As the primary currency recognized around the globe, the U.S. Dollar is pretty important. And the trend of the dollar is pretty important also. While a strong dollar is good in terms of attracting capital to U.S. shores, it makes it more difficult for U.S. firms that export goods. One might argue that a “steady” dollar is generally preferable to a very strong or very weak dollar.

Speaking of the trend of the dollar, a lot of things move inversely to the dollar. In fact, one can typically argue that as long as the dollar is strong, certain “assets” will struggle to make major advances. These include – commodities in general, metals specifically, foreign currencies (obviously) and international bonds (strongly).

Let’s first take a look at the state of the dollar.

Ticker UUP

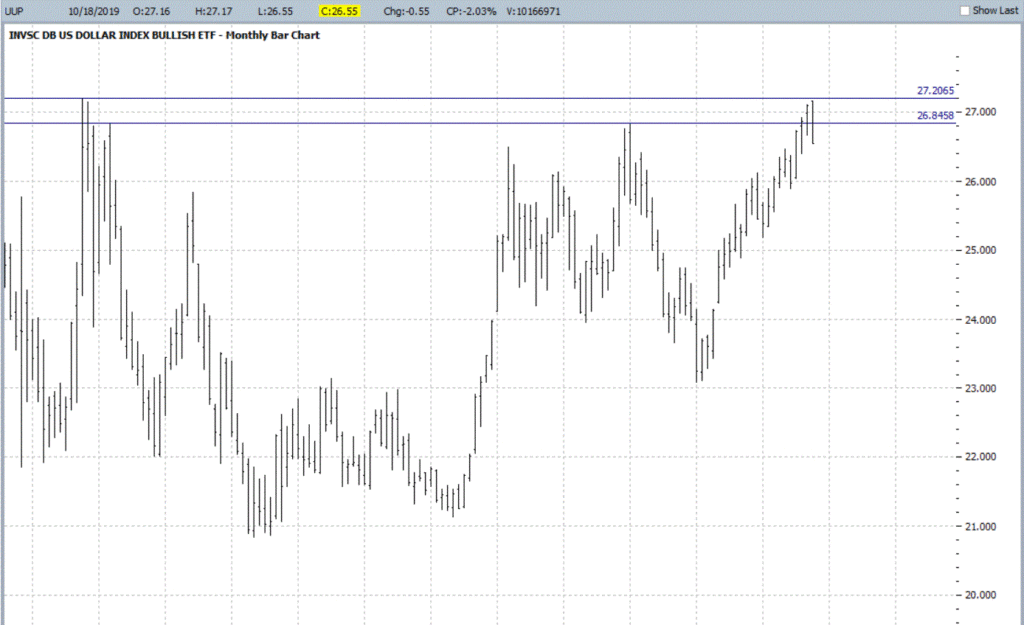

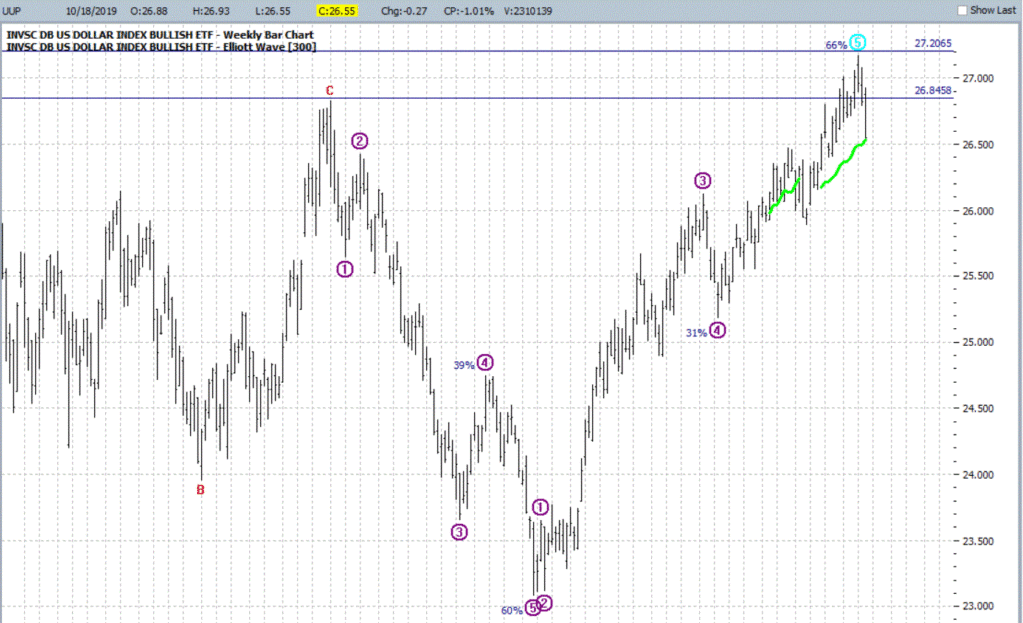

