Weekend Review:

Kick away those Monday morning cobwebs, markets are open!

Friday night saw Federal Reserve Bank of San Francisco President John Williams speaking at the Brookings Institution in Washington DC. In a speech titled “Measuring the Natural Rate of Interest”, Williams was very cautious when speaking about whether a December rate hike was actually in play or not. The tone of the speech was the stock standard, wanting to see more economic data in the coming weeks before deciding whether the economy is ready for any rate hikes.

After Thursday’s hawkish FOMC statement, Williams also took the opportunity to reel back some of last week’s added expectation. After chopping and changing, Williams was asked by the Associated Press why the Fed indicated that December was in play. Williams’ reply was only that the Fed chose to mention the possibility in its statement to avoid surprising investors in case it did raise rates then.

So to not surprise, they surprised. Yep, makes perfect sense.

European Comment:

The weekend also saw Mario Draghi’s comments around the expansion of the ECB’s QE program scaled back.

After last week stating that the ECB was actively exploring ways to expand QE, Italy’s Il Sole 24 Ore published the following from Draghi:

“There is still an open question whether adding further stimulus will be necessary.”

“It is too early to pass judgement on lowering the deposit rate further below zero.”

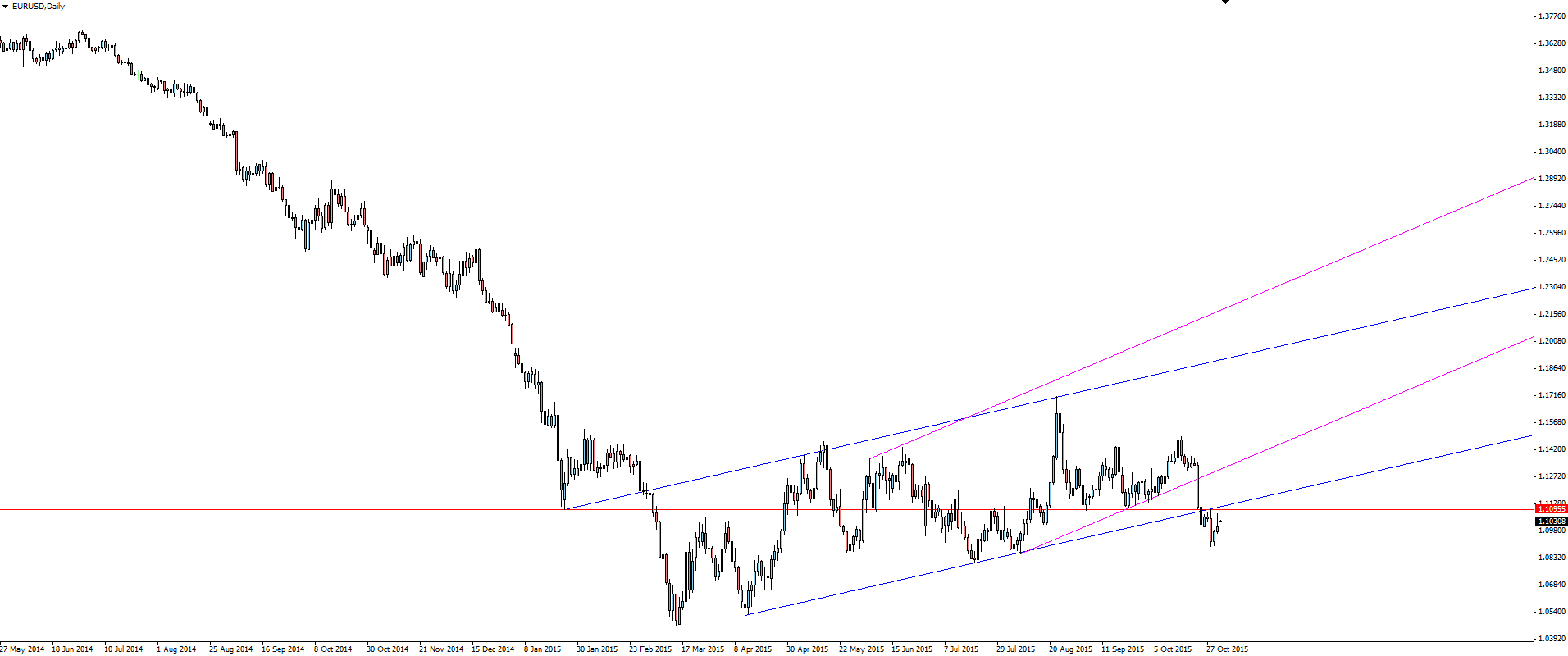

EUR/USD Daily:

Click on chart to see a larger view.

