While junk bonds haven't had much to brag about over the past few years, that trend is doing its best to change.

Junk bonds are often viewed as leading indicators for the future direction of the stock market. Junk bonds represent weak-company debt and how it's priced can be viewed as an important proxy for the health of the overall economy.

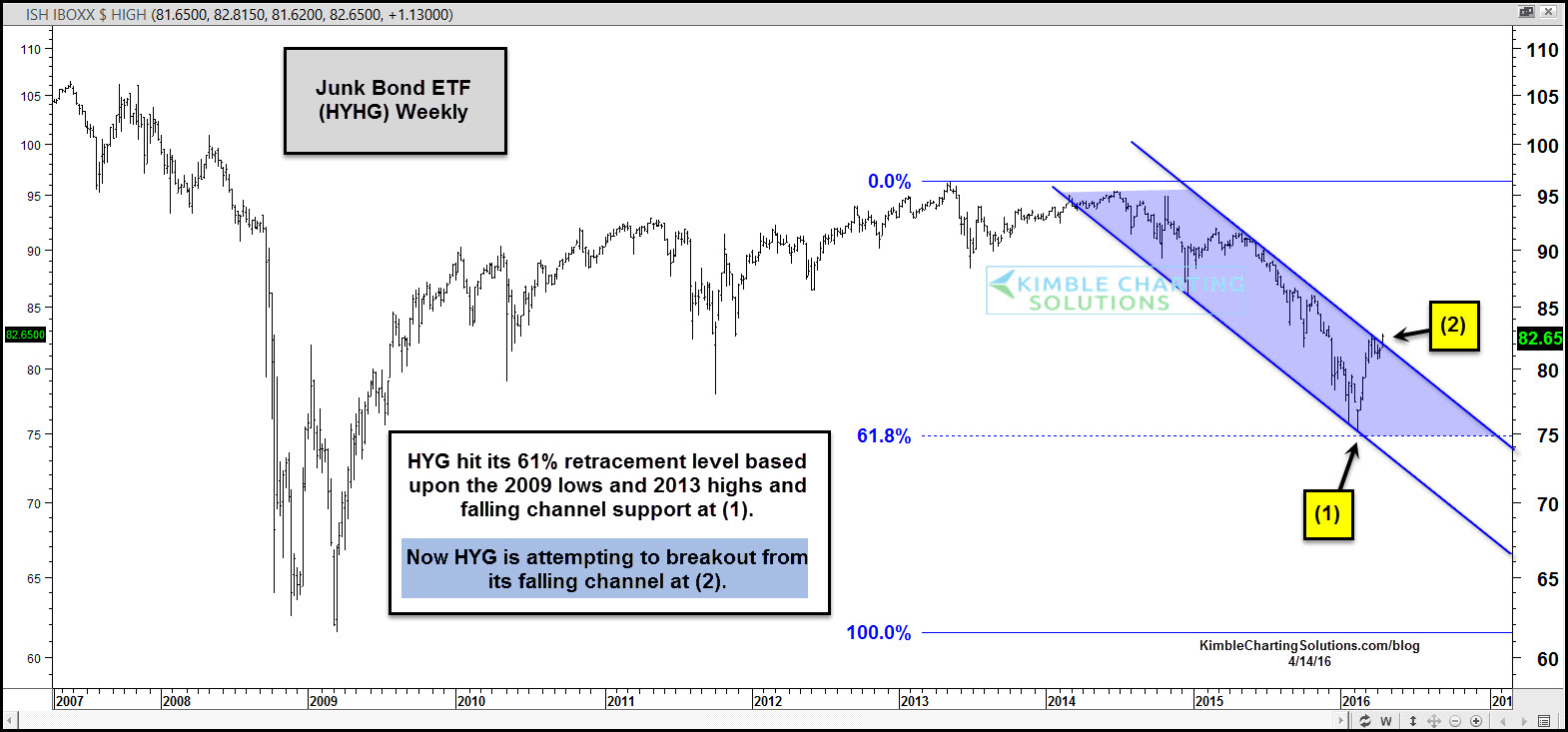

Junk bonds have diverged against the broad market for the past few years, sending a concerning message to many market players. The decline off the highs in 2013 took HYG down to its 61% Fibonacci retracement level based upon its 2009 lows and 2013 highs. At the same time it was hitting its 61% Fib level, it was testing support of a steep falling channel at (1).

Junk Bond ETF HYG is making an attempt to break out of its 2-year falling channel at (2) above.

A further push higher by HYG would send a small positive signal to the broad markets. If HYG reverses and heads down again, it would continue to send a concerning message to the broad markets.

Bottom Line

Junk Bonds are testing a key resistance level. Keep a close eye on what they do the next couple of weeks. They could be sending a very important message, which could be of big help in portfolio construction during the next couple of months.