What amazes me is that despite seeing record levels of trading volumes across crypto exchanges, on the Bitcoin Futures market, and even on the bitcoin blockchain itself, public interest hasn't really picked up just yet.

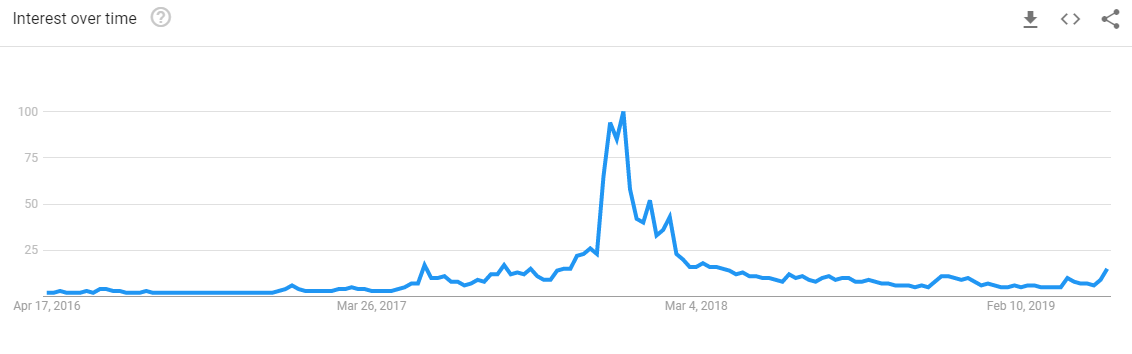

Looking at google trends for the search term "bitcoin", we can see that there has been an uptick recently but we're nowhere near the levels seen in December 2017.

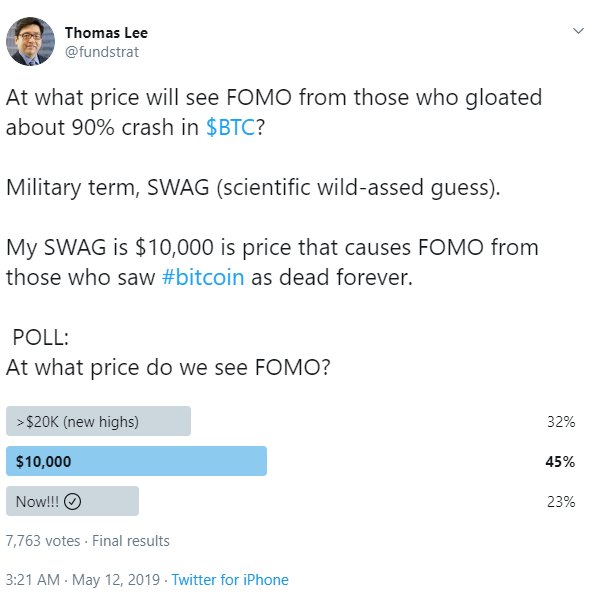

Indeed, despite the massive price movements, a recent survey shows that only 23% of respondents feel that what we're currently seeing can be classified as FOMO.

Yes, we've come a long way already and I would be very surprised if we don't see some sort of pullback, or at least a consolidation.

Given the overwhelming headlines we've seen indicating that mass crypto adoption may be around the corner and given the historic parabolic bull and bear cycles that Bitcoin is used to, in my mind we might be just getting started.

Traditional Markets

The stock markets are doing just fine this morning despite the current trade war between the US and China, possibly due to the recent weak economic data from China.

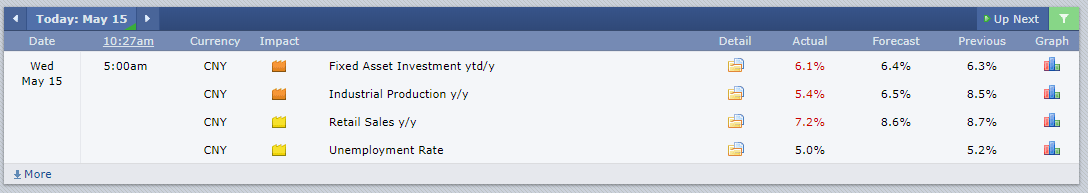

Data from China showed that retail sales, industrial production, capital investments, and even unemployment were all much worse than economists were forecasting. Important to note that this data reflects the period before the recent tariff hikes.

Bad news for the economy is good for the markets though. The expectation is that the People's Bank of China will likely come to the aid of the market with additional stimulus measures.

Here we can see the reaction in the CHINA50 index. The purple circle is the precise time of this morning's data dump.

This is a strong confirmation bias for me. Trade doesn't matter, politics don't matter, the economy doesn't matter. Keep your eyes on the central banks. They're the ones who control the money and the markets.

XRP Outperforming

By popular demand, let's take a look at the most popular crypto asset on the eToro platform, which has been outperforming over the last week.

Here we can see the top seven cryptos by market cap. XRP is the white line.

It did take a while for XRP to join the party this time. Unlike some of the other large-cap altcoins, it did not get a chance to surge during the recent altseason.

On the other hand, it also didn't see much of a plunge while the rest of the crypto market was going through capitulation back in November. Though it did fall during that timeframe, it did manage to hold firmly to its previous level of support at $0.25 per coin, thanks to a massive surge when the xRapid platform was released in September.

Over the last year, Ripple labs and the XRP community have been doing their best to distance themselves from the rest of the crypto community. CEO Brad Garlinghouse famously bashed bitcoin claiming that XRP is a valid replacement.

XRP chartists have also stated that in order for the platform to see great success, it needs to break the price correlation. So in that sense, it seems to be making good progress but isn't quite there just yet.

eToro, Senior Market Analyst

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.