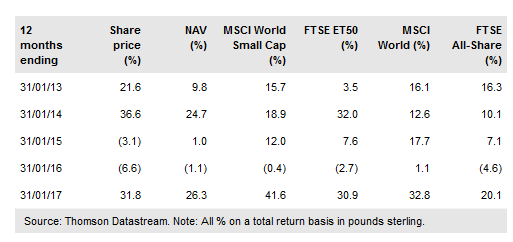

Jupiter Green Investment Trust PLC (LON:JGC) seeks to achieve capital growth by investing in companies that provide solutions to environmental challenges. It is managed by members of the environmental and sustainability team at Jupiter, which launched the UK’s first environmental fund, Jupiter Ecology, in 1988. The portfolio is global and multi-cap, although because of a tilt towards smaller companies it uses the MSCI World Small Cap Index as a performance benchmark. Absolute returns have been positive over all periods from one month to 10 years (annualised for periods longer than one year), and an active discount control mechanism aims to keep the shares trading close to NAV.

Investment strategy: Focus on green solutions

JGC’s managers, Charlie Thomas and team, act as the knowledge centre for environmental investing within Jupiter Asset Management. They monitor a large global investment universe of c 1,200 companies, looking for themes, running regular financial screens and making use of academic contacts, broker networks and company meetings to identify promising investments that are providing solutions to environmental challenges. A rigorous investment process leads to a portfolio of 60 stocks covering three broad areas of resource efficiency, demographics and infrastructure. Turnover is low at c 10% a year.

To read the entire report Please click on the pdf File Below