Karsan Value Funds (KVF) is a value-oriented fund, as described here. Due to securities regulations, the fund is not open to the public at this time. Should that change in the future, there will be an announcement on this site

For the fourth quarter ended December 31st, 2012, KVF earned $0.46 per share, increasing the value of each share to $12.12.This was a good quarter for the fund, both in absolute terms and in relative terms, as the fund's aggregate holdings showed gains even as the S&P 500 was down for the quarter.

Contributing to the gains this quarter were positive movements in the shares of Acme United, Asta Funding, New Frontier Media, Dorel and H Paulin (discussed here, here, here, here and here respectively). As a result, the fund no longer has holdings in these companies.

Currency changes also contributed to this quarter's outperformance. Had the CAD/USD exchange rate finished the quarter at the same level at which it started the quarter, earnings per share would have been lower by 11 cents.

Dragging results down this quarter was, among other things, the performance of Meade, whose operations have taken a turn for the worse. As discussed here, the fund sold its shares of this company at a loss.

Despite the fund's outperformance in the fourth quarter, it is worth mentioning that quarterly and even annual results in this business (where long-term capital appreciation is the goal) are not to be extrapolated. Results are better measured over decades than years, and as such this quarterly result is only one data point among many yet to come.

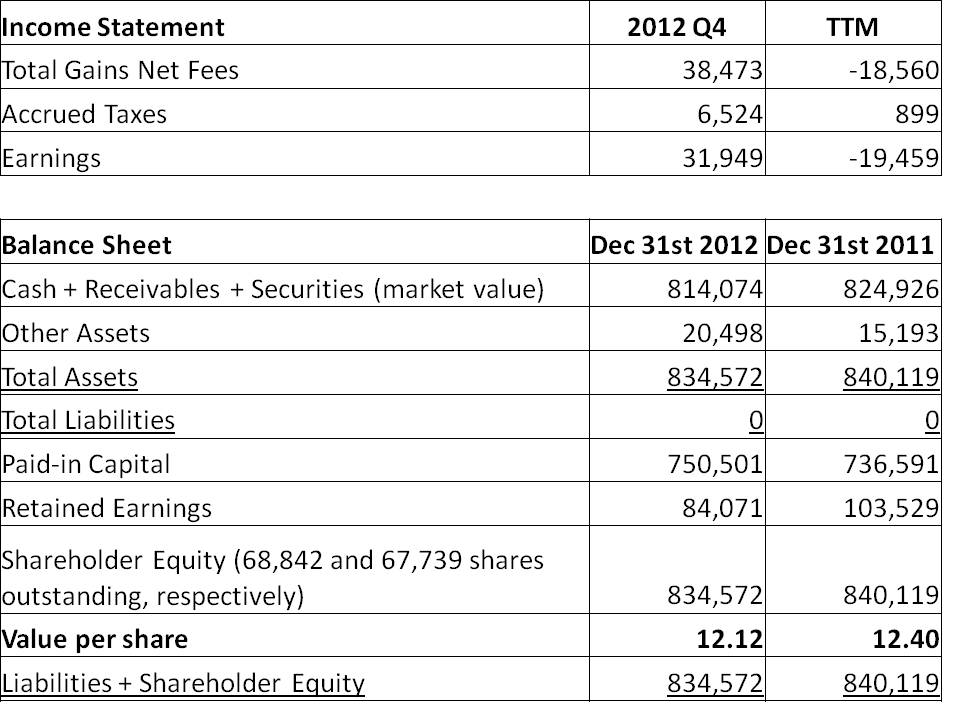

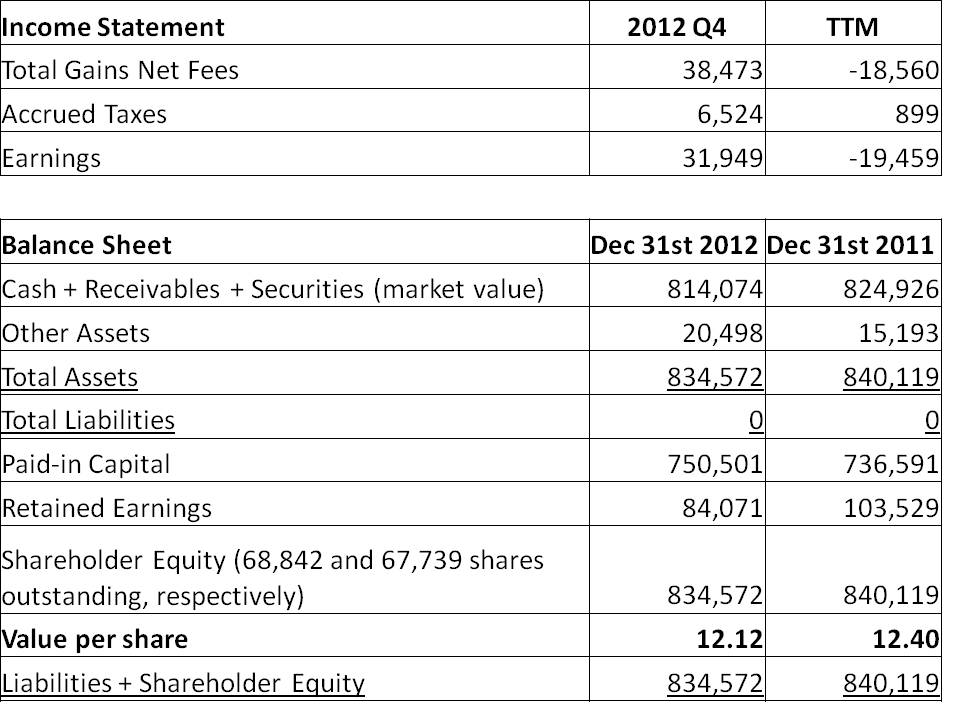

KVF's income statement and balance sheet are included below (click to enlarge). Note that securities are marked to market value, and amounts are in $CAD:

For the fourth quarter ended December 31st, 2012, KVF earned $0.46 per share, increasing the value of each share to $12.12.This was a good quarter for the fund, both in absolute terms and in relative terms, as the fund's aggregate holdings showed gains even as the S&P 500 was down for the quarter.

Contributing to the gains this quarter were positive movements in the shares of Acme United, Asta Funding, New Frontier Media, Dorel and H Paulin (discussed here, here, here, here and here respectively). As a result, the fund no longer has holdings in these companies.

Currency changes also contributed to this quarter's outperformance. Had the CAD/USD exchange rate finished the quarter at the same level at which it started the quarter, earnings per share would have been lower by 11 cents.

Dragging results down this quarter was, among other things, the performance of Meade, whose operations have taken a turn for the worse. As discussed here, the fund sold its shares of this company at a loss.

Despite the fund's outperformance in the fourth quarter, it is worth mentioning that quarterly and even annual results in this business (where long-term capital appreciation is the goal) are not to be extrapolated. Results are better measured over decades than years, and as such this quarterly result is only one data point among many yet to come.

KVF's income statement and balance sheet are included below (click to enlarge). Note that securities are marked to market value, and amounts are in $CAD: