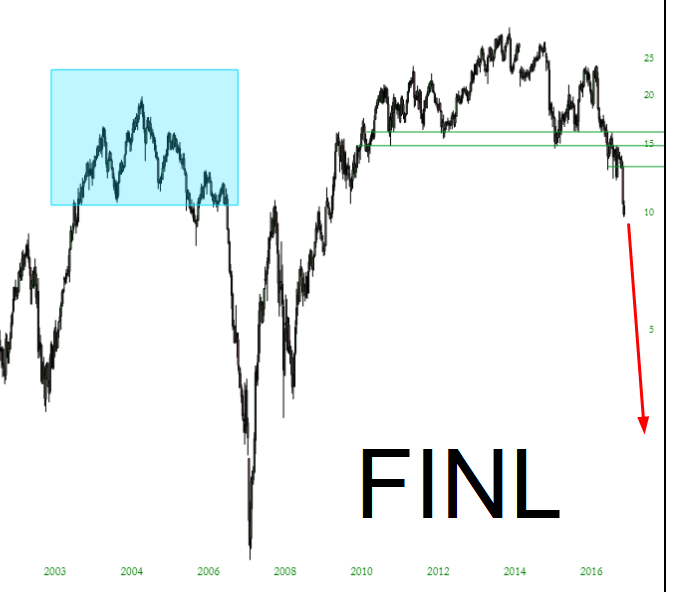

I don’t think there’s ever been a single stock I’ve suggested as a short more than Finish Line (symbol NASDAQ:FINL). My poor tastytrade viewers probably got sick to death of hearing about it, but it’s one of the most amazing topping patterns I’ve ever seen, and given how far it’s fallen, I doubt anyone’s bitching about my frequent mentionings of it.

One problem I’ve had as a trader is covering shorts too soon. One great example is Chicago Bridge & Iron Company NV (NYSE:CBI), which I yammered on about endlessly as well. It did indeed fall hard, and I took my profits. The problem is……….it won’t stop falling.

Anyway, just two days ago (Saturday) I mentioned how retail was going to resume its downtrend. I took this message to heart today as I looked for more stocks to short. I was already short 43 positions. By 12:30 my time (30 minutes until the close) I had identified 40 – count ’em, 40 – other stocks to add.

Thus, I had less than half an hour to:

(1) Ascertain stop positions;

(2) Ascertain appropriate position sizing

(3) Actually enter each and every order.

I am as fast as a son-of-a-bitch, but even Tim couldn’t get this done in time; I managed to enter 33 new positions, leaving 7, which pisses me off, because 76 is a queer number. I wanted either 75, 80, 81, 82, or 83. But I ran out of time.

Mercifully, since I enter trades in alphabetical order, one of my positions that I re-entered was none other than Finish Line. It’s a good thing, too, because although I covered FINL, I dunno, a week or two ago for a good profit, I wanted to give it another go. After hours today, the company issued all kinds of interesting news, including……..

Ummm, so, yeah, they want to “protect shareholders” now that their common stock has fallen from $30 to $8 (after hours), a loss of about 75%. Nice going, Board of Directors People. You’re super-duper swell.

Anyway, I’m pleased, because this is the latest “Slope Bomb”, and for once I didn’t screw the pooch by being out of position just when things were getting juicy again.