Summary

- Juniper Networks (NYSE:JNPR) is a good quality internet infrastructure provider that recently suffered a sizable correction due to the company’s disappointing 3Q guidance. However it's probably an overreaction.

- The growth of cloud computing in the long term allows Juniper to capitalize on increased order flows from clients like Microsoft (NASDAQ:MSFT), IBM (NYSE:IBM), as well as Facebook (NASDAQ:FB) and Oracle (NYSE:ORCL).

- Compared to industry peers, Juniper currently trades at an attractive valuation of 16.4x FY2016 P/E, making it a suitable candidate to enter at current prices.

Correction Likely An Overreaction

Juniper Networks is a California-based manufacturer of internet infrastructure products with geographical exposures (by net revenues) to the United States (60%), Europe (25%) and Asia Pacific (15%). The company manufactures routers and switches, supplying to corporate customers in the cloud computing and telecommunications industries. Key customers include Microsoft, IBM, Facebook and Oracle.

Juniper’s financials are in good shape. The company generates a strong return on invested capital of 8.6% as of FY2016, together with a strong balance sheet of $452 million in net cash. Prudent inventory management has also given the company a low working capital cycle of about 30 days, which transpires into strong free cash flow generation (9.0% FCF yield as of FY2016).

Shares of the company recently suffered a 9% correction on disappointing guidance for the coming 3Q2017 earnings. Revenue for the third quarter is now expected to be in the range of $1.25 billion to $1.26 billion, below the company’s previous forecast of $1.29 billion to $1.35 billion, due to lower than expected revenue of their cloud vertical. Earnings per share (EPS) guidance has also fallen from $0.55 to $0.61, to $0.54 to $0.56. However, taking the midpoint of the estimates, it could be seen that the difference in 3Q2017 EPS guidance is only -5%, while share price tanked by 9%. This could be viewed as a market overreaction, presenting an opportunity for entry.

Cloud Computing Drives Growth

Juniper’s main source of growth comes from supplying routers and switches to the cloud computing industry.

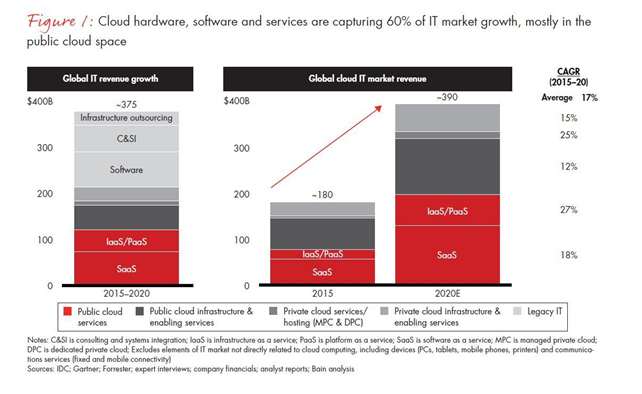

According to IDC’s study published in 2016, global cloud IT market revenue in 2020 is expected to grow to approximately $390 billion, from $180 billion in 2015 – representing a 17% compounded annual growth rate (CAGR). As cloud computing grows, increasingly replacing localized servers, demand for Juniper’s cloud-optimized components such as the vMX routers should increase rapidly in the future, driving underlying earnings growth for the company.

Attractive Valuations Vs. Peers

After the correction, Juniper currently trades at a valuation of 16.4x FY2016 P/E. Compared to peers such as Cisco Systems (NASDAQ:CSCO) and F5 Networks (NASDAQ:FFIV), which are trading at 16.2x and 21.1x historical P/E respectively, Juniper can be considered attractively priced.

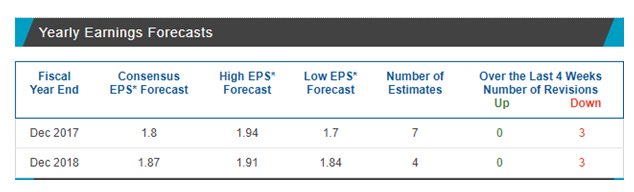

According to Zacks Investment Research, consensus estimates put Juniper’s FY2017 EPS forecast at $1.80, which gives the company a projected earnings growth of 14.6% from the current $1.57. With Juniper beating expectations in the first two quarters of the year, it is very likely that even with disappointing Q3 figures, the company would still be able to meet its projected growth forecasts for the full year. So from an earnings growth perspective, Juniper’s current valuation isn’t expensive as well.

From a technical standpoint, after correcting approximately 9%, shares of Juniper are also nearing technical support levels ($25~$26), meaning that there’s a good probability that prices could stabilize and rebound.

So considering the above factors, Juniper is currently an attractively priced stock with good fundamentals and growth prospects, experiencing a temporary correction due to the company’s own conservative guidance. This makes for a reasonable entry thesis for investors to consider.

Disclosure: We have no positions in any stock mentioned above.