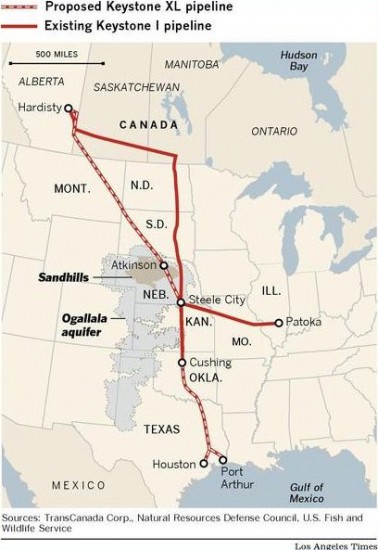

The latest last-ditch temporary fixes to avert another embarrassing political stalemate came on Saturday, 17 Dec. when the U.S. Senate passed a plan to extend the payroll tax cut for two months. However, thanks to the 'creative packaging' of Washington politicians, the senate package somehow includes a measure that would require President Obama to make a decision within 60 days on the Keystone Pipeline project, which would transport Canadian oil sands crude from Alberta to refineries on the Gulf coast around 2013 (See Map Below).

The Obama administration, under intense political and environmentalist's pressure announced in November that it would delay any decision about the Keystone XL pipeline until after the 2012 election. Politics aside, Keystone XL Pipeline controversy seems to have morphed into one that's mostly centered on approving Keystone XL pipeline is in essence endorsing tar sands' potential negative environmental impact, which is entirely off-topic, in our view.

Oil Sands - A Canadian Resource Decision

Oil sands, as "the bomb of carbon and greenhouse gas" as some called it, is nevertheless a natural resource property of another sovereign nation--Canada--that has decided to exploit adding to the world's energy source portfolio, after weighing all risks and benefits. This oil resource, therefore, is and will be available, judging by the size of typical capital and resource requirement, for years to come, till revoked by the Canadian government.

Strategic and Practical Sense

The next logical question is--Does the U.S. and the world need this additional crude oil source? The answer could be a NO if renewable and green energy has reached end-user price, supply reliability and distribution parity as the conventional fossil fuel. However, based on various agencies' forecast, while renewable energy will enjoy increasing market share in the foreseeable future, the world will still run largely on traditional fossil sources.

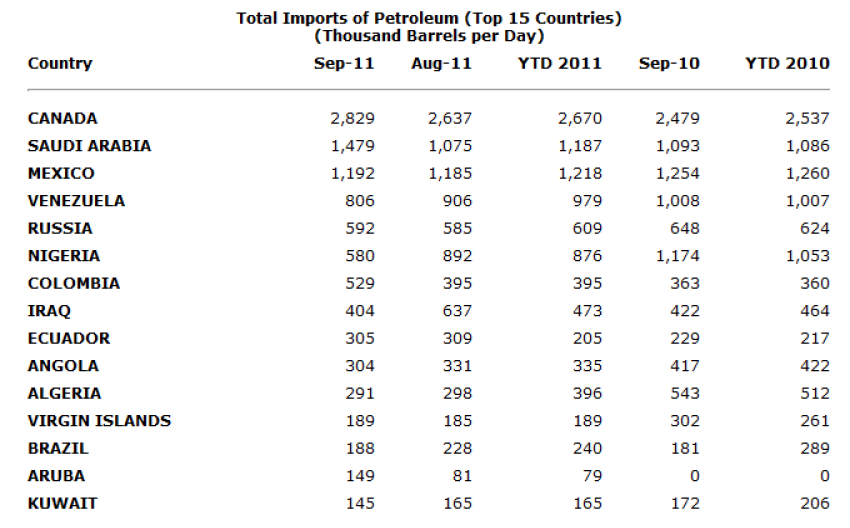

Ideally, it'd be nice if the U.S. could be rid of foreign oil dependency altogether and runs on 100% renewables. Realistically and strategically, the U.S. needs all available energy sources, and fossil fuels will remain critical. So it comes down to a choice between either importing more from Canada or from other volatile and often not-so-friendly regions. (See Table Below)

As natural resources are getting more scarce each day, the decision on the part of the United States is how to secure and utilize this close-to-home new energy source in the most economic and efficient way possible, rather than whether to not tar sand oil should be produced, or transported. And pipeline remains the most economical and efficient among all transportation modes for crude oil.

