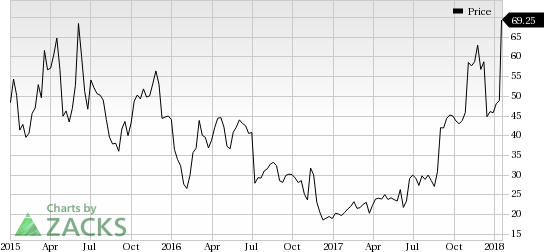

Shares of Juno Therapeutics, Inc. (NASDAQ:JUNO) hit a new 52-week high of $70 on Jan 17 and eventually closed at $69.25. The shares of the company hit the new high on reports that the company is being acquired by Celgene Corp. (NASDAQ:CELG) . Juno already has an agreement with Celgene for the global development and commercialization of immunotherapies. A potential acquisition of Juno, would help Celgene build and diversify its drug pipeline while building up future revenue streams.

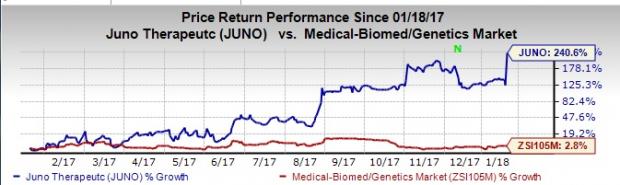

Shares of Juno have gained 240.6% in the past year while the industry registered an increase of 2.8%.

Juno is developing CAR-T therapies and the same has remained in investor focus in 2017, courtesy of immense potential. CAR-T space is expected to be revolutionary in treatments for cancer. Therefore, the company has been in newsever since the CAR-T cancer therapy designer, Kite Pharma was acquired by the Biotech giant Gilead Sciences, Inc. (NASDAQ:GILD) . In fact there were rumors of Juno’s potential acquisition by Gilead or even their biggest partner Celgene.

The FDA also approved Novartis’ (NYSE:NVS) Kymriah, the first CAR-T therapy followed by yet another CAR-T approval of Kite Pharma’s Yescarta in the past one year. Juno has been another player in the market developing the therapy.

Juno’s most advanced pipeline candidates -- JCAR017 and JCAR014 -- use CAR T-cell technology to target CD19.

JCAR017 is presently undergoing a phase I pivotal TRANSCEND study for non-Hodgkin lymphoma (NHL) including those with diffuse large B cell lymphoma (DLBCL), follicular lymphoma grade 3B or mantle cell lymphoma (MCL). Juno reported promising additional data from the pivotal study including patients with DLBCL.in December 2017, The company plans to bring JCAR017 to the market for NHL by the end of 2018 with biologics license application (BLA) expected to be filed in the second half of the same year.

In the third quarter 2017 conference call, Juno and Celgene also initiated a phase Ib PLATFORM study, evaluating the combination of JCAR017 with AstraZeneca’s Imfinzi (durvalumab), for treatment of patients with relapsed/refractory (r/r) NHL.

Zacks Rank

Juno has a Zacks Rank #4 (Sell). You can see the complete list of today’s Zacks #1 Rank stocks here.

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp (NYSE:FMC). and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2018 today >>

Novartis AG (NVS): Free Stock Analysis Report

Gilead Sciences, Inc. (GILD): Free Stock Analysis Report

Celgene Corporation (CELG): Free Stock Analysis Report

Juno Therapeutics, Inc. (JUNO): Free Stock Analysis Report

Original post

Zacks Investment Research