Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

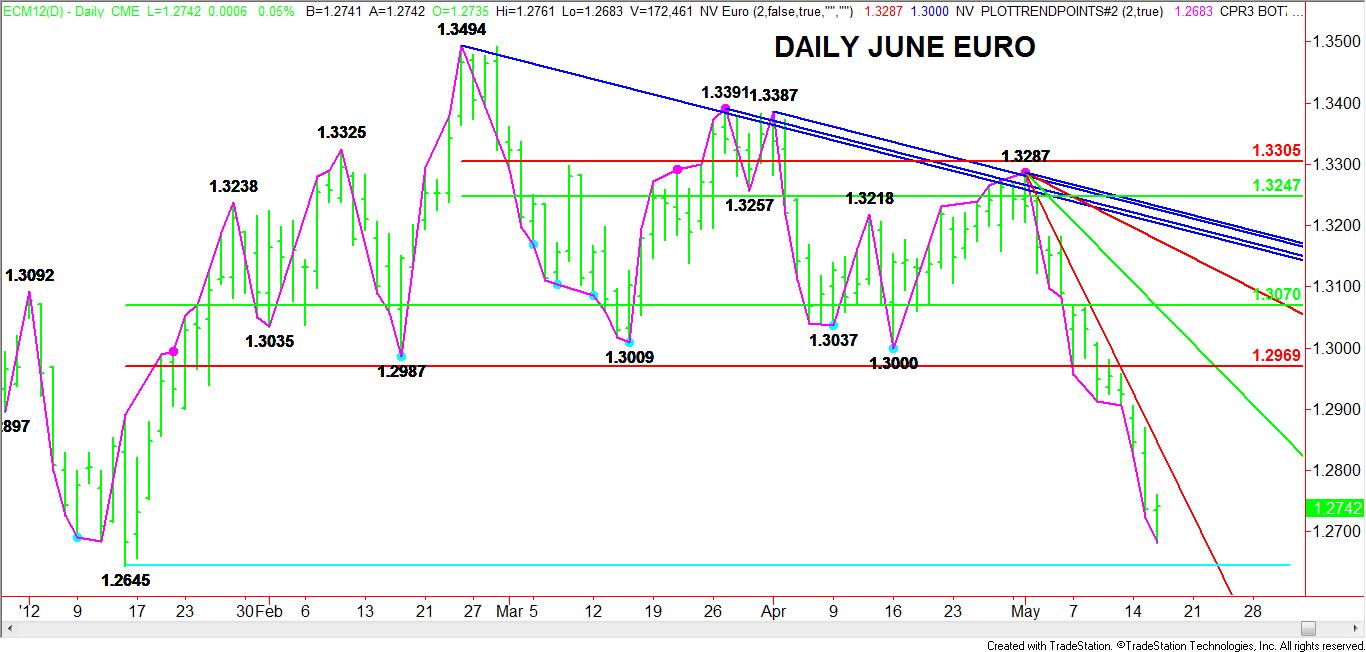

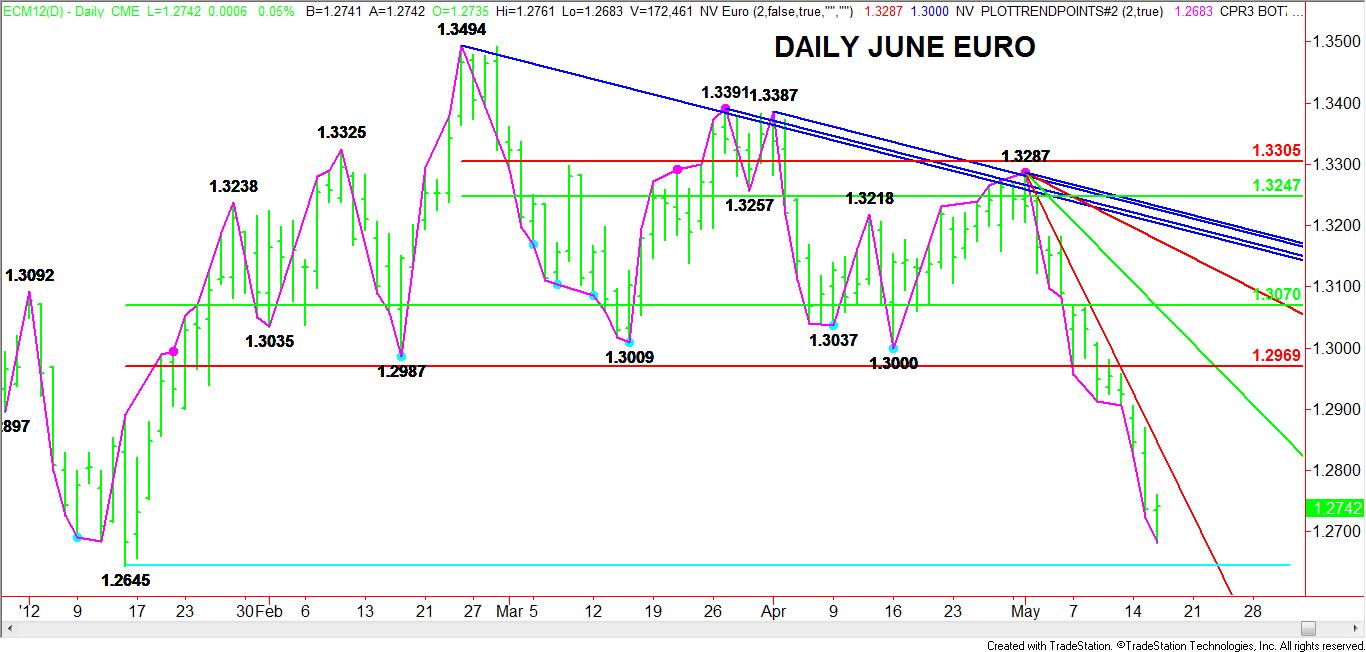

The June euro continued its sell-off overnight, but as it neared the low for the year at 1.2645, the market reversed course and is now trading higher. Since the current break is a clear definition of prolonged move down in terms o price and time, the single-currency is ripe for a closing price reversal bottom.

A closing price reversal bottom is not a change in trend, but often produces a 2 to 3 day counter-trend rally sometimes equal to 50% of the last break. This is where it gets interesting since the current break is 1.3287 to 1.2683. A 50% correction of this range would mean a test of 1.2985. Since the old bottom at 1.3000 is likely to be the next resistance, 1.2985 to 1.3000 could be a strong resistance cluster.

Before we can even think about a rally back to near the 1.3000 level, the market will have to form the closing price reversal and confirm it. In addition, the euro will have to take out the downtrending Gann angle that has guided this market lower for the past 11 trading sessions. This resistance angle is at 1.2847 as of yesterday.

Before we can even think about a rally back to near the 1.3000 level, the market will have to form the closing price reversal and confirm it. In addition, the euro will have to take out the downtrending Gann angle that has guided this market lower for the past 11 trading sessions. This resistance angle is at 1.2847 as of yesterday.

