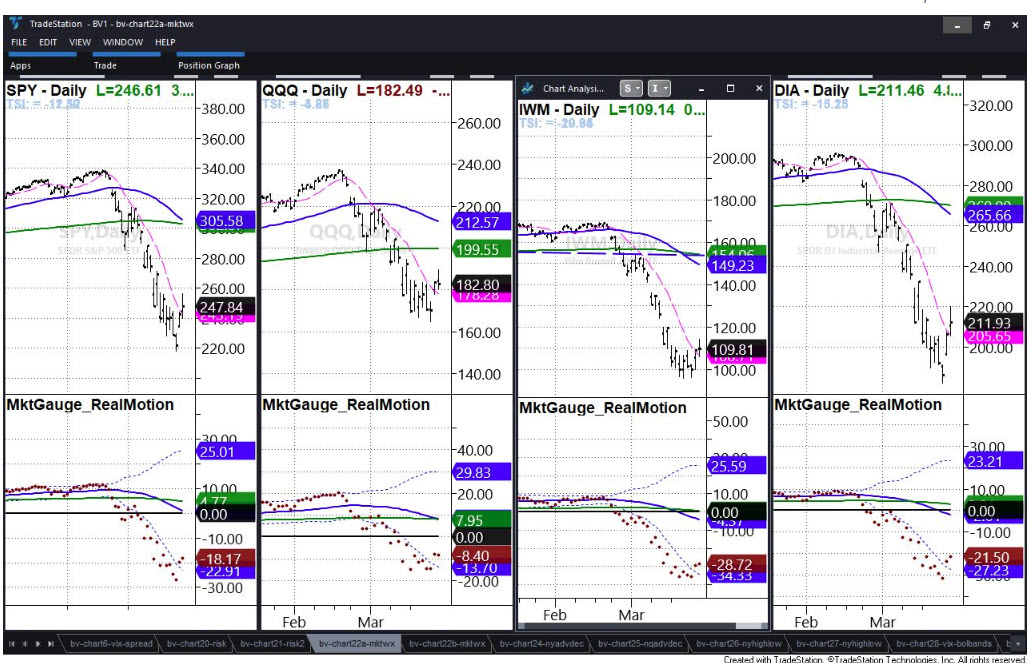

This is a shot of our BigView tool-the indices with our real motion indicators.

All you need to know-

First-the momentum has turned the corner for falling to rising.

Secondly, here are the key closing levels for the week to determine how much if any, risk you should take home for the weekend.

Indices-Closing Levels

In the S&P 500-SPY-it must close over 256.35. The 200-week moving average is 264.00 A close below 241 not healthy.

The Russell 2000-IWM must close over 111.30 and clear 119.47 to keep going

NASADAQ 100-QQQ must hold 184.68 and clear 192.40 to keep going

The Dow DIA must hold 218.31 and clear 232.11 to keep going.

Economic Modern Family-Closing levels

Retail XRT Must clear 30.93, hold 27.96. Biotechnology IBB Must clear 104.99 and hold 95.00. Regional Banks KRE (weakest) must hold 32.25 and clear 35.34.

Semiconductors SMH must hold 112.44 and clear 120.66. Transportation IYT must hold 138.91 and clear 142.58.

Important Outliers-Closing Levels

LQD or High Yield Investment Grade Bonds has the 200-week moving average at 119.96. Must hold 115.42, and clear 122.05.

Junk Bonds JNK must close above 93.49 and hold 85.97

Oil USO (NYSE:USO) must close above 4.94, clear 6.09 and hold 4.29.

This is the basis of my trading plan for not only our existing positions but also whether we add, raise stops or put on protection Friday or Monday.

S&P 500 (SPY (NYSE:SPY)) must close over 256.35. The 200-week moving average is 264.00 A close below 241 not healthy.

Russell 2000 (IWM) must close over 111.30 and clear 119.47 to keep going

Dow (DIA) must hold 218.31 and clear 232.11 to keep going

Nasdaq (QQQ) must hold 184.68 and clear 192.40 to keep going

KRE (Regional Banks) must hold 32.25 and clear 35.34.

SMH (Semiconductors) must hold 112.44 and clear 120.66.

IYT (Transportation) must hold 138.91 and clear 142.58

IBB (Biotechnology) Must clear 104.99 and hold 95.00

XRT (Retail) Must clear 30.93, hold 27.96.

Volatility Index (VXX) Back looking t 40.00

Junk Bonds (JNK) must close above 93.49 and hold 85.97

LQD (iShs iBoxx High yield Bonds) the 200-week moving average at 119.96. Must hold 115.42, and clear 122.05.