More Infrastructure Capacity and Flexibility

Regarding the project itself, the economic bottom line is that any time there's a construction project to build up and invest in a nation's infrastructure is good thing. Keystone XL is just another crude pipeline, which, if approve, will become part of the existing 50,000+ miles domestic crude lines (as of 2009) that will enhance America's transportation infrastructure.

Since most of the domestic crude pipelines are structured to flow inland, the Keystone XL pipeline, flowing from inland to the coast, will add the takeaway capacity to some of the stranded new domestic shale oil producing basins, as well as the infamous Cushing, OK, and flexibility to the nation's existing infrastructure.

Any New Job Creation Is Good, Even Temporary

Despite some dispute regarding the number of jobs Keystone might actually create, the 5,000-6,000 temporary annual new jobs seems to be a realistic number most people can live with so far. Some have criticized the job creation aspect of the Keystone project as a 'temporary' fairy tale. Nevertheless, others, such as the construction sector that's facing 13.1% unemployment rate in Dec. and shrinking employment, would most likely appreciate any new jobs out there, however temporary they might be.

U.S. Gasoline Prices Move With Brent, Keystone XL To Have Little Influence

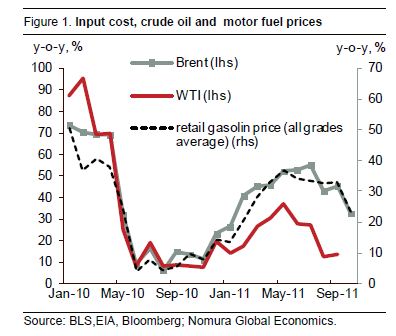

Another argument widely cited is that by importing the more costly tar sand oil, and normalizing WTI oil marker at Cushing, which has traded at a steep discount to the North Sea Brent, American consumers would end up paying a higher price for refined petroleum products such as gasoline and diesel.

Well, here is a new flash. The oil market, as broken as its current paper pricing model, is working quite efficiently in that the U.S. gasoline prices have been moving with Brent which is regarded as the better benchmark, ever since WTI price got artificially pushed down by stranded storage glut at Cushing about two years ago (See Chart Below from Nomura). Brent oil, on the other hand, has been moving tick by tick with geopolitics in the MENA (Middle East and North Africa) more than anything else.

Crude oil is one commodity that's truly international, highly liquid and moves on its own supply, demand and most importantly, geopolitical dynamics. So Keystone pipeline may be a big multi-billion-dollar project, it carries little weight in setting the oil and gasoline prices. (By the way, Federal Reserve's two rounds of QEs is an even bigger factor than MENA geopolitics in driving up all commodity prices, including crude oil since the 2008 financial crisis.)

Creative Packaging Complicates

Now the latest development is that House Republicans are set to vote down the Senate deal, and Congress is preparing for a final showdown over fiscal policy "with the fate of a payroll tax cut for 160 million U.S. workers on the line."

Initially, by forcing President Obama's hand, so to speak, the GOP probably was hoping to expedite the Keystone XL project. And if Obama rejects, it would be another "jobs denial" token in the 2012 GOP election campaign.

So this otherwise mundane pipeline project is now a hotly debated sticking point between idealism, politics and economics. While it is nice that some of us are obviously on a higher tier of Maslow's hierarchy of needs worrying about the potential number of green jobs might get displaced, Keystone XL project should be evaluated based on economic merits first and foremost, rather than letting idealism and politics take the center stage.