You'd think we'd be fed up of Brexit by now, but as another week goes by, there is yet another vote, and we are all over it. UK Prime Minister Theresa May will have another go at pushing her Brexit deal through parliament, but it's unlikely she'll be third time lucky. The German Ifo will also be in focus, the question is, will it point to signs of recovery?

By James Smith, James Knightley, Bert Colijn, Carsten Brzeski, ING

UK: Third time lucky for May's deal? Probably not

After a classic marathon evening of talks at the March European Council meeting, EU leaders have agreed to extend the two-year Brexit Article 50 negotiating period. The decision, being dubbed a "flextension", gives the UK two options and piles the pressure on Westminster to agree on a way forward over the next few weeks. If PM May's Brexit deal passes next week, the EU will grant an extension that lasts until 22 May - the day before European parliament elections. This would give the UK time to pass the relevant legislation. If the deal doesn’t pass next week, then the UK will have until 12 April to decide a way forward.

But will May's deal go through next week? In short, probably not.

The momentum that seemed to be gathering behind May's deal last weekend appears to have faded. And, of course, to have a vote in the first place, the Prime Minister needs to find a 'substantial' change to the deal, to satisfy a requirement put forward by Speaker of the House of Commons John Bercow earlier in the week. If the vote goes through as we expect, lawmakers will be aware that this might be the last opportunity to vote on May's deal, but we still suspect the numbers will be nowhere near enough for May to get her deal passed.

Assuming PM May's deal is rejected for the third time, the focus will switch back to this idea of 'indicative votes' - a process where parliament will get its say on alternative Brexit options.

Federal Reserve: Even more patient

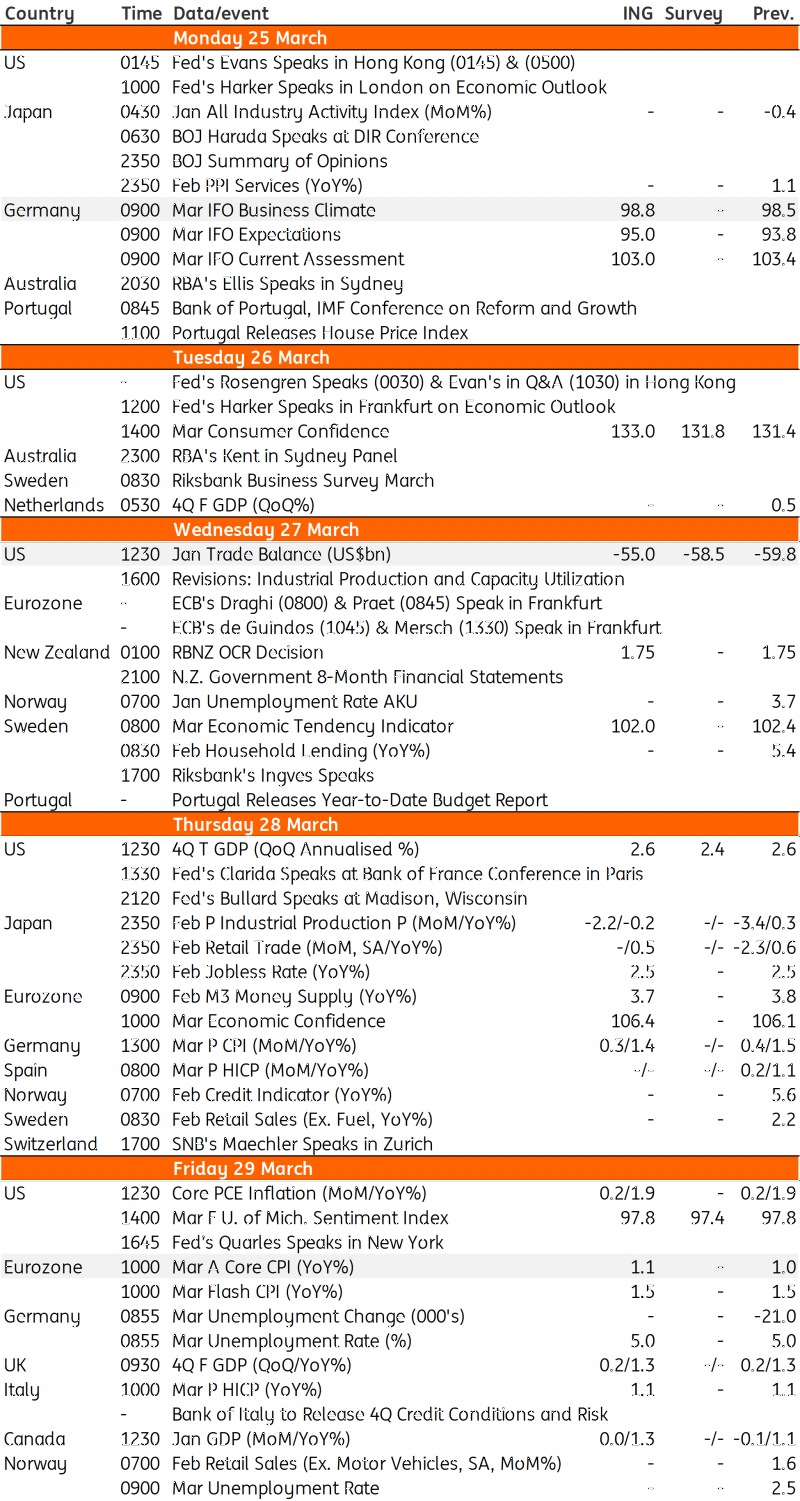

The Federal Reserve has clearly signaled that they will be very patient in their interest rate deliberations. In fact, they have next to no appetite to change monetary policy this year meaning the upcoming data is unlikely to have a massive impact on financial markets, even if we get some surprises. 4Q GDP may be modestly revised lower because of delayed data due to the government shutdown, but any move will be marginal. Of more interest will be what happens to the trade balance in January.

It deteriorated sharply towards the end of the year, which we think was largely due to US firms ramping up imports from China ahead of anticipated tariff increases in January. The tariffs were subsequently delayed, but businesses could not have known that and given the time it takes to ship products across the Pacific we suspect they'd ordered far fewer imports for January. This should show up to some extent in this week’s report, but we think data for February may see even more shrinkage in the deficit. Meanwhile, consumer confidence should be firm thanks to the strong jobs market and rising pay while homes sales should be supported by falling mortgage rates.

Eurozone: All eyes on Brexit as no-deal scenario edges closer

For the eurozone - and especially countries like Ireland, Netherlands and Belgium, all eyes will be on Brexit developments. In a no-deal scenario, these countries are expected to experience a material impact.

In terms of data, inflation figures are out on Friday. Expect one more month with a stable energy contribution before the energy component drops more significantly again. Core inflation seems dependent on business confidence. Right now, higher wages are being absorbed through business margins amid high levels of uncertainty about global economic developments.

Germany: Will Ifo's point towards economic recovery?

The most important data release next week will be the Ifo index. Some forward-looking indicators for global activity have started to pick up again and the German ZEW also showed signs of stabilization. A rebound of the Ifo index would support our view of a gradual recovery of the German economy in the first half of the year.

Canada: Different month, similar story

The late-2018 oil price decline inevitably weighed on growth figures in December (-0.1% MoM), and the seventh consecutive monthly decline for the construction sector was a true reinforcement that the housing market slowdown is well underway. We aren’t expecting any upside surprise in the latter for January - given the real estate sector is materially weak. And although global oil prices were poised somewhat for a recovery at the start of the year, due to lagged effects, average gasoline prices were still down in January.

The positive news is that manufacturing sales recovered in January (+1% MoM) after three weak months. However, given that the decline in December retail sales was largely due to a drop in gasoline sales (which was largely a function of lower gasoline prices), we can’t see January offering much respite, which is why we anticipate no economic growth in January.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more