Will this bring any euro retracement following last week’s carnage?

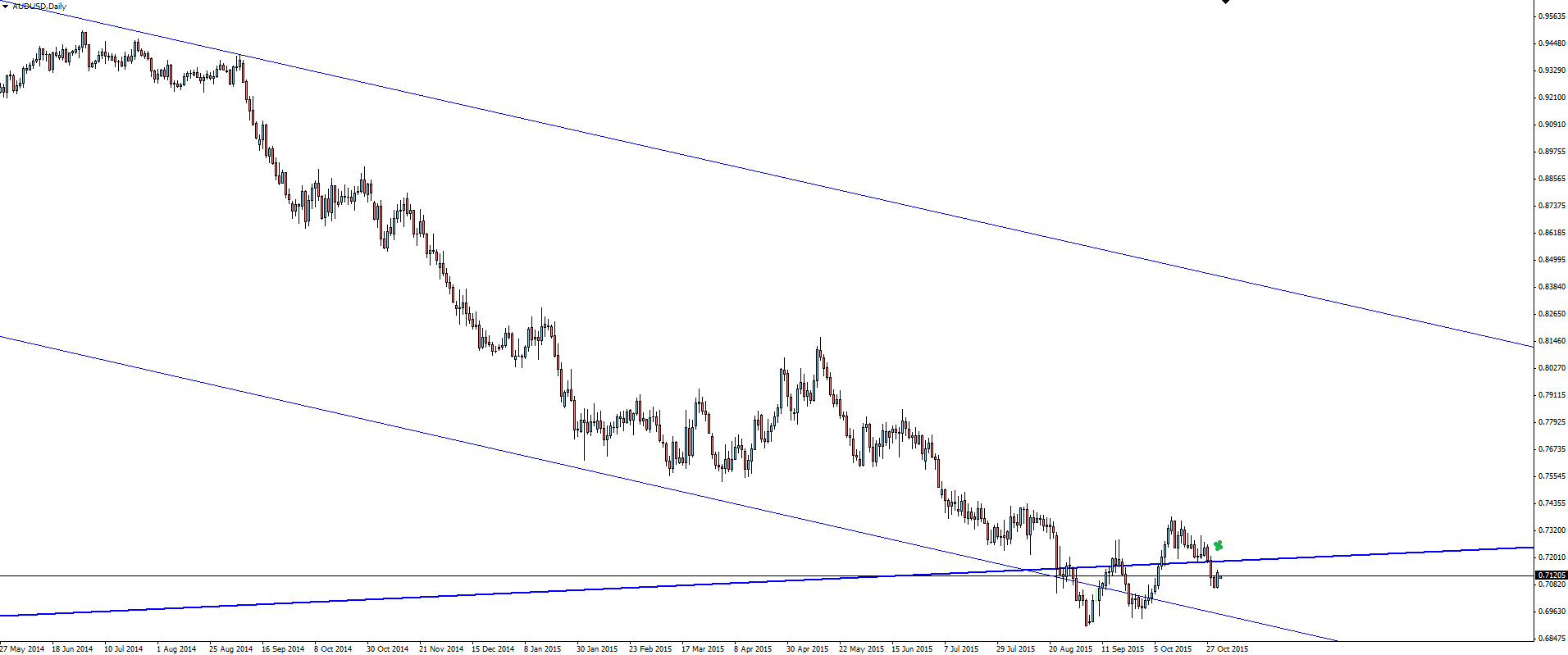

Finally looking forward, we have the RBA seemingly in play tomorrow being the highlight of the week.

AUD/USD Daily:

On the Calendar Monday:

We see a million CPI releases across Europe and North America today. Be aware of what’s coming between the following tier 1 releases.

AUD Building Approvals m/m

CNY Caixin Manufacturing PMI

GBP Manufacturing PMI

USD ISM Manufacturing PMI

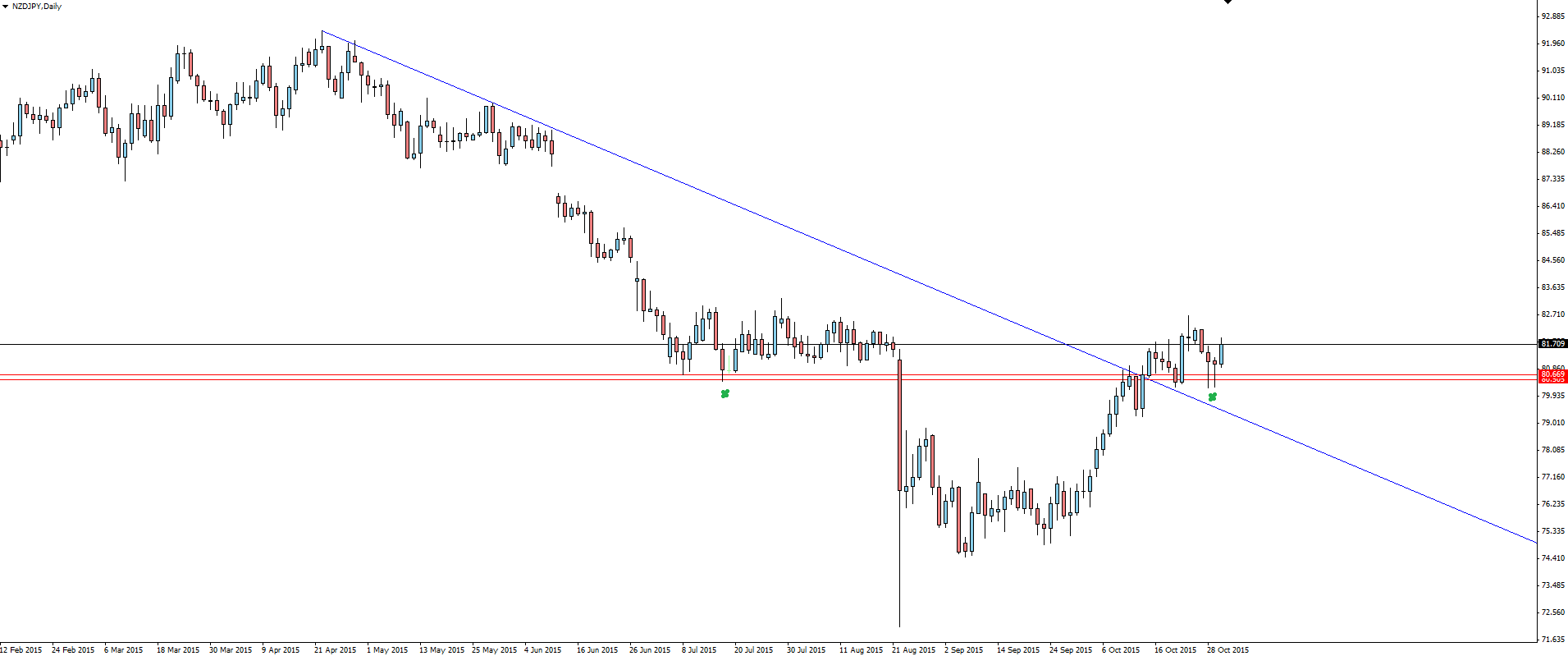

Chart of the Day:

After an initial 130 pip rejection from our NZD/JPY + EUR/JPY correlation trade idea, kiwi yen broke out of its bearish trend line.

NZD/JPY 4 Hourly:

From here, price hasn’t managed to hold onto any higher high. but has been retesting the breakout zone this time as support.

After forming a couple of nice long wicks in and out of support, will price find some traction here?

Do you see opportunity trading the Yen crosses?

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd, does not contain a record of our prices, or an offer of, or solicitation for, a transaction in any financial instrument. The research contained in this report should not be construed as a solicitation to trade. All opinions, news, research, analysis, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person opening a trading account and acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.