Investing.com’s stocks of the week

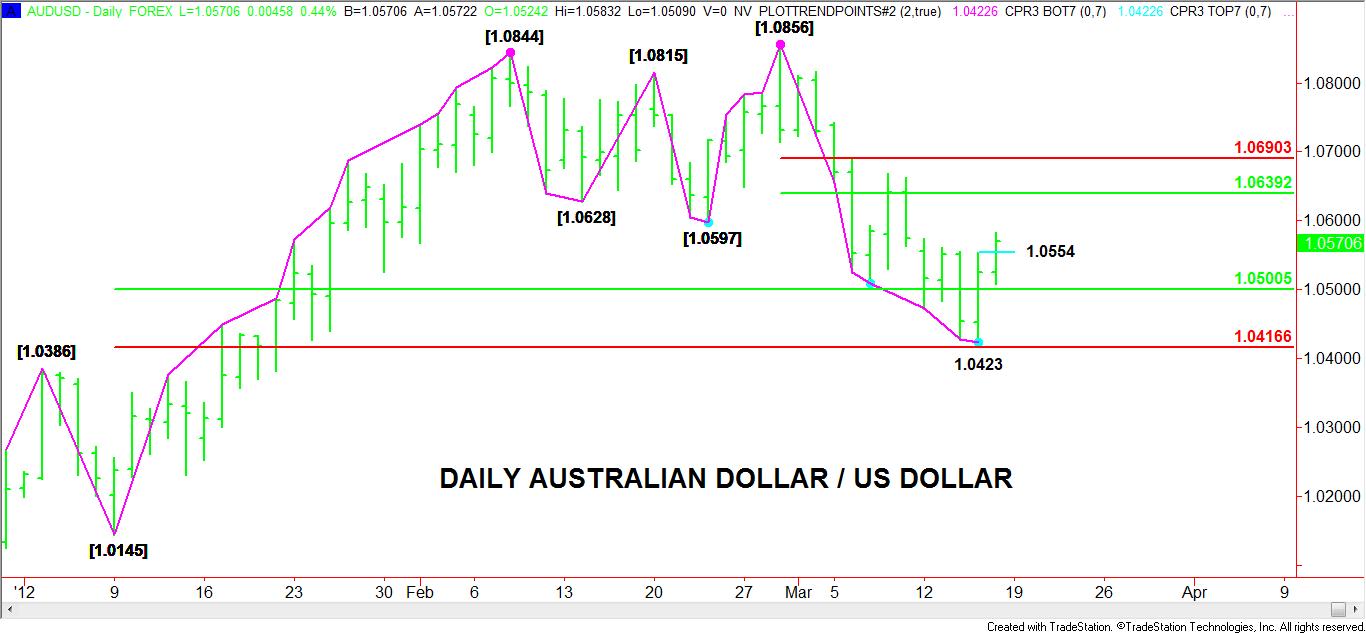

There was an interesting development between the June Australian Dollar futures contract and the AUD/USD Forex market on Thursday. Both trading instruments rebounded to the upside after testing their respective Fibonacci levels and closed higher, but the AUD/USD had a lower low than the June Australian Dollar. This action produced a closing price reversal bottom, setting up a potential 2 to 3 day rally and a 50 percent retracement of the last break.

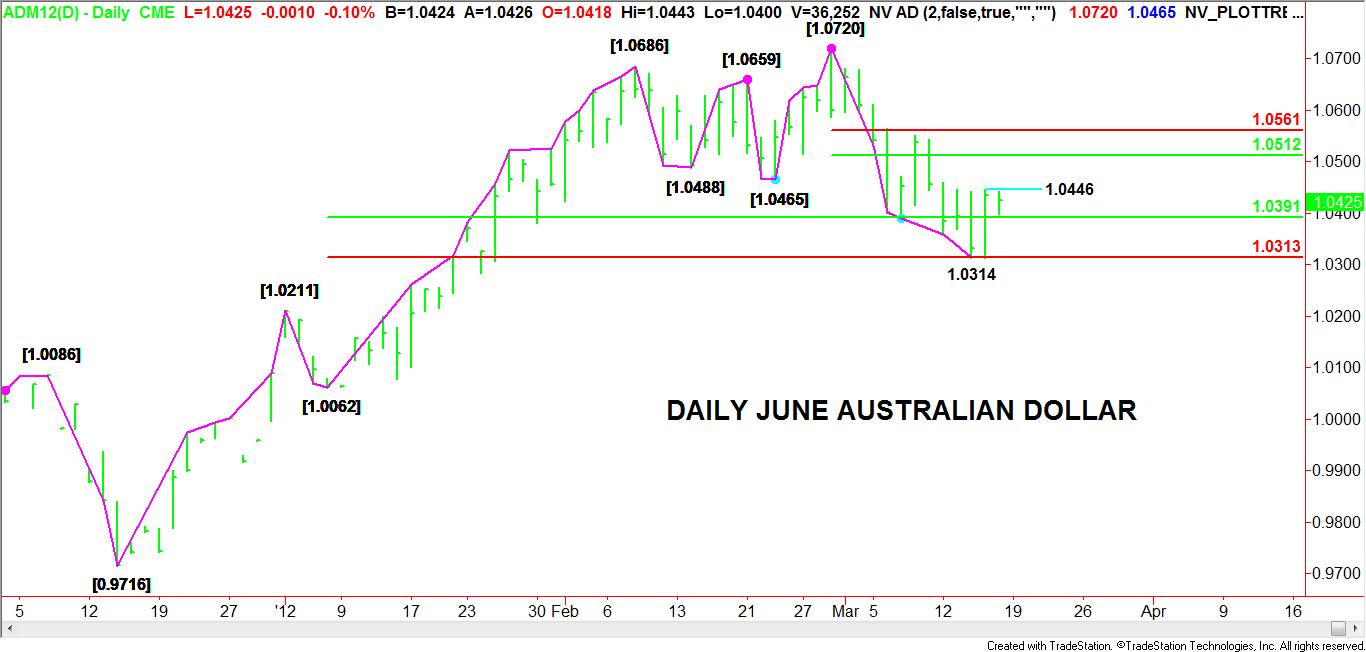

Since the Forex market has more volume and the futures contract is a derivative of the Forex market, I’m going to suggest that a breakout over 1.0446 in the June Australian Dollar market is likely to trigger a rally into 1.0512 to 1.0561 by early next week.

This is a counter-trend trade since the main trend is down on the daily chart. A test of the retracement zone created by the break from 1.0720 to 1.0314 is likely to attract selling pressure in an attempt to form a secondary lower top. If this top forms inside the zone, then the market is likely to begin another leg down.

Fundamentally, although most global equity markets have been trending higher, the Australian Dollar has fallen out of favor as a “risk on” currency. Traders could be waiting to see improvements in Australian economic indicators before they get the clarity they need to trade the currency with any confidence.

In addition, the Chinese government’s recent downgrade of economic growth targets, as well as ongoing concerns about Euro Zone sovereign debt are other reasons why bullish traders are shying away from the long side of the Aussie.

Aggressive short-term traders should watch for a quick rally to set up the next shorting opportunity over the next 2 to 3 days. If the market does hit resistance as anticipated then the next break may be labored until the market can clear the retracement zone at 1.0391 to 1.0313.