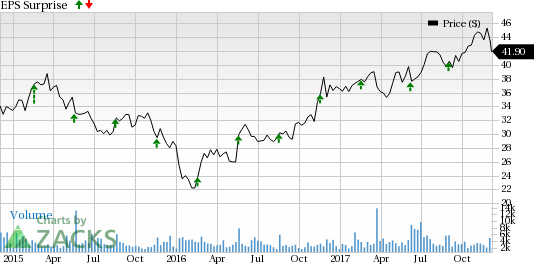

Keysight Technologies Inc. (NYSE:KEYS) is set to release fiscal fourth-quarter 2017 results on Dec 6. The company has delivered positive earnings surprise in the trailing four quarters, with an average beat of 3.85%.

The company’s focus on launching new solutions for growth markets like 5G, Internet of Things (IoT), next-generation wireless, high-speed datacenters and automotive & energy are expected to be key catalysts.

Last quarter, the company delivered a positive earnings surprise of 1.67%. Non-GAAP earnings of 61 cents per share declined 2.6% from the year-ago quarter but surpassed the Zacks Consensus Estimate of 54 cents per share. Non-GAAP revenues of $863 million surged 21.4% on a year-over-year basis.

For fourth-quarter fiscal 2017, Keysight forecasts non-GAAP revenues in the range of $875-$905 million. Non-GAAP earnings are expected to be in the range of 59-69 cents per share or 64 cents at the mid-point.

Key Factors

During the last reported quarter, Keysight’s management stated that orders for 5G solutions have more than doubled on a year-over-year basis. The company’s expertise in high-frequency and millimeter wave technologies is helping it to partner innovators like Verizon Communications Inc. (NYSE:VZ) in the domain.

The trend continued in the fourth quarter of fiscal 2017 as Keysight and Qualcomm Technologies, Inc., a subsidiary of Qualcomm Incorporated (NASDAQ:QCOM) established a 5G data connection in a single-chip 5G modem.

Additionally, the company also released the latest version of its SystemVue electronic system level (ESL) software aimed at providing designers with the first-of-its-kind 5G design and verification process.

Moreover, IoT also presents significant growth opportunity based on the company’s broad and diverse portfolio that effectively addresses the needs of customers related to power consumption, RF performance, interoperability and conformance testing.

During the soon-to-be-reported quarter, the company’s mobile IoTtest system was adopted by China Mobile Research Institute (CMRI) for the purpose of verification and optimization of IoT devices.

However, uncertainties related to aerospace, defense & government (ADG) end markets are anticipated to hurt the top line of the company.

What Our Model Says

According to the Zacks model, a company with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) has a good chance of beating estimates if it also has a positive Earnings ESP. The Sell-rated stocks (Zacks Rank #4 or #5) are best avoided. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Keysight has a Zacks Rank #3 and its Earnings ESP is 0.00%. Therefore, the company is unlikely to deliver a positive surprise this quarter.

Stock to Consider

Here is a stock which, as per our model, has the right combination of elements to post an earnings beat this quarter:

Arista Networks (NYSE:ANET) with an Earnings ESP of +2.13% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

QUALCOMM Incorporated (QCOM): Free Stock Analysis Report

Arista Networks, Inc. (ANET): Free Stock Analysis Report

Verizon Communications Inc. (VZ): Free Stock Analysis Report

Keysight Technologies Inc. (KEYS): Free Stock Analysis Report

Original post

Zacks Investment Research