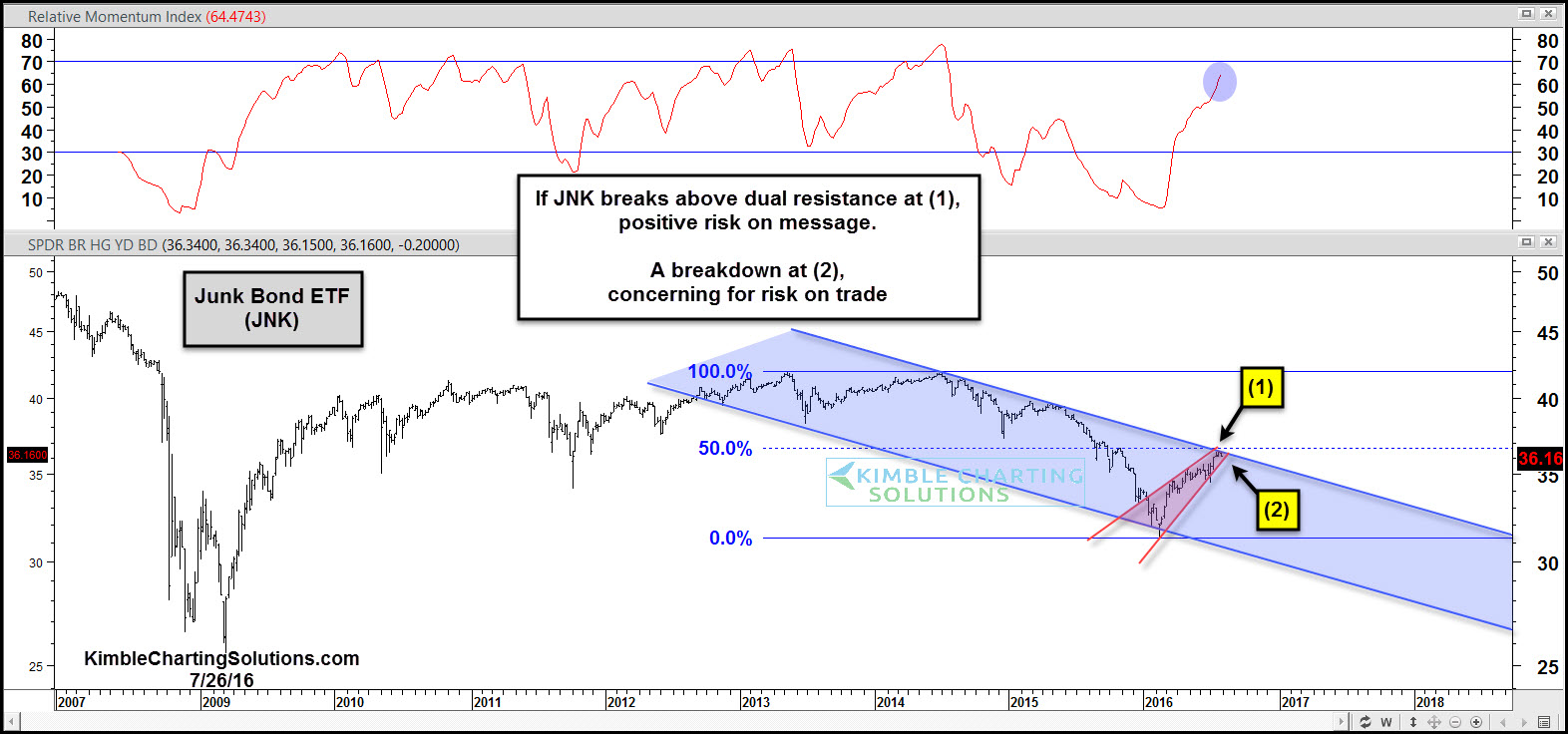

Junk bonds have been good at sending risk-on and risk-off messages to the broad stock market. Below looks at Junk Bond ETF JNK over the past decade.

Right now, JNK is at an important price point and how it performs in the next couple of weeks will have a big impact on the risk-on/risk-off trade.

After peaking in 2014, JNK turned weak, with little impact on the broad market. JNK hit falling channel support in February of this year and the risk-on trade hit a low at the same time.

Now JNK is testing the top of its 3-year falling channel as well as its 50% Fibonacci retracement level at (1 ). If it can breakout, the risk-on trade will surge.

If JNK breaks down at (2), it will encourage the risk-off crowd.

With weekly momentum now entering a lofty range (top of chart above), JNK's performance at (1) becomes pretty important.