Everyone likes a good bowl of hot soup on a dreary day. But for traders and investors it is equally as enjoyable to see a large gain in their portfolio from Campbell’s Soup (N:CPB). This stock showed some sighs of heating up in November as it moved over long term resistance at 51.80. It started to simmer as it moved over 54 in January and has been in a full on boil since then. If you bought the initial break at 51.80 you are up over 16% in 3 months!

Thursday morning the company reports earnings for their fiscal 2nd quarter. I have no idea how the report will turn out but I do know that I do not want to see that 16% gain evaporate into steam. This stock is a perfect candidate for a options collar into earnings.

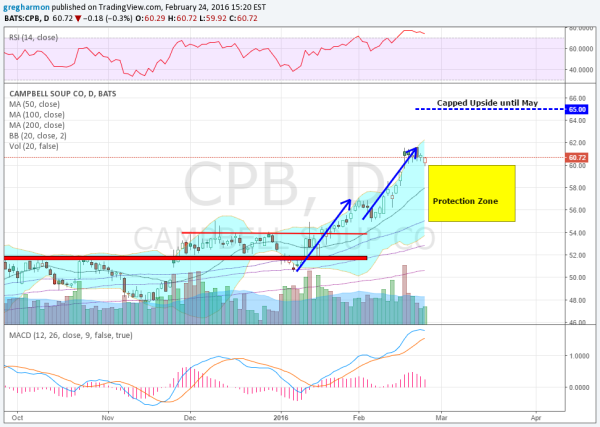

First some information from the chart. Indications are that the stock is overheated into earnings. The momentum indicators are in overbought territory and starting to pull back. The price action is also showing signs of rolling over. After reaching the Measured Move on the break out the price has printed a few small body candles and is pulling back into earnings. With the declining volume on the pullback this could just be building strength again in a bull flag. But you have a 16% gain right?

Putting on a collar in this environment with downside risk is prudent, but will also let you sleep sounder Wednesday night. The collar is nothing more than a buying a put and selling a covered call. In this case buying the March 60 strike Put for $1.25 and then selling the May 65 Strike Call for 85 cents. This puts your out of pocket cost at 40 cents, or less than 1% of the stock price. If this is still too much then limit your downside protection by also selling the March 55 Put for 15 cents, for a net cost of 25 cents or less than 1/2% of the stock price.

This structure gives you $5 of down side protection and allows for $4.50 of upside over the next 3 months. If it moves higher faster the covered calls can always be adjusted higher. Isn’t that worth 25 cents?

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.