Last week's economic data releases brought volatility to the financial markets. Stocks sold off following worse-than-expected PMI readings, then they got back up after Friday's huge Nonfarm payrolls beat. The price of Gold rallied and then sold off. In the coming week, we may see even more trading action. Especially on Wednesday. Let's take a look at the details.

The week behind

Last week's economic data releases brought volatility to financial markets. On Monday and Wednesday stocks were selling off and prices of gold, oil were gaining following weaker-than-expected PMI numbers readings. But on Friday we saw roller coaster-type ride back, as investors went risk-on again following much better than expected monthly jobs data release.

The week ahead

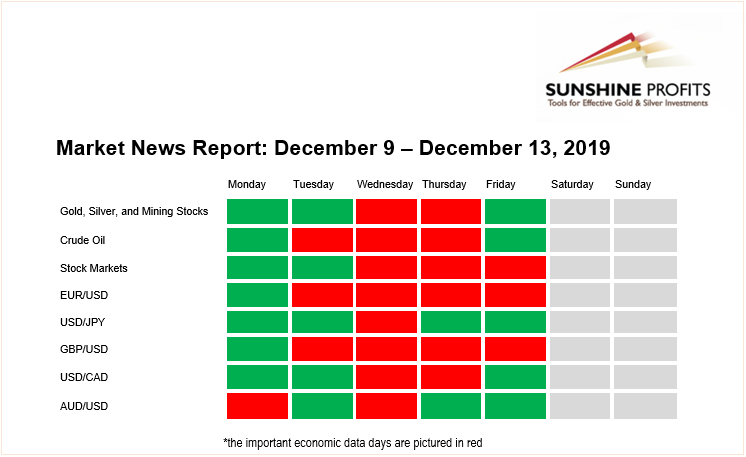

What about the coming week? All eyes will be on Wednesday's FOMC Rate Decision. There's no need to argue that it will be the most important piece of economic data this week. Then we will get the analogous Eurozone's rate decision on Thursday. The other market-moving releases include Tuesday's German ZEW Economic Sentiment number, Wednesday's CPI and Friday's Retail Sales. Let's take a look at the key highlights: