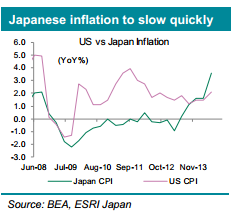

While Q2 Japan inflation data recently rose above levels seen in the US, today’s anticipated 3.4%YoY headline print is unlikely to trigger renewed JPY strength. Indeed with policy officials from both sides now publically questioning the sense of further VAT increases in the face of still weak consumer spending, previous price should slow quickly.

Moreover, if already soft real activity data deteriorate further, expectations for additional BoJ monetary policy stimulus will likely rise.

As we wrote last Friday, growing BoJ QE expectations remain a key threat for JPY in Q4. This was seen in JPY’s sensitivity to Kuroda’s speech at Jackson Hole last week. While not specifically mentioning any new policy initiatives, his reiterating that further measures could be taken if needed was sufficient for many to draw QE conclusions.

We therefor continue to look for further JPY weakness and remain long NZD/JPY as a trade recommendation.

**CA maintains a long NZD/JPY position targeting 92 with a stop at 84.