Developed markets pick up the pace in the week ahead. US retail sales and inflation data will provide further clues about future Fed policy while in Sweden, investors will focus on the result of Sunday's general election.

US: spend, spend, spend

US consumer sentiment continues to be boosted by tax cuts, a strong jobs market and rising asset prices. This suggests that retail sales should continue to grow strongly with already released auto sales number offering support for a robust 0.6% month-on-month number. Gasoline price edged lower through the month so there is perhaps a little downside risk from gasoline station sales. This also means that consumer price inflation may be more muted than the consensus expects. We look for both headline and core inflation to rise 0.2%. This would see headline annual inflation slip to 2.7%, but given the risks from an ever tightening labour market, the Fed looks set to hike rates again in both September and December.

Election fallout looms

The Swedish elections on 9 September are likely to return a hung parliament. Negotiations (and posturing) will begin this week, though we don’t expect a new government to be settled for some time. A strong result for the far-right populists would make the task harder for the mainstream parties, and could weigh on the krona.

On the economic front, inflation figures in Norway (Monday) and Sweden (Friday) are the key data to watch. We see continued high headline inflation, as energy prices remain elevated, but core inflation remains some way below 2%.

End in sight for the ECB's QE programme

The main item in the eurozone will be the European Central Bank meeting on Thursday. ECB President Mario Draghi will, in our view, announce the already anticipated next step in the tapering process, reducing monthly quantiative easing purchases from €30 billion to €15 billion, with the goal of ending QE by year-end.

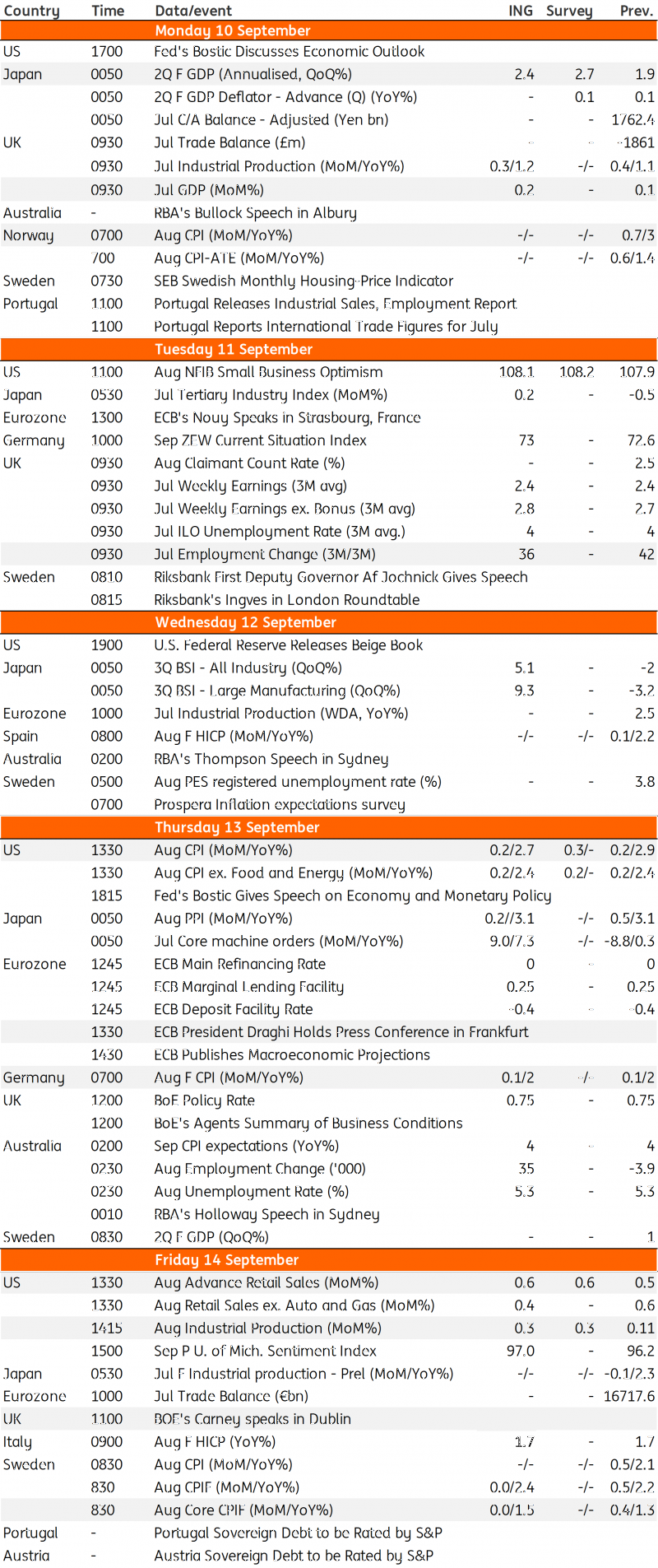

Developed Markets Economic Calendar

Content Disclaimer: The information in the publication is not an investment recommendation and it is not an investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument.

This publication has been prepared by ING solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. “For more from ING Think go here.”