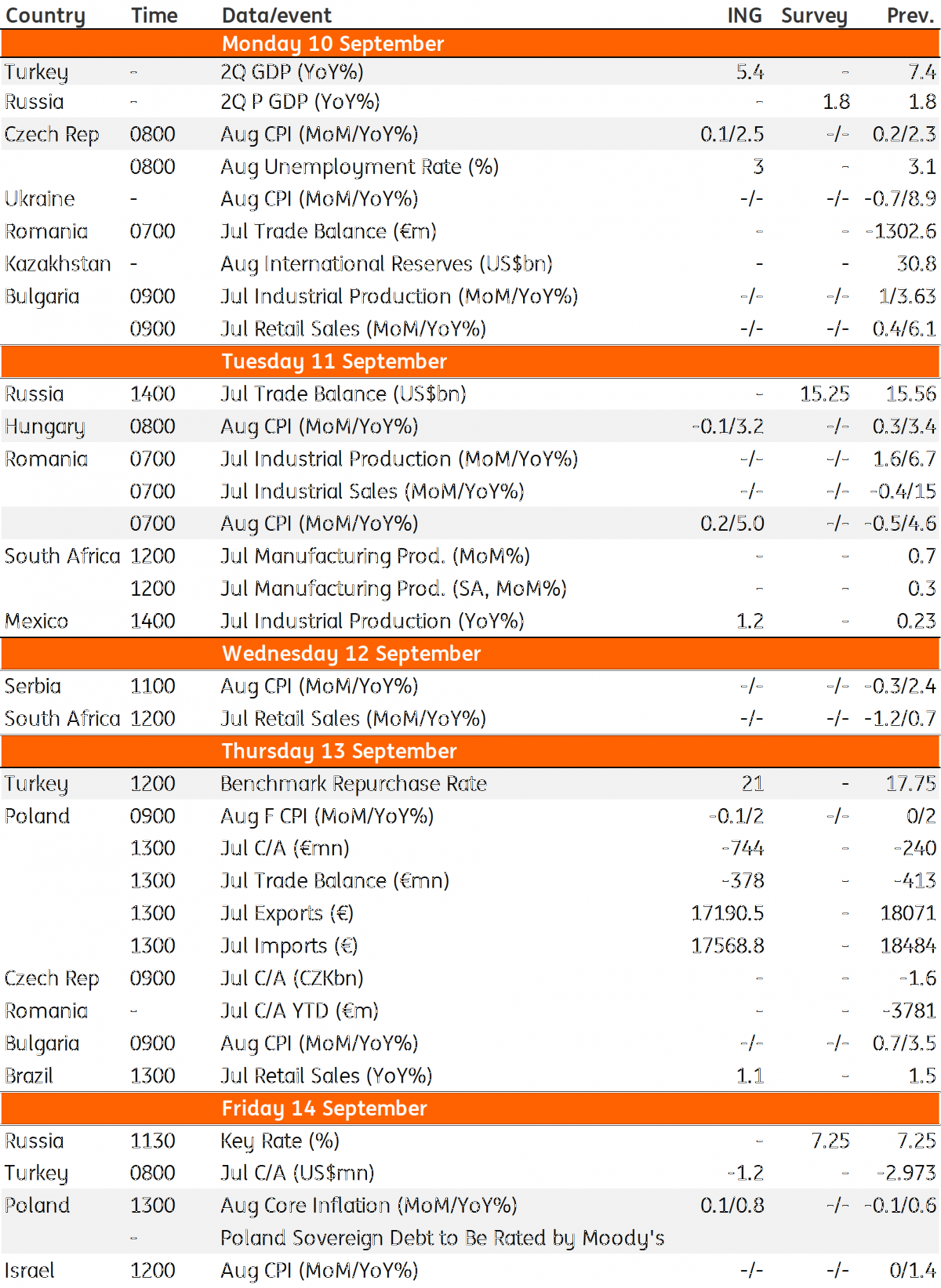

We expect Turkey to hike its one-week repo rate on Thursday to further support the lira. Also watch out for strong inflation readings from the EMEA and Latam regions.

Turkey: Hike expected to prevent a TRY slide

The Central Bank of Turkey tightened liquidity again last month, pulling the effective cost of funding up to 19.25%. The bank signalled a hike in policy rates following the latest inflation release to halt a slide in the Turkish lira and restore price stability. Accordingly, we expect the bank to raise the one-week repo rate by 325 basis points to 21%, and start funding banks via one-repo auctions again.

Meanwhile, growth in 2Q is likely to decelerate to 5.4% year-on-year given that the PMI has fallen below the 50 threshold, sectoral confidence indicators have declined and industrial production and retail sales have softened.

August CPI to stay above the National Bank of Hungary's target

The August inflation reading is the only important event in Hungary next week. We see the headline CPI declining from the five-year high of 3.4% YoY, but will likely remain above the National Bank of Hungary’s inflation target. The main reason behind the deceleration is the higher base of oil/fuel prices. In the meantime, we expect core CPI to remain unchanged at 2.5% YoY.

Romania CPI to bounce back to 5.0% in August

We expect inflation to inch up in August, from 4.6% in July, on the back of regulated gas price hikes. We also expect food inflation, which posted negative monthly rates in June and July, to remain flat versus the previous month. The producer price index, for the food industry, has been recently drifting upwards, which poses some risks to the inflation outlook. We are comfortable with our year-end inflation forecast at 3.6% YoY, which is 0.1 percentage points above the central bank’s projection.

We see the National Bank of Romania keeping rates unchanged at the next two meetings scheduled for the rest of this year; absent signs of contagion from recent emerging market jitters.

Poland: Neither an upgrade nor a downgrade

We expect Moody’s to maintain an A2 rating with a stable outlook. The major obstacle preventing an upgrade is the strongly negative international investment position (-59% GDP after 1Q), as well as risks regarding the institutional outlook (e.g. clash with European Commission on judiciary reform) - the latter especially overshadowing a solid fiscal stance. According to the 2019 budget bill draft, the deficit of the general government should not exceed 1.8% GDP - a historically low reading.

Moreover, the final inflation reading should have minimal relevance in our opinion; the flash figure suggesting August core inflation accelerated to 0.8% YoY. Another increase in September and October seems unlikely in our opinion. Headline CPI should decelerate from September onwards on lower food and fuel prices. We expect November readings close to 1% YoY vs. 2% YoY in August.

Czech: Accelerating inflation points to need for tightening

Although fuel prices stagnated in monthly terms in August, and food prices might even fall slightly - according to preliminary data, we see an acceleration of core inflation given solidly growing wages, a weak koruna and a pickup in energy prices for households. As such, year-on-year inflation should accelerate towards the 2.5% mark, which would confirm mounting inflationary pressures. This will most likely motivate the Czech National Bank to tighten monetary policy further at the forthcoming meeting at the end of September.

Content Disclaimer: The information in the publication is not an investment recommendation and it is not an investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument.

This publication has been prepared by ING solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. “For more from ING Think go here.”