Obviously, the big news this past week was the Greek deal. This only delayed the inevitable. The plan calls for additional austerity measures, which have been completely ineffective.Greek unemployment is over 25%; the economy is in the middle of a depression, and the debt/GDP ratio increased from 105% in 2008 to 177% currently.

The country will simply continue on this path for the foreseeable future, leading to another inevitable conflict with the lending troika. The ECB also issued its policy statement this week, which kept rates unchanged.Here is how the bank described the current EU economic environment:

Euro area quarterly real GDP growth was confirmed at 0.4% in the first quarter of 2015, supported by contributions from private consumption and investment. … Looking ahead, we expect the economic recovery to broaden further. Domestic demand should be further supported by our monetary policy measures and their favourable impact on financial conditions, as well as by the progress made with fiscal consolidation and structural reforms. Moreover, the recent decline in oil prices should provide additional support for households’ real disposable income and corporate profitability and, therefore, private consumption and investment. Furthermore, demand for euro area exports should benefit from improvements in price competitiveness. However, the ongoing slowdown in emerging market economies continues to weigh on the global outlook and economic growth in the euro area is likely to continue to be dampened by the necessary balance sheet adjustments in a number of sectors and the sluggish pace of implementation of structural reforms.

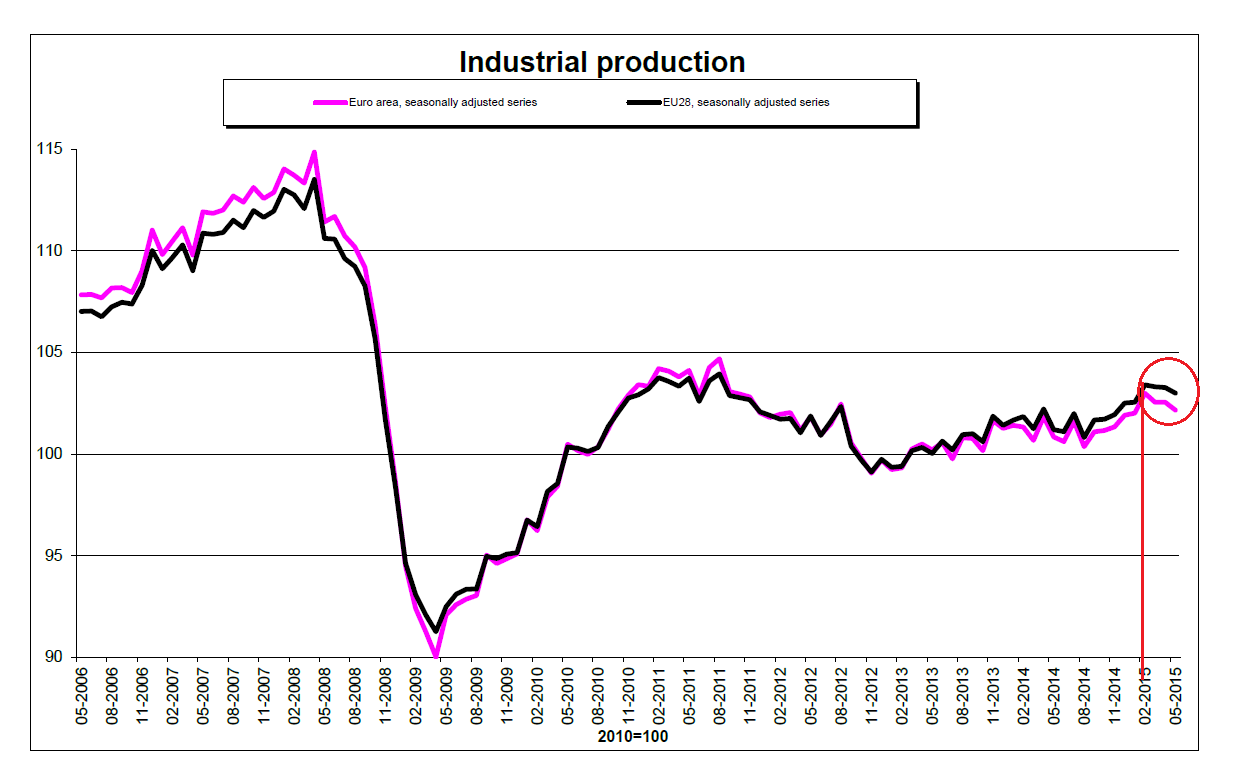

Data has rebounded since the first of the year. The PMI surveys are positive and retail sales have risen.However, the latest industrial production number showed a .4% decline. While energy production decreased 3.2%, non-durable consumer goods also dropped 1.4%. As this accompanying chart shows, overall production has been weaker the last few months:

