The junior gold miner ETF (Market Vectors Junior Gold Miners (NYSE:GDXJ)) broke out of a handle that was formed near its one year high around $27 after the Fed stayed put on interest rates and stated there may only be two hikes instead of four this year. This should continue to be bullish for precious metals, commodities and the junior miners.

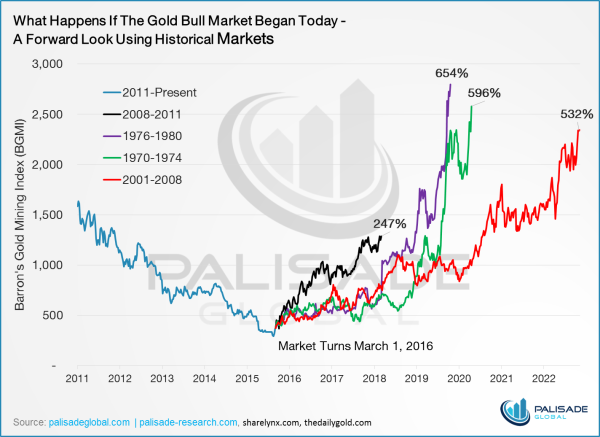

I believe we are in a new bull market for junior miners that has followed a five year historic rout in junior resource stocks. The early stages of a new uptrend are when some of the greatest gains can be made. Looking at the chart above made by Palisade Research, the gains in juniors can be huge coming off a major bottom around 600%.

This recent pullback to the 20 Day Moving Average followed by a bullish reversal today indicates the uptrend should continue into new 52 week highs. Investors are growing concerned about the US in an election year. The Republican Primaries and the choosing of a populist outsider with no political experience shows the anger and fear of the masses who are growing increasingly concerned about the way business is run in Washington and are fearful of a coming economic crisis.

The US dollar could be in the beginning of the next down leg. The Fed is aware of the growing hostility of the public in an election year and may not want to create undue volatility with increased rate hikes. Look at the selloff caused by the only rate hike last year. The last thing the Fed wants to do is go into the next election with a full blown bear market.

If blue chips and tech darlings continue to weaken look for The Fed to continue to prop up the market by even lowering the rates are announcing another quantitative easing. This could send juniors soaring even higher which they have already been doing this year. Some of our top stocks have doubled this year on huge volume.

Take a look at some of the top performers I picked on the TSX Venture in 2014 and 2015 by clicking here.

Look at these two gold stocks I picked in 2015 that have been real winners…

The lithium battery sector is on fire as well completely diverging with the volatility of the equity markets. Check out this first class advanced lithium brine asset in Argentina and this huge high grade Graphite deposit in Alaska breaking out into new highs on huge volume.

I have a whole list of stocks ready to possibly breakout in gold, silver, lithium and graphite. If you are not yet following the top small cap performers returning huge gains on the OTCQX and/or TSX Venture now is a great time to join our premium service.