Yesterday, the minutes of the ECB’s July meeting were released. What do they say about the ECB stance and what do they mean for the gold market?

On Wednesday, the FOMC released minutes from its July meeting. Yesterday, the ECB followed and issued its own recent minutes, which are called “Account of the monetary policy meeting”. Similarly to its U.S. counterpart, the ECB minutes were considered by the markets as dovish. This is because they showed that the officials were worried about the continued discrepancy between strengthening economic activity and subdued inflation dynamics. Thus, although the economic expansion strengthened, while inflation moved towards the 2-percent target and confidence in this movement increased overall, “convincing signs of a more dynamic pick-up in measures of underlying inflation were yet to appear.”

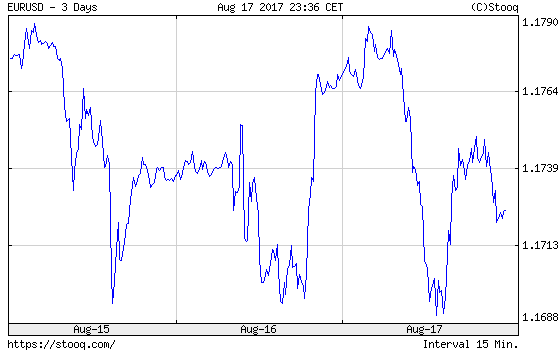

Moreover, the members of the ECB’s governing council expressed concerns about the risk of the exchange rate overshooting in the future. Therefore, the euro plunged to a three-week low $1.17 after the release, paring its Wednesday’s gains, as one can see in the chart below.

Chart 1: EUR/USD exchange rate over the last three days.

Although the US dollar strengthened, gold gained almost $5 in New York yesterday (see the chart below), which showed its resilience. The reason may be that two major central banks turned dovish.

Chart 2: Gold prices over three last days.

Summing up, the July ECB minutes were released yesterday and the yellow metal gained that day. The reason is that the minutes showed increasing worries about the recent softness in inflation and the strength of the euro. It means that the ECB may remain very dovish for longer than investors started to expect after Draghi’s speech in Sintra.

In such a scenario, the US dollar could appreciate against the euro, putting downward pressure on gold. However, there is plenty of time before the fall when the ECB will consider the future course of its monetary policy. If the economic momentum in the Eurozone persists, the tightening will be inevitable. Although some sources say that Draghi will not give a pivotal monetary policy speech, investors are awaiting his speech at the Jackson Hole conference, looking for any hints about the ECB’s future stance. Stay tuned!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.