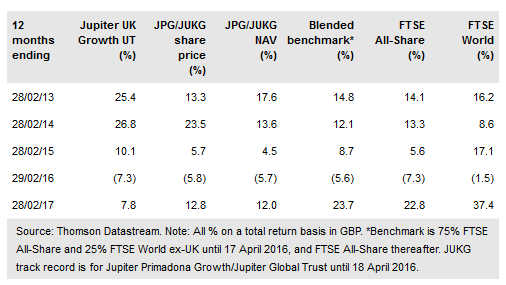

Jupiter UK Growth Investment Trust PLC (LON:JUKG) aims to generate long-term capital growth from a concentrated portfolio of predominantly UK equities. Manager Steve Davies runs the portfolio with the same contrarian, high-conviction approach as the much larger, well-established Jupiter UK Growth unit trust. He is “genuinely excited” about JUKG’s current portfolio, which he believes gives him the opportunity to make good the relative underperformance versus the FTSE All-Share benchmark following the Brexit vote. Davies is unconstrained by the benchmark; he currently has zero weightings in the oil & gas and utilities sectors.

Investment strategy: Bottom-up stock selection

Davies has a sell-side analyst background and uses this experience to build detailed financial models, aiming to select companies trading on reasonable valuations that have the potential to generate meaningful long-term capital growth. The portfolio is concentrated, typically containing c 35 stocks with either recovery potential or secular growth. JUKG is broadly invested in five themes: financials; UK domestic economy; the connected world; brands, travel & leisure; and tomorrow’s world. Up to 20% may be invested in overseas equities (currently less than 10%) and gearing of up to 20% of net assets is permitted.

To read the entire report Please click on the pdf File Below