KBR, Inc. (NYSE:KBR) recently announced that it has clinched a Project Management Consultancy (PMC) contract from Occidental of Abu Dhabi Ltd. The company will provide PMC services for Dalma and H&G Islands Projects on behalf of Abu Dhabi National Oil Company (ADNOC). Revenues related with the project will be booked as unfilled orders in Engineering and Construction (E&C) Segment backlog in second-half 2017.

The PMC Contract

Per the contract, KBR will offer project management consultancy services for the development of the Dalma Gas Field in order to increase productivity, performance and delivery of gas supply. KBR is expected to perform the work over two years, with an option to extend the time frame by another one year.

KBR will also provide project management services for the Detailed Design and Surveys phase of ADNOC’s one of the largest ongoing sour gas fields projects located in Abu Dhabi, United Arab Emirates. These services will be provided at the Hail & Ghasha Project, which is being developed to produce about 1 billion cubic feet of sour gas per day.

Other Notable Contracts

Notable contracts secured by the Engineering and Construction segment include a contract from Sydney Desalination Plant Pty Limited and services contract by international pager products maker, International Paper (IP).

KBR’s Engineering and Construction business segment utilizes its operational and technical excellence to provide engineering, procurement, construction (‘EPC’) and commissioning services for oil and gas, refining, petrochemicals and chemicals customers.

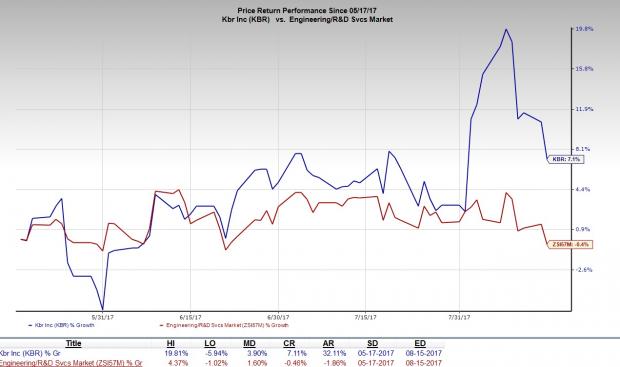

Over the past three months, the stock has returned 7.1% against the industry’s loss of 0.5%. Analysts have become increasingly bullish on the company over the past couple of two months, as the Zacks Consensus Estimate for full-year 2017 earnings trended up over the same time frame, from $1.33 to $1.42, on the back of four upward estimate revisions.

KBR currently carries a Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked stocks in the sector include TopBuild Corp. (NYSE:BLD) , Owens Corning Inc (NYSE:OC) and Toll Brothers Inc. (NYSE:TOL) . While TopBuild and Owens Corning sport a Zacks Rank #1 (Strong Buy), Toll Brothers carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

TopBuild has a positive average earnings surprise of 10.4% for the last four quarters, having beaten estimates all through.

Owens Corning has excellent earnings beat history, having surpassed estimates every time over the trailing four quarters. It has an average positive surprise of 20.2%.

Toll Brothers has a positive average earnings surprise of 1.1% for the last four quarters, having beaten estimates twice over the last four quarters.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires ,"" but that should still leave plenty of money for regular investors who make the right trades early. See Zacks' 3 Best Stocks to Play This Trend >>

TopBuild Corp. (BLD): Free Stock Analysis Report

Owens Corning Inc (OC): Free Stock Analysis Report

Toll Brothers Inc. (TOL): Free Stock Analysis Report

KBR, Inc. (KBR): Free Stock Analysis Report

Original post

Zacks Investment Research