% to $1.5 billion in second-quarter 2017 owing to lower volumes and average selling prices. Sales improved in developing and emerging markets but declined in two other regions of North America and developed markets outside North America.

Segment operating profit declined 12% to $241 million in the quarter, as lower sales, higher cost inflation and other manufacturing costs more than offset the benefits from cost savings and lower marketing spending.

K-C Professional (KCP) & Other:The segment consists of facial and bathroom tissue, paper towels, napkins, wipers and a range of safety products.

Segment sales grew marginally to $0.8 billion in the second quarter. Growth in volumes and improved product mix was offset by lower selling prices. Sales improved in North America and developing and emerging markets but it declined in developed markets outside North America.

Segment operating profit surged 9% to $163 million, gaining from cost savings, lower manufacturing costs and reduced marketing, research and general spending, partially offset by input cost inflation.

Other Financial Update

Cash and cash equivalents were $1.05 billion as of Jun 30, 2017. Capital expenditure was $171 million. Cash provided by operations in second-quarter 2017 was $825 million. Long-term debt was $6.8 billion.

In the second quarter, the company repurchased 2.3 million shares at a total cost of $300 pursuant to a share repurchase program.

Guidance for 2017

The company has revised its earnings guidance for 2017 in view of weak second quarter result. It now expects earnings per share at the low end of its previous targeted range of $6.20–$6.35.

Net sales and organic sales in 2017 are expected to be similar or slightly up from the previous estimate of 1 to 2% growth, for both sales and organic sales driven by higher volumes. Input cost inflation are expected to be higher in the range of $200–$300 million as compared with the previous estimate of $150–$250 million. Encouragingly, the company has raised the cost savings target for 2017. It now expects cost savings of $425–$450 million from the company's FORCE program. The prior estimate for savings was $400 million.

Zacks Rank and Key Picks

Kimberly-Clark currently carries a Zacks Rank #4 (Sell).

Some better-ranked companies from the industry include Energizer Holdings, Inc. (NYSE:ENR) , Ollie's Bargain Outlet Holdings, Inc. (NASDAQ:OLLI) and Newell Brands Inc. (NYSE:NWL) . While Energizer Holdings sports a Zacks Rank #1 (Strong Buy), both Ollie's Bargain Outlet Holdings and Newell Brands carry a Zacks Rank #2 (Buy). You can seethe complete list of today’s Zacks #1 Rank stocks here.

While Energizer has a long-term earnings growth rate of 10.1%, Ollie's Bargain and Newell have a long-term earnings growth rate of 18.9% and 12.1%, respectively.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artifical intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Kimberly-Clark Corporation (KMB): Free Stock Analysis Report

Newell Brands Inc. (NWL): Free Stock Analysis Report

Energizer Holdings, Inc. (ENR): Free Stock Analysis Report

Ollie's Bargain Outlet Holdings, Inc. (OLLI): Free Stock Analysis Report

Original post

Zacks Investment Research