- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Keeping Banks (Not Greece) From Failing Is The Real Eurozone Crisis

Over the last several weeks, JP Morgan Chase & Co (JPM) has remained in the headlines after suffering trading losses tied to the bank’s now infamous “London Whale” with losses at $7 billion more or less (yes, maybe more). With tangible assets at $125 billion, and annual gross revenue around $90 billion – $7 billion may be pocket change in this case.

A strong financial system is paramount for economic expansion, so the government steps in via central banks to provide bridging financing during high outflow periods, as well as insuring deposits / trading accounts. Financial institutions (without explicit government backstop) could never cover all the money owed to clients if demanded at once as the client money held is “invested” with high leverage and is therefore simply not available.

In return for this government “support”, the banks are subject to more overview / audit and regulation than a normal business. Yet, even with regulation and audit, the financial industry walked to the edge of destruction in 2008 – and needed significant intervention by the government to buttress the financial system.

The current regulation and audit system today is not effective. Econintersect author William K. Black argued this past week that embedding auditors at financial institutions is dysfunctional.

We only embed examiners for systemically dangerous institutions (SDIs) – banks so large that they pose a systemic risk to global economy. Embedded examiners do not work. They get too close to the bank officers and employees. In the regulatory ranks we called this “marrying the natives.” Nothing works with SDIs – they are too big to manage, too big to fail, and too big to regulate.

Auditing only finds the obvious, and the determined institution can easily disguise the grey and black functions until well after the damage is done (whether auditors are embedded or not). This JP Morgan Chase fiasco this past week shows current laws, regulations, and oversight are incapable of preventing another crisis.

This “London Whale” occurred after Basil III and Dodd–Frank Wall Street Reform and Consumer Protection Act. It will take more than band-aids – a new approach to limiting financial institution activities and risk is needed. Systems need to be self policing with criminal (not civil) penalties as institutions are backstopped with public sector monies.

The markets reacted to positive news on Greece at the beginning of this past week, but then began to react to deteriorating news on the Spanish financial institutions (which provide the lubricant to make the economy function). What contagion is possible?

The European economies will implode if Eurozone banks begin to fail. Here we stand almost three years after the “end” of the last financial crisis – and the viability of the Euro banks still remains an open question in a Euro system which lacks a “real” Eurozone central bank. The ECB is hampered by not having a fiscal partner spanning the Eurozone. Having monetary policy without a fiscal companion puts severe shackles on the operation of a central bank.

Many pundits argue that the Eurocrisis will slowly be resolved just in time – as it takes time to line up (convince) each country state of each painful step. My headline is that even though the pundits may be correct, the Euro economies will contract in the meantime.

Economies with sick banking systems contract.

Other Economic News this Week:

The Econintersect economic forecast for June 2012 continues to show moderate growth – although marginally weaker. There was degradation both in our government pulse point,and in some of our transport related pulse points. There are no recession flags showing in any of the indicators Econintersect follows.

ECRI has called a recession. Their data looks ahead at least 6 months and the bottom line for them is that a recession is a certainty. The size and depth is unknown but the recession start has been revised to hit around mid-year 2012.

This week ECRI’s WLI index value has been jumping around due to backward revision. The index is hovering around zero which means the economy six month from today will be as bad as it is today.

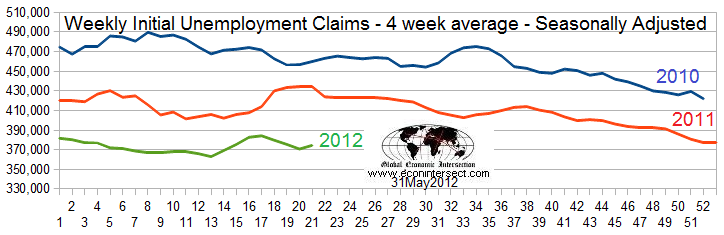

Initial unemployment claims increased from 370,000 (reported last week) to 383,000 this week. Historically, claims exceeding 400,000 per week usually occur when employment gains are less than the workforce growth, resulting in an increasing unemployment rate (background here and here). The real gauge – the 4 week moving average – rose from 370,000 (reported last week) to 374,500. Because of the noise (week-to-week movements from abnormal events AND the backward revisions to previous weeks releases), the 4-week average remains the reliable gauge.

Data released this week which contained economically intuitive components (forward looking) was only rail movements which is still indicating a moderate expansion if one ignores coal. Econintersect does not see any other data release this week as particularly intuitive in understanding future economic conditions.

Weekly Economic Release Scorecard:

Click here to view the scorecard table below with active hyperlinks.

Bankruptcies this Week: Filene’s Basement, Dewey & LeBoeuf (fka Dewey Ballantine), B+H Ocean Carriers, WP Steel Venture

Related Articles

The private sector added 183K jobs in January, which was well above the market's expectation of 148K. These results were a little better than last month (December), revised to a...

US bonds rip higher, 10-year yields dive Gold charges to fresh records, no topping signals yet USD/CHF cracks key support, downside risk builds Payrolls data the next big...

I am continually fascinated by how many second-order ‘understandings’ are missed, even by those people who have a really good first-order understanding of finance. For example,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.