Retail sales rose 0.6 percent in June, while inflation increased 0.2 percent. What does it imply for the Fed policy and the gold market?

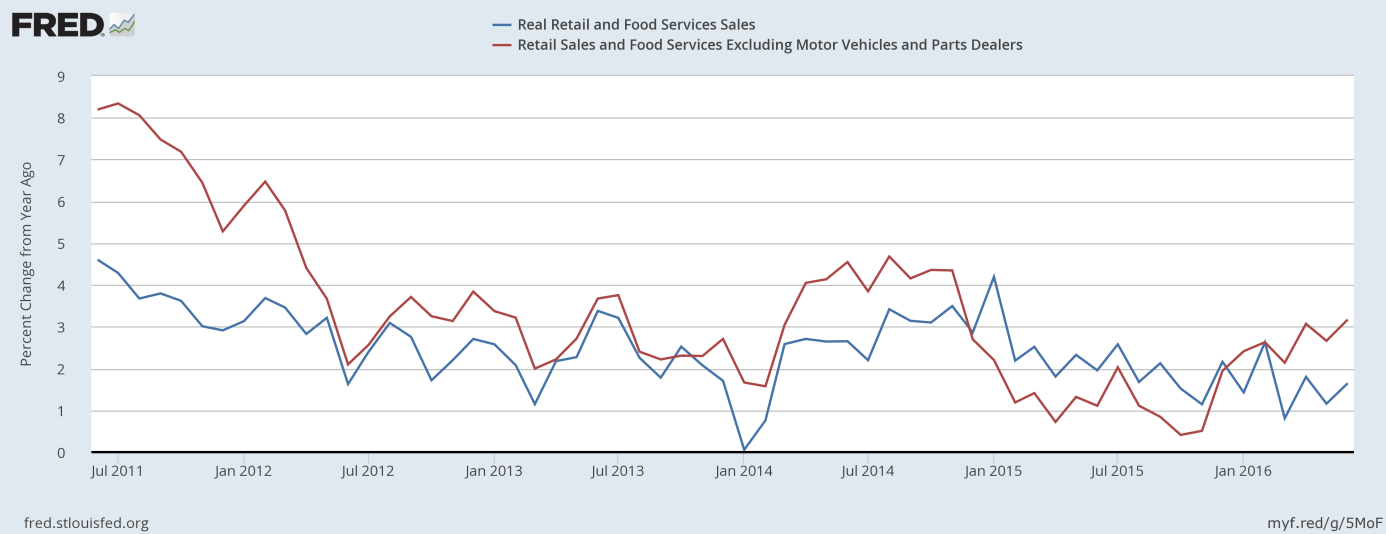

Sales at U.S. retailers increased 0.6 percent last month, according to the U.S. Department of Commerce. The rise followed the 0.2 percent increase in April (after a downward revision from 0.5 percent) and was bigger than expected. On an annual basis, retail sales rose 2.7 percent, while retail sales excluding motor vehicles jumped 3.2 percent, which shows soft purchases of new cars and trucks. As one can see in the chart below, the annual pace of growth of retail sales accelerated from May, signaling that the U.S. economy rebounded in the second quarter of 2016.

Chart 1: Retail and food services sales (blue line) and retail and food services excluding motor vehicles and parts dealers (red line) as percent change from year ago, from June 2011 to June 2016.

Indeed, the GDPNow model forecast for real GDP growth in the second quarter of 2016 edged up from 2.3 percent to 2.4 percent after the release of the retail sales report. Therefore, tomorrow’s FOMC statement may sound more hawkish. However, the probability of a June hike is literally zero, according to the CME Group (NASDAQ:CME) FedWatch. Thus, the June hike is off the table – otherwise the Fed would trigger financial turmoil.

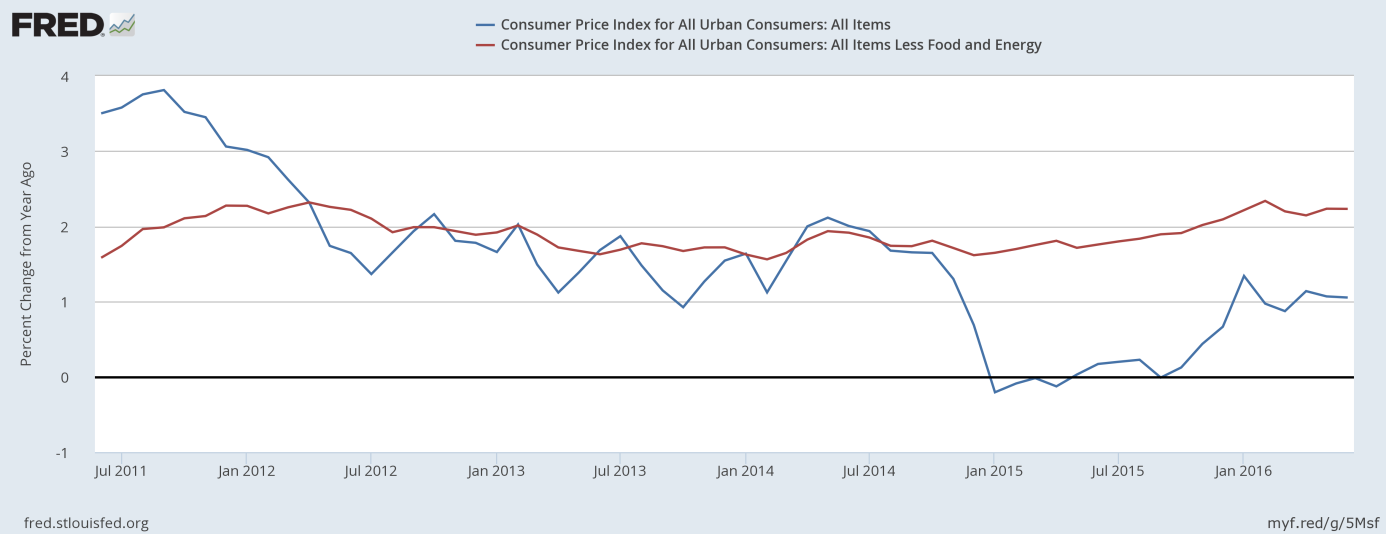

Both the CPI Index and the core CPI Index, which excludes food and energy, rose 0.2 percent in June. On an annual basis, consumer prices increased just 1 percent, while core CPI jumped 2.3 percent. As one can see in the chart below, the annual dynamics of inflation is stagnant. The lack of acceleration in inflation may be an argument for Fed’s dovish stance.

Chart 2: CPI (blue line) and core CPI (red line) year-over-year from June 2011 to June 2016.

To sum up, retail sales were strong last month, but inflation remains low and does not want to rise significantly. Thus, recent U.S. economic data is mixed and should not affect the FOMC outlook. However, the Fed may sound rather hawkish tomorrow, as the Brexit vote did not cause financial turmoil. Given the current very flat expected path of the federal funds rate, there is a lot of room for an upward recalibration of market expectations of the Fed rate hike this year. Such a correction would put important downward pressure on gold.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.