Talking Points

- EUR/USD fails at key Gann level

- NZD/USD cracks important trendline

- USD/NOK nearing cyclical inflection point

Foreign Exchange Price & Time at a Glance

Charts Created using Marketscope – Prepared by Kristian Kerr

- EUR/USD traded to its highest level two months last week before stalling at Gann resistance in the 1.1270 area

- Our near-term trend bias remains higher while above 1.1075

- A close over 1.1270 is needed to re-instill upside momentum in the rate

- A minor cycle turn window is eyed around the middle of the week

- A close below 1.1075 would turn us negative on the euro

EUR/USD Strategy: Like the long side while above 1.1075, but a cycle convergence this week suggests the broader trend could be re-asserting.

|

Instrument |

Support 2 |

Support 1 |

Spot |

Resistance 1 |

Resistance 2 |

|

EUR/USD |

*1.1075 |

1.1115 |

1.1130 |

1.1200 |

*1.1270 |

Charts Created using Marketscope – Prepared by Kristian Kerr

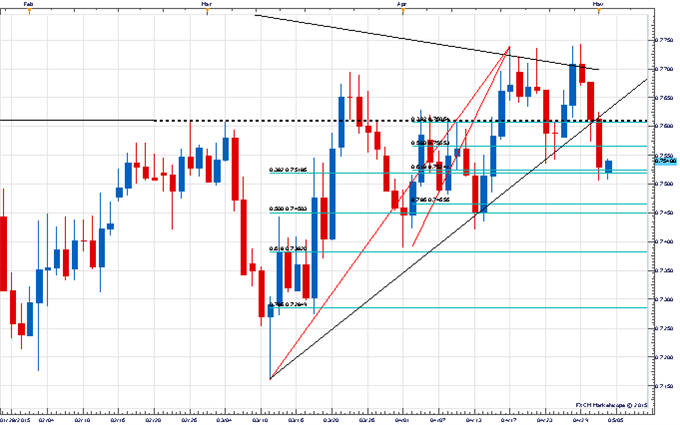

- NZD/USD failed last week near a trendline connecting the October and January highs

- Our near-term trend bias is now lower in the Kiwi

- A move under the 38% retracement of the March-April rally at .7520 is needed to set off a more serious decline

- A minor turn window is eyed tomorrow

- A daily close back over .7630 would turn positive again on NZD/USD

NZD/USD Strategy: Like the short side while under .7630.

|

Instrument |

Support 2 |

Support 1 |

Spot |

Resistance 1 |

Resistance 2 |

|

NZD/USD |

.7465 |

*.7520 |

.7530 |

.7560 |

*.7630 |

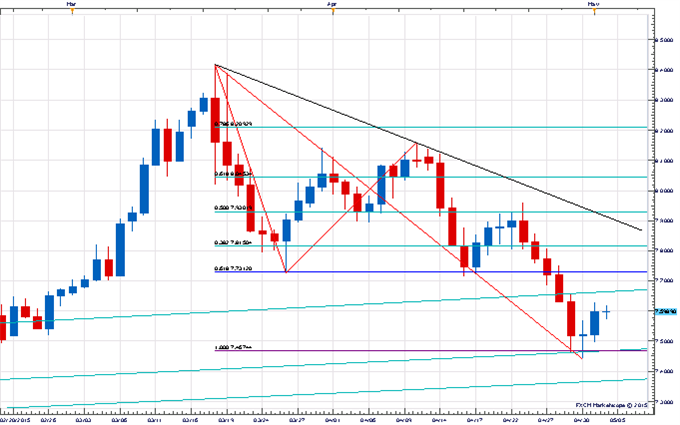

Focus Chart of the Day

Our work with cycles suggests this week should prove important for USD/NOK. Around the middle of the week several short and medium-term timing relationships will be converging in the pair setting up a clear potential reversal in spot. Since March, the rate has come under steady pressure and has proven to be one of the better ways to express a negative USD view. Despite the steadiness of the decline, it has still had a rather corrective tone about it. Questions should be answered this week as to the true nature of this recent move lower. A turn higher over the next few days would confirm our suspicions and allow for a resumption of the broader uptrend. A failure to respond to this turn window, however, would signal that a much more important correction is still unfolding and set the stage for at least a few more weeks of downside. Last week’s low came around the measured move of the late March decline in the 7.4700 area and this level should continue to be an important level to monitor. On the upside, a clear pivot looks to be the recent breakdown point near 7.7300 with traction above needed to confirm that the dollar has turned.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com