If anything, a closing price reversal could trigger a 2 to 3 day short-covering rally, but reaching the 50% level at 1.2985 seems pretty remote. Even if there is a rally, it is going to take a lot of effort to change the main trend back to up. With the fundamentals on the side of the short-seller, any rally that takes place without a supporting story is likely to be met by stiff resistance.

A closing price reversal bottom is not a change in trend, but often produces a 2 to 3 day counter-trend rally sometimes equal to 50% of the last break. This is where it gets interesting since the current break is 1.3287 to 1.2683. A 50% correction of this range would mean a test of 1.2985. Since the old bottom at 1.3000 is likely to be the next resistance, 1.2985 to 1.3000 could be a strong resistance cluster.

Before we can even think about a rally back to near the 1.3000 level, the market will have to form the closing price reversal and confirm it. In addition, the euro will have to take out the downtrending Gann angle that has guided this market lower for the past 11 trading sessions. This resistance angle is at 1.2847 as of yesterday.

Before we can even think about a rally back to near the 1.3000 level, the market will have to form the closing price reversal and confirm it. In addition, the euro will have to take out the downtrending Gann angle that has guided this market lower for the past 11 trading sessions. This resistance angle is at 1.2847 as of yesterday. If anything, a closing price reversal could trigger a 2 to 3 day short-covering rally, but reaching the 50% level at 1.2985 seems pretty remote. Even if there is a rally, it is going to take a lot of effort to change the main trend back to up. With the fundamentals on the side of the short-seller, any rally that takes place without a supporting story is likely to be met by stiff resistance.