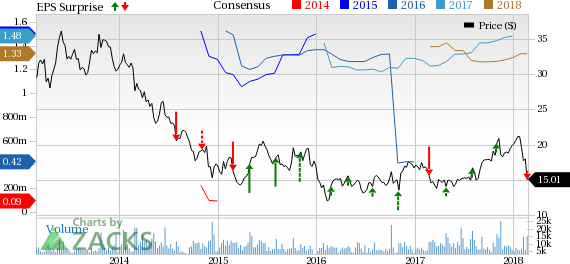

KBR, Inc. (NYSE:KBR) reported adjusted earnings per share of 28 cents in fourth-quarter 2017, which lagged the Zacks Consensus Estimate of 30 cents by 6.7%. Investors were discouraged with the earnings miss and shares of the company declined 15.6% at the close of trading session on Feb 23.

However, the company’s adjusted earnings per sharecame well ahead of the loss of 59 cents, in the prior-year quarter.

For full-year 2017, the company posted adjusted earnings of $1.49 per share against a loss of 43 cents per share last year.

Inside the Headlines

Revenues were down 21.3% year over year to $937 million, which missed the consensus mark of $974 million. The top-line performance was affected by completion of diverse projects in its Engineering and Construction segment as well as completion of EPC power project’s execution phase in the Non-strategic Business segment.

At Technology & Consulting segment revenues rose 5.9% year over year to $90 million. The uptick can be primarily attributable to strong demand for its technologies as well as organic growth in consulting services for upstream projects.

Meanwhile, Government Services’ revenues charted impressive growth as the metric increased 7% to $553 million on a year-over-year basis. Revenue growth was backed by organic growth and expansion of task orders on existing U.S. Government contracts. Also, growth on existing program management projects in the U.K led to the improvement.

However, Engineering & Construction revenues continued with its weak trajectory and declined 44.7% year over year to $293 million. Completion of several projects across the segment played spoilsport.

Revenues at the Non-strategic Business segment came in at $1 million compared with $56 million in the year-ago quarter. The year-over-year decline was chiefly due to the completion of execution phases of its EPC power projects.

As of Dec 31, 2017, the company’s total backlog was $10.6 billion down 2.8% on a year-over-year basis. Of the total backlog, about $8.4 billion is booked under the Government Services segment (up 6.8% year over year) and around $1.8 billion under the Engineering & Construction segment (down 35.4% year over year). While Technology and Consulting accounted for $419 million of the backlog (up 34% year over year), non-strategic Business had $6 million in backlog (down 82.8%).

Major Contract Wins

In the fourth quarter, KBR’s Engineering & Construction segment clinched some prestigious awards. These include two separate FEED contracts for a new production, drilling, quarters platform — the Azeri Central East platform to be located in Azerbaijan and a multiple-year master engineering services contract from Covestro.

Additionally, the company’s Technology & Consulting segment secured a contract from Indorama Eleme Fertilizer & Chemicals Limited and Toyo Engineering Corporation for the Train 2 ammonia plant, located in Nigeria.

Liquidity & Cash Flow

As of Dec 31, 2017, KBR’s cash and equivalents were $439 million, down from $536 million as of Dec 31, 2016.

In the quarter under review, cash flow generated from operating activities came in at $193 million, up from $61 million in the year-ago quarter.

Guidance

Concurrent with the earnings release, KBR provided its guidance for full-year 2018. The company projects earnings per share within $1.35-$1.45, excluding legal costs associated with the legacy U.S. government contracts.

Also, the company expects to incur legal costs of around $10 million or 7 cents per share in the current year. This estimated legacy legal fees exclude any future cost reimbursement from the U.S. Government.

Existing Business Scenario

KBR’s Government Services business has been acting as the major profit churner, primarily driven by lucrative contracts from the U.S. military and the new work wins from the UK Ministry of Defense.

Moreover, for the Technology & Consulting segment, KBR expects thriving global technology opportunities led by ammonia, refining and olefins projects to persist, thus remaining bullish about its prospects. Further, KBR expects growth across all its key markets in the United States, the UK and Australia, driven by continued opportunities across the lifecycle of projects.

However, this Zacks Rank #3 (Hold) company’s lower revenues from the Engineering and Construction segments have been a pressing concern for the past few quarters. This apart, volatility in the oil and gas markets with oversupply continues to strain the prices and spending levels.

Stocks to Consider

A few better-ranked stocks in the same space include Boise Cascade, L.L.C. (NYSE:BCC) , EMCOR Group, Inc. (NYSE:EME) and Jacobs Engineering Group Inc. (NYSE:JEC) . While Boise Cascade sports a Zacks Rank #1 (Strong Buy), EMCOR Group and Jacobs Engineering carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Boise Cascade has a decent earnings surprise history, surpassing estimates thrice in the trailing four quarters, with an average beat of 116.3%.

EMCOR Group has an impressive earnings surprise history, surpassing estimates in the trailing four quarters, with an average beat of 28.1%.

Jacobs Engineering has an excellent earnings surprise history, exceeding estimates in the trailing four quarters, with an average beat of 11.4%.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

Boise Cascade, L.L.C. (BCC): Free Stock Analysis Report

Jacobs Engineering Group Inc. (JEC): Free Stock Analysis Report

EMCOR Group, Inc. (EME): Free Stock Analysis Report

KBR, Inc. (KBR): Free Stock Analysis Report

Original post

Zacks Investment Research