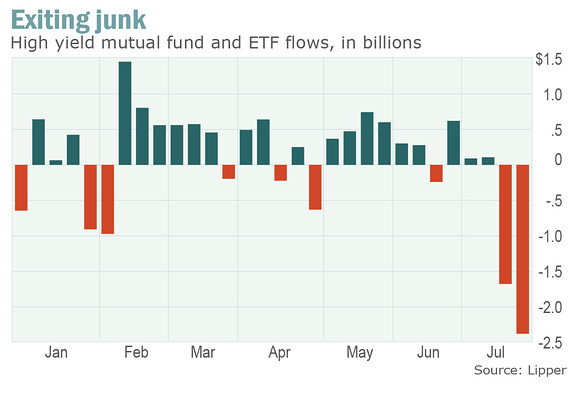

The news the last few weeks has been about record outflows from the Junk Bond market. The chart from Lipper above shows shows the massive out flows recently. This could have been caused by nervousness over fighting in Gaza or the Ukraine situation or any number of reasons. It is not important to me why it happened. What is important is that the sell off completed a near perfect bullish Shark harmonic pattern, and then reversed higher. The move up has now retraced over 50% of the pattern extremes and is approaching the next target of a 61.8% retracement at 41.15.

As a trader this is a difficult point to try to enter with a new position, so close to the target and just getting back to the 200 day SMA. The bounce may be over before the pundits even start talking about it. But a move over 41.15 does create a buying opportunity, using the 200 day SMA as a stop. The momentum indicators, RSI and MACD are both very positive. Keep this on your radar.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.