Investing.com’s stocks of the week

Karsan Value Funds (KVF) is a value-oriented fund, as described here. Due to securities regulations, the fund is not open to the public at this time. Should that change in the future, there will be an announcement on this site.

For the fourth quarter ended December 31st, 2011, KVF earned $0.26 per share, increasing the value of each share to $12.40. Negative currency movements between the Canadian and US dollars held the fund back from further gains. Had the CAD/USD exchange rate finished the quarter at the same level at which it started the quarter, earnings per share would have been another 26 cents higher. Currency movements are likely to continue to significantly impact short-term results, but their long-term impact is expected to be low.

Contributing to the gains this quarter were positive price movements in the shares of Parlux, hhgregg, and Envirostar (as discussed here, here and here, respectively). As a result, the fund no longer holds positions in these companies.

For the year, KVF was down 5% compared to S&P 500, S&P/TSX and Russell 2000 returns of 0%, -11% and -4.5%, respectively. This was a disappointing year for KVF, for a couple of reasons. First, absolute returns (-5%) were negative, thanks in large part to poor price performance in the middle two quarters of the year. Second, as a deep value fund, I would expect KVF to outperform the broader market during bear markets, but it did not do so in 2011 to a satisfactory extent.

It would be easy to blame market inefficiencies and other external factors for the mediocre results this year. So to the extent that I can, I will. As this chart shows, it was a terrible year for value strategies. Fundamental value portfolios were down almost 24% for the year through the middle of December.

But I am hardly off the hook. Some of my poorest decisions of the year are discussed on the Value Fail page, and while the book has yet to be closed on the RIM saga, at this point I think it is safe to say that I overestimated the company's competitive advantages. I expect to learn from these and be better in 2012 and beyond. Thank you for your continued support.