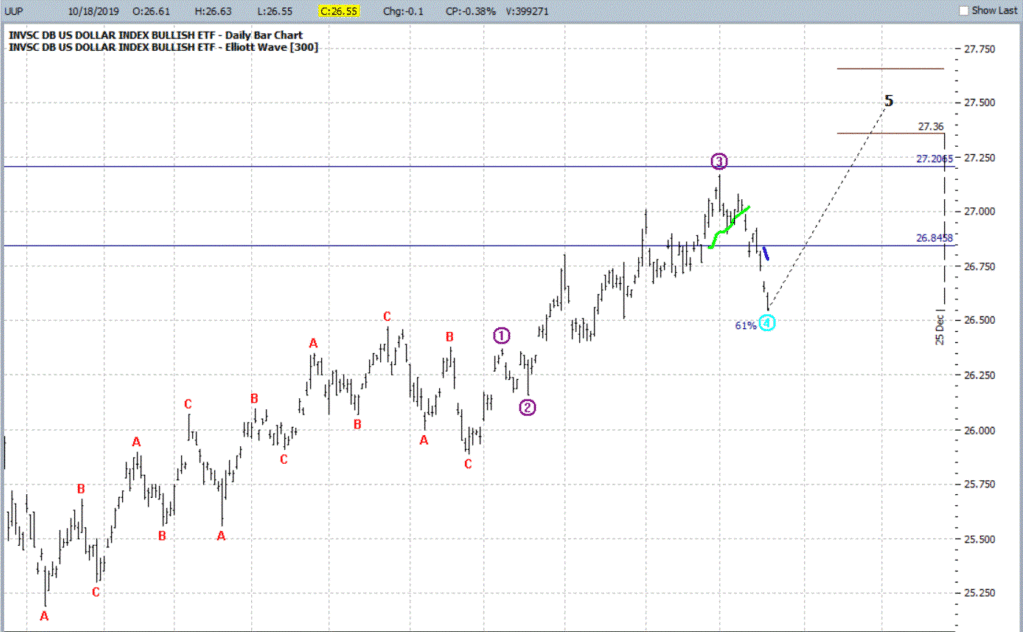

For our purposes we will use the ETF ticker (NYSE:UUP) ( Invesco DB US Dollar Index Bullish Fund) to track the U.S. dollar Figure 1 displays a monthly chart and suggests that UUP just ran into – and reversed at least for now – in a significant zone of resistance.Figure 1 – UUP Monthly (Courtesy ProfitSource by HUBB)Figure 2 displays a weekly chart which suggests the possibility that UUP has completed a 5-wave advance.Figure 2 – UUP Weekly (Courtesy ProfitSource by HUBB)Figure 3 displays a daily chart and paints a more potentially bullish picture, looking for a 5th Wave up. Figure 3 – UUP Daily (Courtesy ProfitSource by HUBB)Which way will things go? It beats me. But I for one will be keeping a close eye on UUP versus the resistance levels highlighted in Figures 1 and 2. So will traders of numerous other securities.Inverse to the Buck

