If you're looking for clues about central bankers' next steps, you're unlikely to find them at Jackson Hole. We don't expect to hear anything new from Fed Chair Jerome Powell at the annual economic symposium over the weekend. Still, data from Germany next week could provide insight into the ECB's next move.

Don’t expect any fresh hints from Powell at Jackson Hole

Markets will be closely scrutinising Fed Chair Jerome Powell’s comments at the annual get-together of central bankers at Jackson Hole this weekend, although we doubt there will be much new on offer. History tells us that the speeches tend to quite “high level” and academic, and generally offer few firm hints on the policy outlook.

So we doubt investors will glean much more on Powell's view of the recent escalation in trade tensions, the difficulties unfolding in emerging markets, or indeed his thoughts on President Trump’s recent comments about higher rates.

In any case, we still suspect the majority view of policymakers is that the current US economic momentum will continue to outweigh trade uncertainties – at least for now. We expect further rate hikes in September and December.

German data to create a base ahead of the ECB's September meeting

Germany will help set the scene this week for the ECB’s September meeting. The Ifo index should show whether German corporates took comfort from the visit by Jean-Claude Juncker to the US and a period of calm on the US-EU trade tension front, or whether the more general fear of a trade war still prevails. At the same time, German headline inflation is likely to hover around 2%, strengthening the ECB’s case for a dovish tapering.

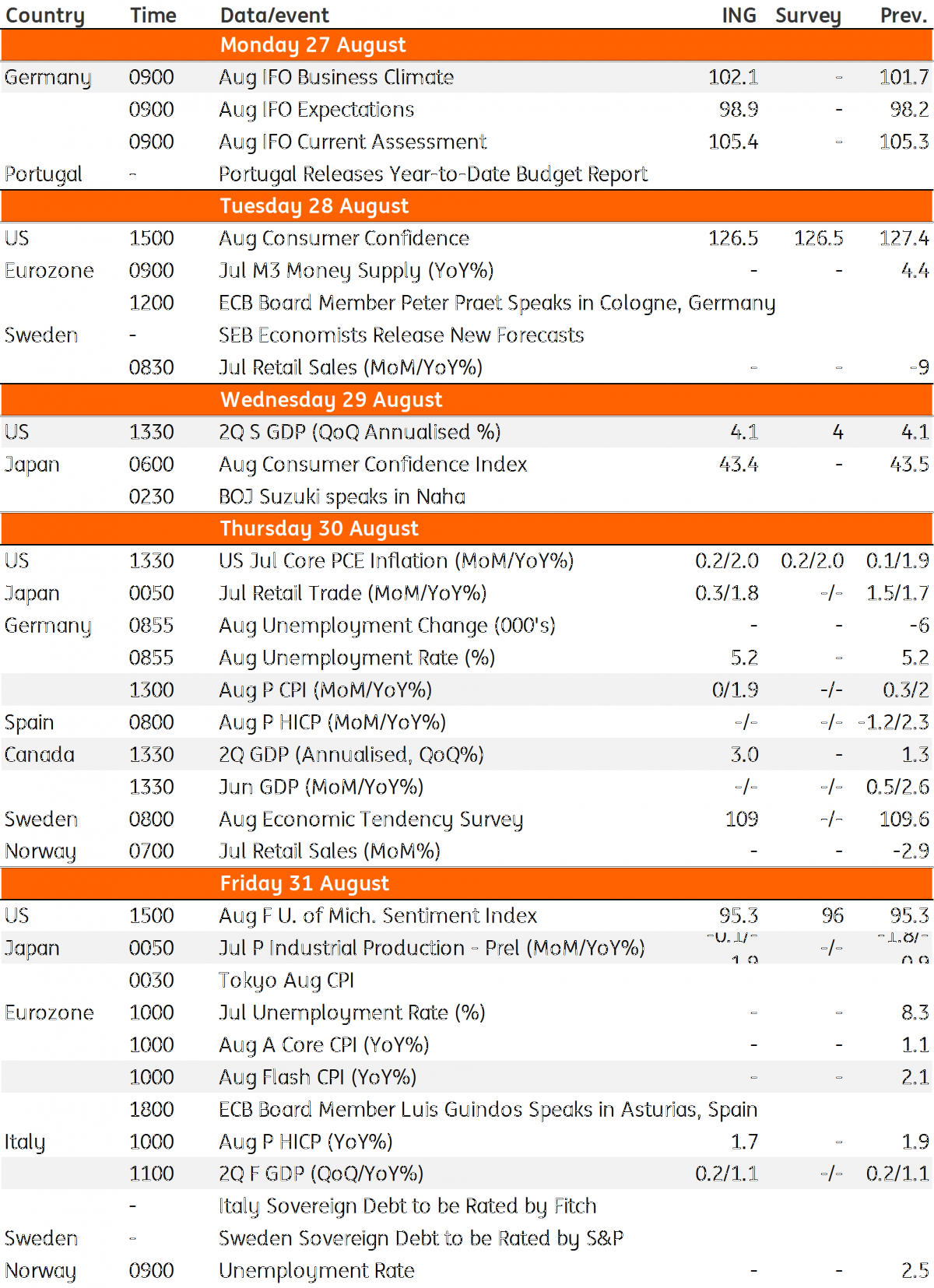

Developed Markets Economic Calendar

Content Disclaimer: The information in the publication is not an investment recommendation and it is not an investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument.

This publication has been prepared by ING solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. “For more from ING Think go here.”