Different week, same old story; the US's strong growth prevails with expectations of a 4%+ GDP reading in 2Q18, but it seems we can say quite the opposite for Sweden...take a look to see what else is going on in developed markets next week.

US Staying Strong

The US experienced robust growth in 2Q18, which we expect will be underlined by a 4%+ GDP reading. Consumer and business activity has been boosted by massive tax cuts with the positive momentum carrying over into 3Q. As such, employment growth remains strong, with unemployment set to dip back below 4% on Friday while payrolls look set to rise by around 190,000 in June - above the average for 2017. With the ISM surveys continuing to point to strong economic expansion and with inflation measures continuing to move higher, the Federal Reserve is likely to sound a little more positive on the economy at Wednesday’s FOMC meeting but stick to its “gradual” approach to policy tightening. No change from the Federal Reserve next week but we do look for a hike in September.

Bank of England to hike – but don’t expect another rate rise for a while…

Some of the more recent numbers have been mixed, but overall we suspect the data flow since the May Inflation Report will give the Bank of England confidence that the economy has rebounded from the first quarter soft patch. We expect a rate hike next week, but it will be interesting to see what the Bank has to say on its next steps.

After August, markets are barely pricing in another rate hike before the end of 2019. We suspect policymakers would prefer investors to expect an earlier move, however realistically we think the Bank will struggle to hike rates again for quite some time. As long as Brexit talks remain in deadlock (specifically over the Irish backstop), talk of ‘no deal’ will only increase. If this starts to hit sentiment, it would complicate efforts to tighten policy further.

We therefore suspect the Bank will keep its cards close to its chest next week on the timing of its next move. We currently don’t expect a hike again before May 2019, at the earliest.

Swedish growth slowing down

We expect 2Q GDP released on Monday to come in at 0.5% QoQ, down from 0.7% QoQ in 1Q. The July manufacturing PMI survey out on Wednesday and the latest forecast from the National Institute of Economic Research (out on Friday) are also likely to indicate slower growth in the second half of the year. So far, it is the slowing housing market and softer economic momentum in key trading partners in Europe that are the key drivers for weakening Swedish GDP growth and things could get considerably worse if US trade policy escalates further.

Core inflation worries for Germany

In a typical post-ECB meeting week with little macro data out, Germany's inflation data could once again stress the ECB’s current dilemma; headline inflation is on target but core inflation is far below.

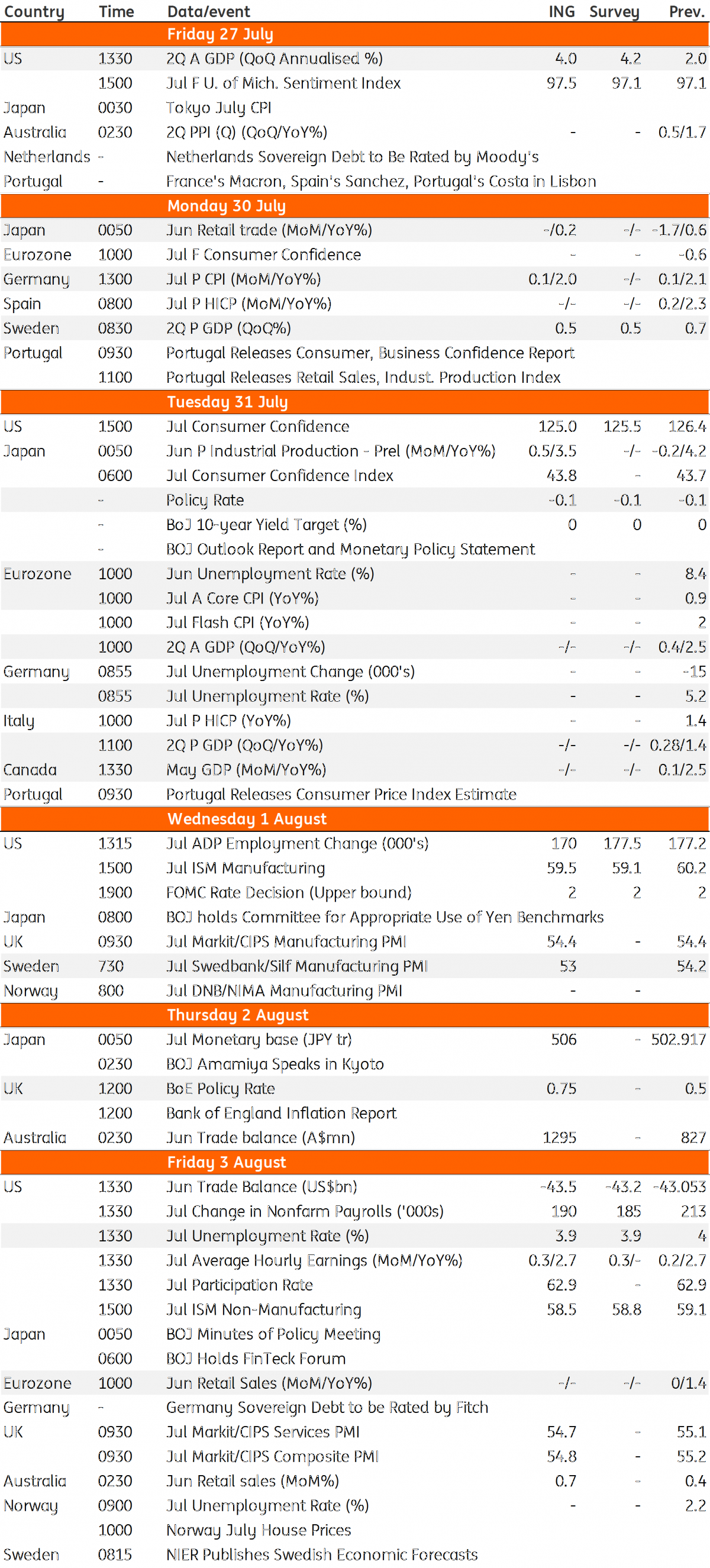

Developed Markets Economic Calendar

Content Disclaimer: The information in the publication is not an investment recommendation and it is not an investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument.

This publication has been prepared by ING solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. “For more from ING Think go here.”