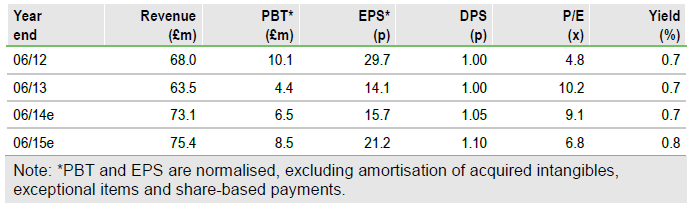

As flagged in the recent trading update, FY13 results were negatively affected by the combination of weak retail markets in the UK and Holland, and increased investment in developing K3’s AX for Retail solution. Recent order intake for both NAV and AX solutions points to a recovery in the Microsoft UK business, while the other business lines look set for a steady performance in FY14. Trading at a discount to peers, we see scope for upside as evidence of sustained revenue and margin recovery emerges.

FY13 results affected by retail market weakness

FY13 revenues declined 6.5% y-o-y as the weak retail market led to a 24% decline in the Microsoft UK division and suppressed growth in the International division. This pushed the Microsoft UK division into a loss-making position and depressed International margins, with adjusted operating profit falling 55% to generate an 8.1% margin (vs 16.8% in FY12). The performance of SYSPRO and Sage held up in the year, and demand for Sage X3 and SYSPRO 7 should drive growth in FY14. Although Managed Services saw 18% revenue growth in FY13, investment in developing hosting platforms (now complete) resulting in an operating loss. Good working capital management resulted in a better than expected year-end net debt.

Recent order intake points to more positive FY14

The strength of Q4 bookings points to a revenue recovery for the Microsoft UK division in FY14, which in turn could drive demand for hosting in the Managed Services division. As Gemstone development is completed and the software is made available to the international sales channel, there is scope for growth to exceed our conservative FY15 forecast. We forecast revenue growth of 15% in FY14 (with 36% growth in Microsoft UK) followed by 3% in FY15. This drives improving profitability, with operating margins of 9.7% in FY14 and 12.1% in FY15. We forecast a reduction in net debt of £1.6m in FY14 and £3.0m in FY15.

Valuation: Evidence of sustained recovery is key

K3’s share price is up 47% since the lows reached after the June trading update but on a P/E of 9.1x FY14e and an EV/sales multiple of 0.8x FY14e, still trades at a material discount to its peers (sub-£200m market cap UK Software P/E 15.6x, EV/sales 1.8x). With operating margins moving towards 10% in FY14 we believe that K3 could trade up to at least 10x FY14e EPS (157p), and with evidence of sustained improvement in the Microsoft UK division and further improvement in margins, could move towards 200p (equivalent to EV/sales of 1x FY14e).

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

K3 Business Technology

Turning a corner

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.