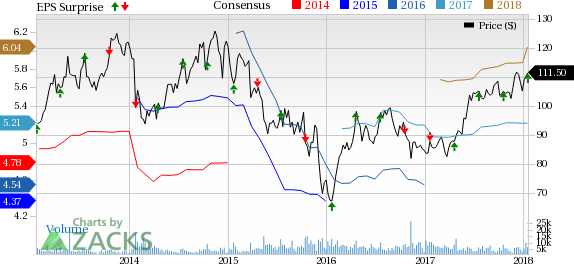

Kansas City Southern’s (NYSE:KSU) fourth-quarter 2017 earnings (excluding $3.95 from non-recurring items) of $1.38 surpassed the Zacks Consensus Estimate of $1.36 per share. The bottom line also improved 23.2% on a year-over-year basis. Results were driven by a 5% rise in overall carload volumes.

The company reported revenues of $660.4 million, which marginally missed the Zacks Consensus Estimate of $660.6 million. However, the top line improved 10.3% on a year-over-year basis. Revenue growth was witnessed across most of the company’s key segments.

Also, operating income increased 13% (on a reported basis) to $238 million. Kansas City Southern’s operating ratio (operating expenses as a percentage of revenues) was 64% compared with 64.8% reported a year ago. Improvement in this key metric is a positive for the company.

Segment Results

The Chemical & Petroleum segment generated revenues of $137.7 million, up 24% year over year. Volumes improved 12% year over year. Revenues per carload also increased 11% from the prior-year quarter.

The Industrial & Consumer Products segment generated revenues of $147.1 million, up 8% year over year. While business volumes improved 10%, revenues per carload decreased 1% year over year.

Total revenues at the Agriculture & Minerals segment were $121.7 million, down 1% year over year. While business volumes declined 9%, revenues per carload were up 9% both on a year-over-year basis.

The Energy segment generated revenues of $69.8 million, up 15% year over year. Impressive performances at the Frac Sand and Crude Oil boosted the segment’s results. While business volumes increased 3% year over year, revenues per carload rose 11%.

Intermodal revenues were $97.4 million, up 5% year over year. While business volumes improved 7%, revenues per carload decreased 2% in the reported quarter.

Revenues at the Automotive segment came in at $60.6 million, up 15% year over year. While business volumes improved 5%, revenues per carload increased 9%.

Other revenues totaled $26.1 million, up 16% year over year.

Zacks Rank

Kansas City Southern carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Releases

Investors interested in the Zacks Transportation sector are keenly awaiting fourth-quarter earnings reports from the key players like United Continental Holdings (NYSE:UAL) , Canadian National Railway Company (NYSE:CNI) and Norfolk Southern Corp. (NYSE:NSC) in the coming days. While United Continental and Canadian National are scheduled to report on Jan 23, Norfolk Southern will do the same on Jan 24.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

United Continental Holdings, Inc. (UAL): Free Stock Analysis Report

Kansas City Southern (KSU): Free Stock Analysis Report

Canadian National Railway Company (CNI): Free Stock Analysis Report

Norfolk Souther Corporation (NSC): Free Stock Analysis Report

Original post

Zacks Investment Research