Keryx Biopharmaceuticals Inc. (NASDAQ:KERX) incurred second-quarter 2017 loss of 21 cents per share, narrower than the year-ago loss of 42 cents. However, the loss was wider than the Zacks Consensus Estimate loss of 17 cents.

Revenues came in at $15.1 million in the quarter, exceeding the Zacks Consensus Estimate of $14 million. Further, revenues improved almost 62.4% from the prior-year figure of $9.3 million.

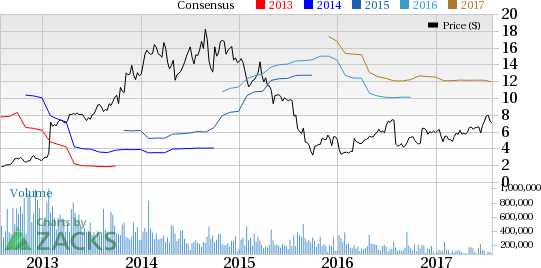

In fact, , the company’s share price has increased 20.5% so far this year, outperforming the Zacks classified industry’s 10% gain.

Quarter in Details

Net sales of Auryxia in the U.S. were $14.1 million, up 71%, following strong prescription growth. A total of 21,100 prescriptions were written in the reported quarter, up 61% year over year. Also, Auryxia was added to Medicare Part D drug list at two of the largest Medicare Part D insurance providers, which will give the drug unrestricted access to approximately 95% of phosphate binder patients.

Currently, Keryx is working on expanding Auryxia's label to include the treatment of iron-deficiency anemia (IDA) in adults with stage III–V NDD chronic kidney disease (CKD). In Mar 2017, the FDA accepted the company’s supplemental New Drug Application (sNDA) for Auryxia for review and a decision is expected on Nov 6, 2017.

License revenues came in at $1 million, up 1.9% year over year. Keryx earns license revenues from royalties on net sales of Riona (Japan trade name for Auryxia) from its Japanese partners.

Research and development expenses increased 28.6% year over year to $9 million, primarily owing to manufacturing and clinical activities to support the long-term growth of Auryxia.

Selling, general and administrative expenses were $25 million, up 23.7% backed by expansion of continued commercialization of Auryxia, and costs related to potential launch of the drug for IDA.

2017 Outlook

Keryx raised its 2017 guidance. The company now expects Auryxia product sales in the U.S.to come around $62 - $66 million, up from itsprevious expectation of $56 to $60 million. The guidance does not include sales from a potential label expansion of the drug (decision expected in November 2017). The guidance was raised based on strong Auryxia prescription demand.

Our Take

Keryx’s loss in the second quarter was wider than expected but sales beat estimates. The company raised its 2017 outlook for net U.S. Auryxia product sales which is encouraging.

The company intends to focus on the growth of Auryxia in the U.S. dialysis market. Evidently, the company’s label expansion efforts on Auryxia in the iron-deficiency anemia (IDA) indication are encouraging, given that the IDA market holds great potential.

Zacks Rank and Stocks to Consider

Keryx currently carries a Zacks Rank #2 (Buy). Some top-ranked health care stocks in the same space include Enzo Biochem, Inc. (NYSE:ENZ) , Exelixis, Inc. (NASDAQ:EXEL) and Sanofi (NYSE:SNY) . While Enzo Biochem and Exelixis sport a Zacks Rank #1 (Strong Buy), Sanofi carries Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Enzo Biochem’s loss per share estimates narrowed from 12 cents to 7 cents for 2017 and from 11 cents to 3 cents for 2018, over the last 60 days. The company delivered positive earnings surprises in all the trailing four quarters, with an average beat of 55.83%. The share price of the company has increased 58.1% year to date.

Exelixis’ pulled off positive earnings surprises in all the trailing four quarters, with an average beat of 512.11%. The share price of the company has increased 81.8% year to date.

Sanofi’s earnings per share estimates increased from $3.18 to $3.24 for 2017 and from $3.30 to $3.38 for 2018, over last 30 days. The company came up with positive earnings surprises in three of the trailing four quarters, with an average beat of 5.10%. The share price of the company has increased 18.9% year to date.

The Hottest Tech Mega-Trend of All Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early. See Zacks' 3 Best Stocks to Play This Trend >>

Sanofi (SNY): Free Stock Analysis Report

Enzo Biochem, Inc. (ENZ): Free Stock Analysis Report

Exelixis, Inc. (EXEL): Free Stock Analysis Report

Keryx Biopharmaceuticals, Inc. (KERX): Free Stock Analysis Report

Original post

Zacks Investment Research