My guess is the Greek and, to a lesser extent, Ukraine situations are the primary reasons for this decrease. Now that Greece is settled, at least for the short-term, this figure should start increasing in line with the PMI numbers. The balance of trade was positive while inflation was still low: Y/Y core inflation was .8% while total was .2%. With the exception of Greece (and that’s a big exception) the region is still doing well.

The bank of Canada lowered rates 25 basis points to 50. As noted in last week’s column, this was a distinct possibility. Oil’s price drop has severely impacted the Canadian economy, which the bank noted in their policy statement:

The Bank’s estimate of growth in Canada in 2015 has been marked down considerably from its April projection. The downward revision reflects further downgrades of business investment plans in the energy sector, as well as weaker-than-expected exports of non-energy commodities and non-commodities. Real GDP is now projected to have contracted modestly in the first half of the year, resulting in higher excess capacity and additional downward pressure on inflation.

The Bank expects growth to resume in the third quarter and begin to exceed potential again in the fourth quarter, led by the non-resource sectors of Canada’s economy. Outside the energy-producing regions, consumer confidence remains high and labour markets continue to improve. This will support consumption, which will also receive a fiscal boost. Recent evidence suggests a pickup in activity and rising capacity pressures among manufacturers, particularly those exporters that are most sensitive to movements in the Canadian dollar. Financial conditions for households and businesses remain very stimulative.

The Bank now projects Canada’s real GDP will grow by just over 1 per cent in 2015 and about 2 1/2 per cent in 2016 and 2017. With this revised growth profile, the output gap is significantly larger than was expected in April, and closes somewhat later. The Bank anticipates that the economy will return to full capacity and inflation to 2 per cent on a sustained basis in the first half of 2017.

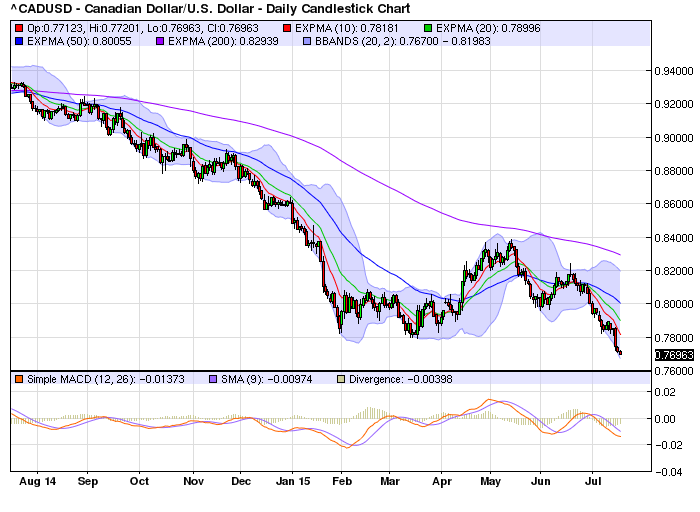

The bank admitted a technical recession (two consecutive quarters of contract) is a strong possibility at this point. In response to the policy change, the Canadian dollar dropped through the 77 support level. This should have a positive impact on Canadian exports, which have moved lower recently:

The Loonie also dropped through the 4.85 level versus the Chinese yuan:

Due to their reliance on oil exports, keep an eye on the Canadian economy.