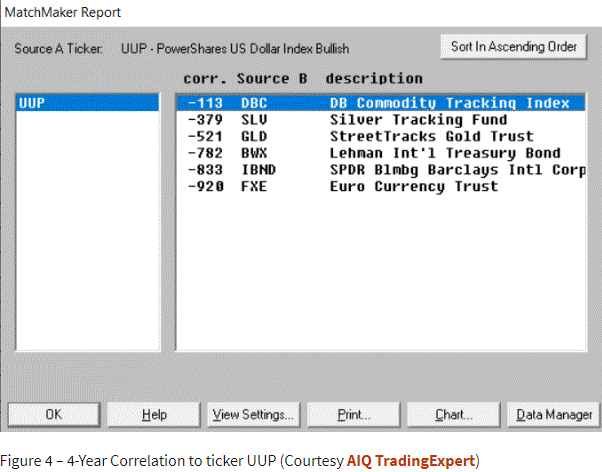

Figure 4 displays the 4-year weekly correlation for 5 ETFs to ticker UUP (a correlation of 1000 means they trade exactly the same a UUP and a correlation of -1000 means they trade exactly inversely to UUP).

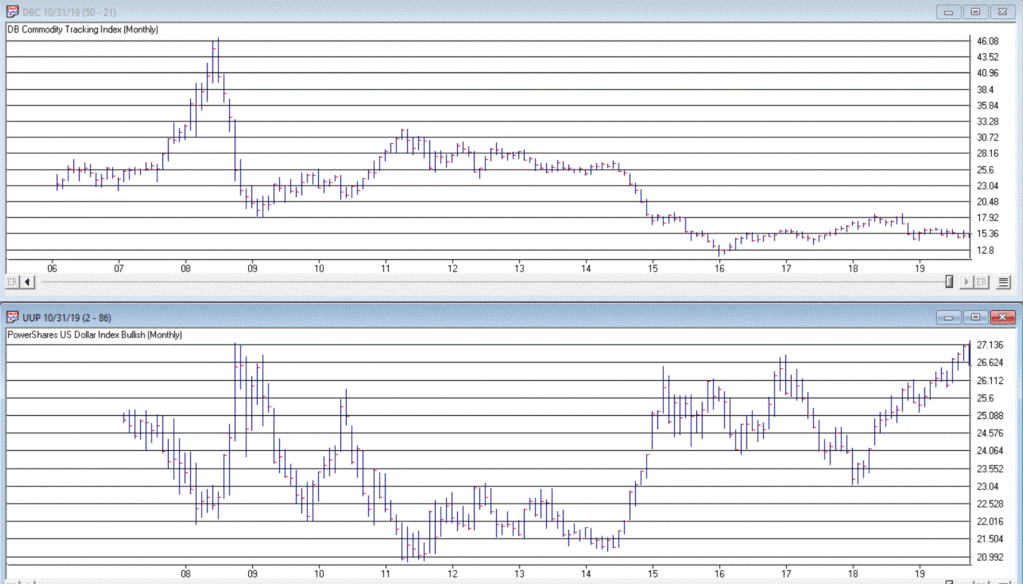

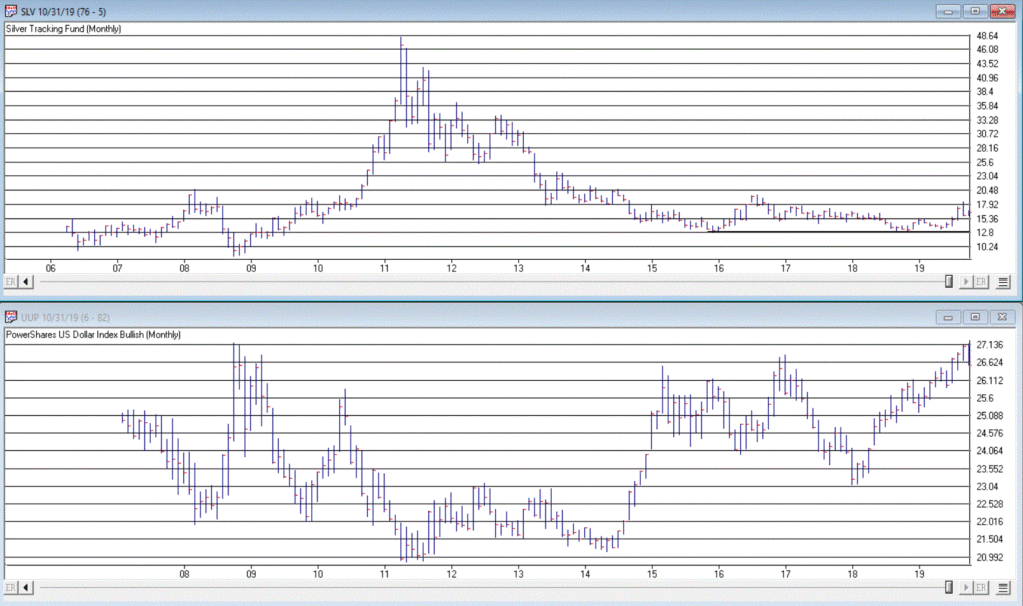

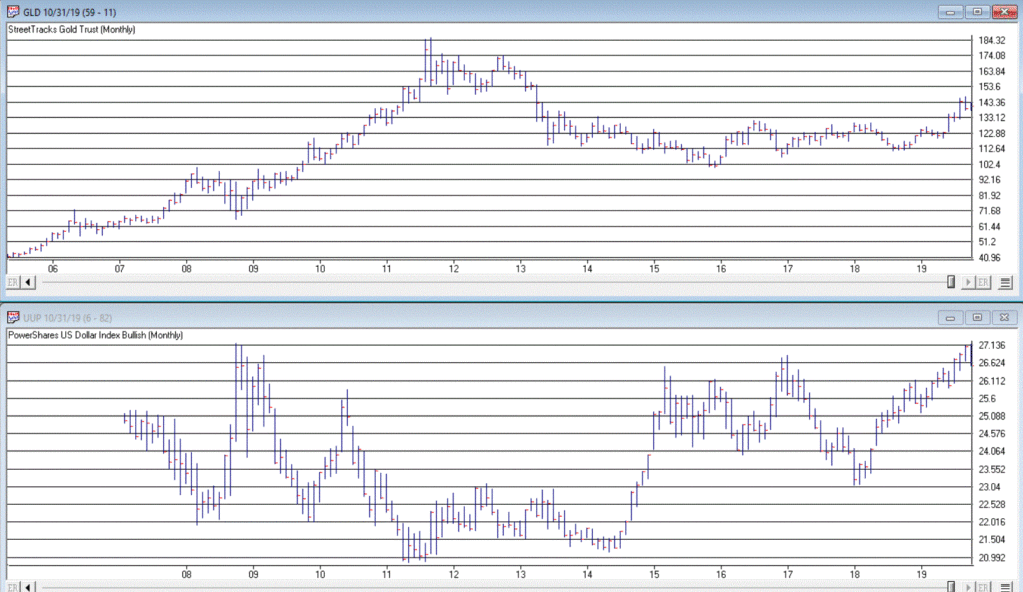

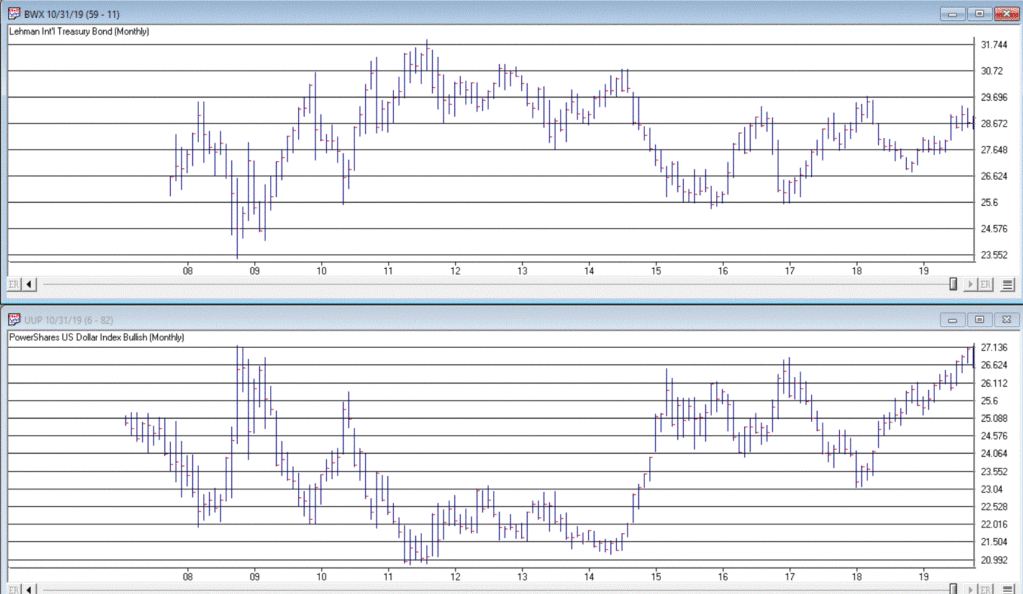

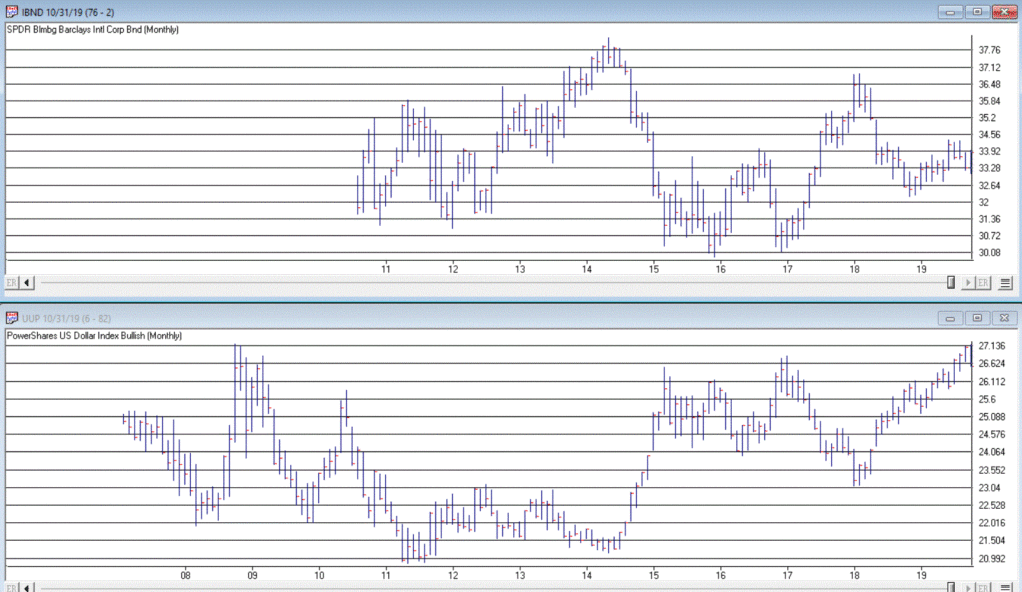

In the following charts, note the inverse relationship between the dollar (UUP on the bottom) and the security in the top chart. When the dollar goes way down they tend to go way up – and vice versa.

