Thursday was a down day in the markets. Whether you attribute it to a build up in military strength in Russia or China credit worries or a reaction to an unsustainable trend of fewer new 52 week highs in NYSE stocks and fewer S&P stocks in uptrends does not matter. The 5-minute chart of the SPDR S&P 500 ETF (SPY) looks horrible. Straight down for almost the entire day. Just a little bounce at the end. But you can get caught up in the hysteria and the hype when you are this close to it.

And visually the scale of the chart reinforces that. So step back a little. A daily view helps that some. The rising channel is still in place, but this not going to get you all warm and fuzzy about the SPY. Look at that RSI rolling down hard (top of chart) and the MACD (bottom of chart) crossed down boding for more downside. Sure there is some room to the bottom of the channel until it gets really troublesome. And depending on your timeframe the 8 additional points to the 177 area may or may not be significant to you. Not a bear market by a longshot, but definitely

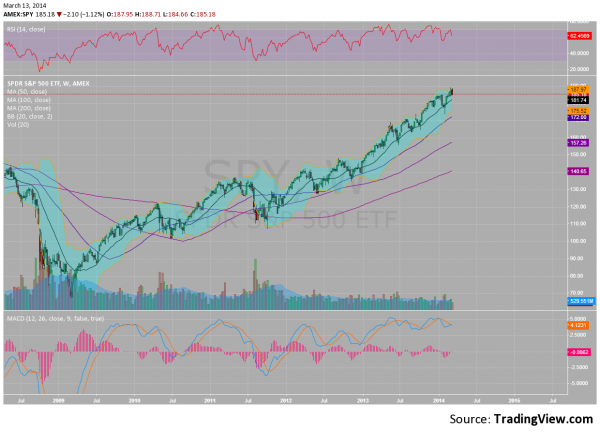

leaning towards a further pullback. But what happens if you are playing on a longer scale, looking at weekly charts, like below. It is hard to not be bullish looking at this chart. Since the beginning of 2013 the Simple Moving Averages (SMA) have fanned out making for a strong look higher. The trend is undeniably up and unabated, and that 20 week SMA line in the middle of the blue zone at 181.80 as support does not look very scary. The 177 from above is also within the blue zone. Could you notice that if you did not look every 5 minutes?

This latest pullback has already brought in a flood of top callers. They may be right, but you cannot tell today. Personally I think staking your reputation by calling an ultimate top and being wrong has more risk than reward and is a bad trade idea. But the 1 in a million chance for fame is what drives many people, and hey they can always do something else if they are wrong, or just ignore that they were wrong. But where is the value in creating a fear, implying that investors should sell all of their stocks, whether they say that or not, on a 2% pullback from a 185% run higher. Does that make sense to you. Don’t ignore the pullback (or future pullbacks) but also don’t pull the trigger and unwind everything without good confirmation that the trend has changed.