According to Econintersect, the July 2012 pending home sales index released by the National Association of Realtors (NAR) suggests:

- August 2012 unadjusted existing home sales of 445,000 (see details below);

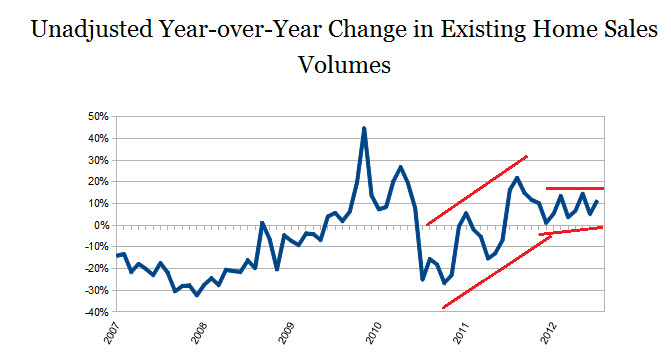

- If this 407,000 historical correlation is correct, this would only be a 4.0% gain year-over-year in August existing home sales, and the 14th month in a row of year-over-year gains.

- unadjusted actual July existing home sales were up 6.2% month-over-month, Up 11.4% year-over-year. Note that Econintersect is suggested a significantly poorer August existing home year-over-year sales growth compared to July.

Econintersect analysis shows the index up 6.6% (versus last months down 6.3%) month-over-month and up 15.0% year-over-year. Last month’s poorer data was completely negated this month.

From the NAR press release:

Pending home sales rose in July to the highest level in over two years and remain well above year-ago levels, according to the National Association of Realtors®.The Pending Home Sales Index,* a forward-looking indicator based on contract signings, rose 2.4 percent to 101.7 in July from 99.3 in June and is 12.4 percent above July 2011 when it was 90.5. The data reflect contracts but not closings.

Lawrence Yun , NAR chief economist, said the index is at the highest level since April 2010, which was shortly before the closing deadline for the home buyer tax credit. “While the month-to-month movement has been uneven, more importantly we now have 15 consecutive months of year-over-year gains in contract activity,” Yun said.

Limited inventory is constraining market activity. “All regions saw monthly increases in home-buying activity except for the West, which is now experiencing an acute inventory shortage,” Yun added.

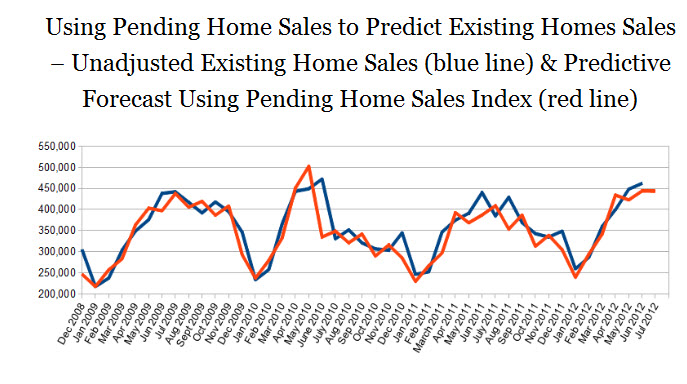

The National Association of Realtors (NAR) pending home sales index offers a window into predicting existing home sales. The actual home sale might appear in the month the contract was signed (cash buyers account for 29% of home sales in June according to the NAR), or in the following two months. Econintersect evaluates by offsetting the index one month to project existing home sales.

Using this index offset one month suggests existing home sales of 445,000 in August 2012 (including a +40,000 fudge factor for historical error of this methodology for the month of August in years past. Note the graph below does not include fudge factors.

Using this methodology, 420,000 existing home sales were forecast in July 2012 vs the actual reported number of 429,000 (which is subject to further revision). Existing home sales (unadjusted) were up 6.2% month-over-month, Up 11.4% year-over-year in July.

As shown on the above graphic, since mid 2011 home sales have been positively growing year-over-year. However, the strong rate of growth seen since mid-2010 appears to have moderated to a lower growth channel as shown on the graph above.

Keeping things real – home sales volumes are only 65% of previous levels.

Caveats on the Use of Pending Home Sales Index

According to the NAR:

NAR’s Pending Home Sales Index (PHSI) is released during the first week of each month. It is designed to be a leading indicator of housing activity. The index measures housing contract activity.

It is based on signed real estate contracts for existing single-family homes, condos and co-ops. A signed contract is not counted as a sale until the transaction closes. Modeling for the PHSI looks at the monthly relationship between existing-home sale contracts and transaction closings over the last four years.

…… When a seller accepts a sales contract on a property, it is recorded into a Multiple Listing Service (MLS) as a “pending home sale.” The majority of pending home sales become home sale transactions, typically one to two months later.

NAR now collects pending home sales data from MLSs and large brokers. Altogether, we receive data from over 100 MLSs & 60 large brokers, giving us a large sample size covering 50% of the EHS sample. This is equal to 20 percent of all transactions.

In other words, Pending Home Sales is an extrapolation of a sample equal to 20% of the whole. Econintersect uses Pending Home Index to forecast future existing home sales.

Econintersect reset the forecasting of existing home sales using the pending home sales index coincident with November 2011 pending home sales analysis (see here) – as the NAR in November revised the historical existing home sales data.

The Econintersect forecasting methodology is influenced by the speed at which closings occur. When they slow down in a particular period – this method overestimates. The number of cash buyers are speeding up the process (cash buyers analysis here). A quick cash home sale process could begin and end in the same month.

On the other hand, contracts for short sales can sometimes take months to close. Interpreting the pending home sales data is complicated by weighing offsetting effects in the current abnormal market.

Please note that Econintersect uses unadjusted data in its analysis.

Econintersect determines the month-over-month change by subtracting the current month’s year-over-year change from the previous month’s year-over-year change. This is the best of the bad options available to determine month-over-month trends – as the preferred methodology would be to use multi-year data (but the New Normal effects and the Great Recession distort historical data).