Note also that in the last year several of these securities went up at the same time the dollar did. This is a historical anomaly and should not be expected to continue indefinitely.

Figure 5 – Ticker DBC (Invesco DB Commodity Index Tracking Fund) vs. UUP (Courtesy AIQ TradingExpert)

Figure 6 – Ticker SLV (iShares Silver Trust (NYSE:SLV)) vs. UUP (Courtesy AIQ TradingExpert)

Figure 7 – Ticker GLD (SPDR Gold Shares (NYSE:GLD)) vs. UUP (Courtesy AIQ TradingExpert)

Figure 8 – Ticker BWX (SPDR Bloomberg Barclays (LON:BARC) International Treasury Bond) vs. UUP (Courtesy AIQ TradingExpert)

Figure 9 – Ticker IBND (SPDR Bloomberg Barclays (LON:BARC) International Corporate Bond) vs. UUP (Courtesy AIQ TradingExpert)

Figure 10 – Ticker FXE (Invesco CurrencyShares Euro Currency Trust) vs UUP (Courtesy AIQ TradingExpert)

Summary

If the dollar fails to break out of it’s recent resistance area and actually begins to decline then commodities, currencies, metals and international stocks and bonds will gain a favorable headwind. How it all actually plays out, however, remains to be seen.

So keep an eye on the buck. Alot is riding on it – whichever way it goes.