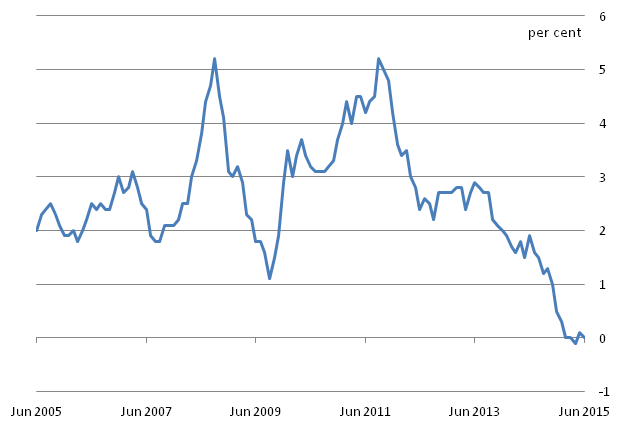

UK inflation was 0% Y/Y. This marked the fifth consecutive month with the Y/Y rate fluctuating around the 0% rate:

Earlier this month, the Bank of England stated it was still focused on raising rates, largely as a result of rising wages. But while weekly pay increased 2.8% Y/Y in the latest employment report, unemployment increased .1%, rising to 5.6%.

The Bank of Japan maintained their rate and asset purchase program. Their policy announcement contained the following assessment of the Japanese economy:

Japan's economy has continued to recover moderately. Overseas economies -- mainly advanced economies -- have been recovering, albeit with a lackluster performance still seen in part. In this situation, exports and industrial production have been picking up, albeit with some fluctuations. As corporate profits have improved and business sentiment has generally stayed at a favorable level, business fixed investment has been on a moderate increasing trend. Against the background of steady improvement in the employment and income situation, private consumption has been resilient and housing investment has started to pick up. Meanwhile, public investment has entered a moderate declining trend, although it remains at a high level. Financial conditions are accommodative. On the price front, the year-on-year rate of increase in the consumer price index (CPI, all items less fresh food) is about 0 percent. Inflation expectations appear to be rising on the whole from a somewhat longer-term perspective.

The 1Q 3.9% growth rate was the result of broad-based contributions, with the exception of residential investment. This is reflected in the above policy statement. The bank did slightly lower their 2H15 growth projections while maintaining 2016 and 2017 levels. However, some analysts are projecting a 2Q15 contraction:

Economists such as Mr Adachi are not forecasting a recession. They expect growth to pick up in the second half but their gloom about the second quarter reflects a lack of momentum in recent data.

Most painfully, industrial production fell by 2.2 per cent in May, while an index of services activity fell 0.7 per cent. Consumption data published by the Cabinet Office is down since March.

“What we have currently is consistent with contraction of as much as half a per cent in the second quarter,” said Marcel Thieliant, who follows Japan at Capital Economics in Singapore.

2Q15 Chinese Y/Y GDP was 7% while CPI was 1.3%. Growth clearly benefitted from the four interest rate cuts in the last year:

Although industrial production and retail sales did increase on a Y/Y basis, the long-term trend of both coincident indicators continues lower:

As always, I’ll cover US data in far more detail in the weekly US Equity and Economic Review. There were two important Federal Reserve releases: Janet Yellen’s testimony and the Beige Book, which offered the following assessment of the economy:

All twelve Federal Reserve Districts indicated that economic activity expanded from mid-May through June. Activity in New York, Philadelphia, and Kansas City grew at a modest pace, while Richmond, Atlanta, Chicago, St. Louis, Minneapolis, Dallas, and San Francisco saw moderate growth. Compared with the previous report, growth remained steady in Cleveland, and Boston reported conditions were stable or improving. Boston, Philadelphia, Atlanta, Kansas City, and Dallas reported that contacts were optimistic about future growth, while Chicago and San Francisco cited optimism coming from specific sectors.

Industrial production printed a .3% increase – which, considering the negative strong dollar and energy sector impacts, was welcome. Retail sales disappointed with a .3% decrease. Finally, inflation was up a very tame .3%.

So, how to sum up these week's events? The financial markets were surprisingly resilient with regard to the Greek situation. There were no major market crashes; instead, everyone seemed to take the results in stride.

We are still facing two issues: continued problems from Greece and potentially other EU countries (Spain, Portugal and, to a lesser extent, Italy) along with the continued Chinese slowdown. These will be with us for the foreseeable future. Aside from these two events, however, the world economy continues in slow-growth mode.