The Fed is failing us. It started out great. The initial reaction to the pandemic was timely and forceful. The yield curve on March 18 was signaling confidence.

But, since then, we have been slowly sinking into stagnation. The long end of the Eurodollar curve is barely over 1% now. It is true that forward inflation expectations have continued to slowly rise, though they are still well under 2%.

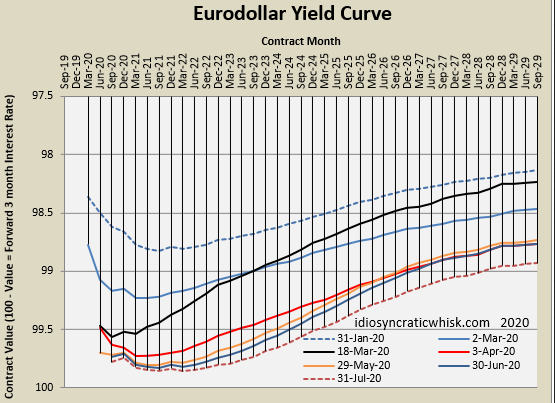

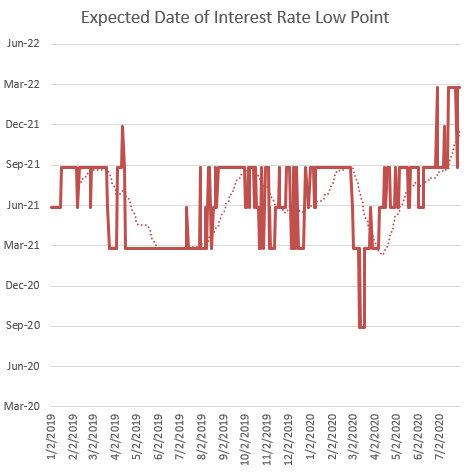

Here are two graphs of yields. The first shows the Eurodollar curve at several points in time. It is now at a new low. The second shows the expected date of the bottom in short-term yields. The yield curve bottom is now settling in on March 2022. The date is moving away from us over time, not toward us. This was the pattern during QE1-3, when QEs were on, the date of the first rate increase would stabilize, but the Fed always cut the QEs off before we actually arrived at the date, and when they would stop the QEs, the date would move off into the future again.

When the yield curve inverted in 2019, the Fed reacted moderately well to it, and at least the expected date of the next rate hike was relatively stable, ranging around June 2021 for all of 2019. Then, their aggressive moves in March actually briefly moved the date closer. I thought that the pandemic might have actually kicked them into gear a bit to focus more on nominal economic recovery. Briefly, in March, the expected first rate hike had moved as far as September—next month. But that didn't last.

This is not a comment on all the emergency lending programs. They simply should be buying a lot more Treasuries until nominal income or inflation expectations recover more.