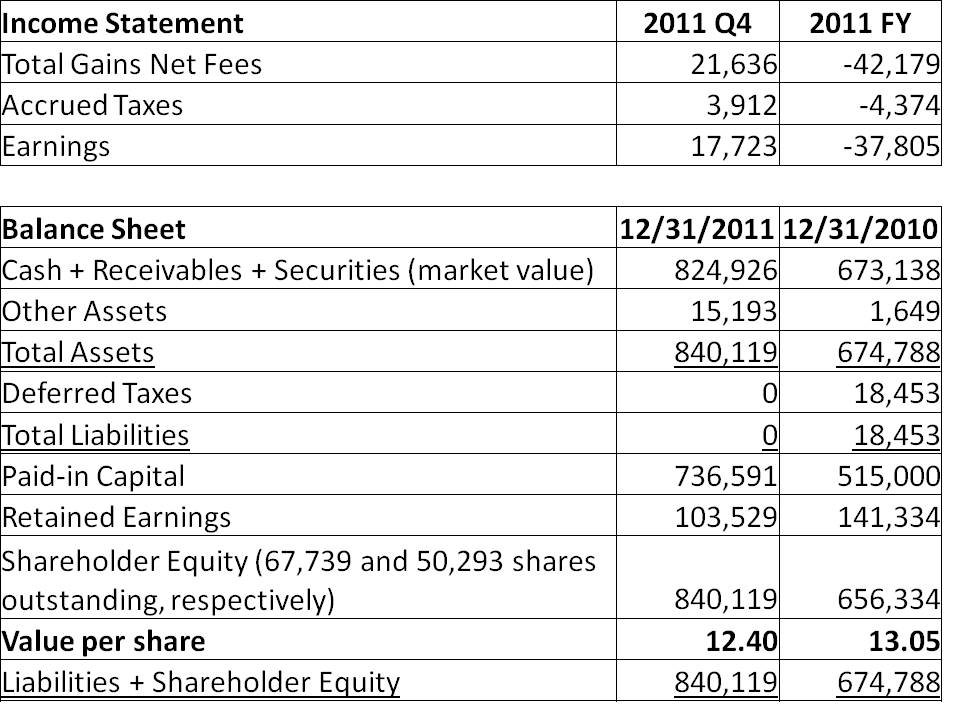

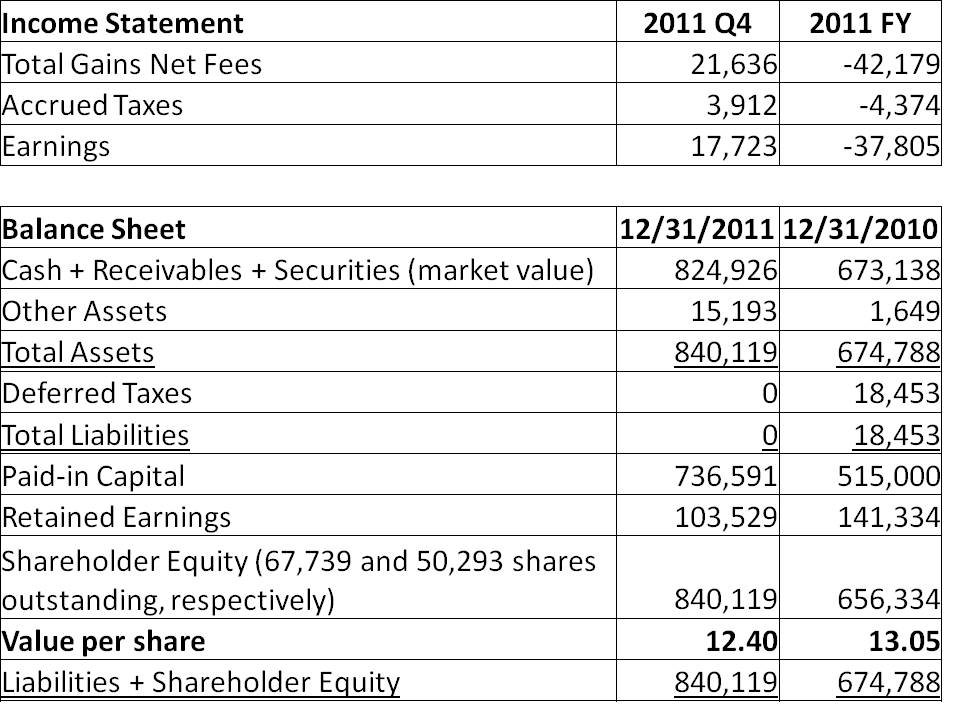

KVF's income statement and balance sheet are included below (click to enlarge). Note that securities are marked to market value, and amounts are in $CAD:

For the fourth quarter ended December 31st, 2011, KVF earned $0.26 per share, increasing the value of each share to $12.40. Negative currency movements between the Canadian and US dollars held the fund back from further gains. Had the CAD/USD exchange rate finished the quarter at the same level at which it started the quarter, earnings per share would have been another 26 cents higher. Currency movements are likely to continue to significantly impact short-term results, but their long-term impact is expected to be low.

Contributing to the gains this quarter were positive price movements in the shares of Parlux, hhgregg, and Envirostar (as discussed here, here and here, respectively). As a result, the fund no longer holds positions in these companies.

For the year, KVF was down 5% compared to S&P 500, S&P/TSX and Russell 2000 returns of 0%, -11% and -4.5%, respectively. This was a disappointing year for KVF, for a couple of reasons. First, absolute returns (-5%) were negative, thanks in large part to poor price performance in the middle two quarters of the year. Second, as a deep value fund, I would expect KVF to outperform the broader market during bear markets, but it did not do so in 2011 to a satisfactory extent.

It would be easy to blame market inefficiencies and other external factors for the mediocre results this year. So to the extent that I can, I will. As this chart shows, it was a terrible year for value strategies. Fundamental value portfolios were down almost 24% for the year through the middle of December.

But I am hardly off the hook. Some of my poorest decisions of the year are discussed on the Value Fail page, and while the book has yet to be closed on the RIM saga, at this point I think it is safe to say that I overestimated the company's competitive advantages. I expect to learn from these and be better in 2012 and beyond. Thank you for your continued support.

KVF's income statement and balance sheet are included below (click to enlarge). Note that securities are marked to market value, and amounts are in $CAD: