Japan’s Finance Minister stated the G20 has no objections to Japan’s policies, which are naturally “not aimed at weakening the JPY”. The market is trying to pick up the pieces of the risk-on trades again.

The yen was weaker Friday morning after Japan’s Finance Minister Taro Aso said the G20 participants offered no objections to Japan’s policies. The initial reaction from this development is to jump back into the pro-risk. JPY-short trades as well as JPY crosses jumpedback higher Friday morning. Gold pushed above 1400, and equities in Asia had a positive start. It all looks a bit too easy, thinking we might see some dramatic swings Friday, though not sure of the direction. If 100 falls in USD/JPY and asset markets chime in with their approval, the psychology of the global liquidity trade could mean a further blow-out to the upside in JPY crosses with a swell of support from asset markets – although I remain sceptical after the recent volatility across markets.

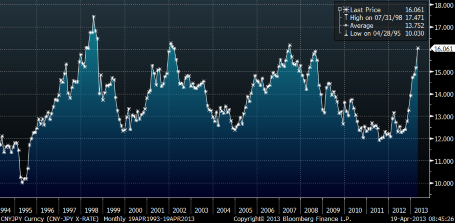

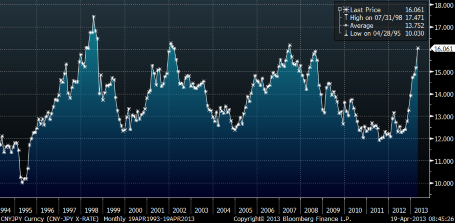

The G20 statement will still caution against policies aimed toward competitive devaluation. The South Korean president has complained that Japan’s policies are more of a threat to the country than the situation with North Korea. Look for the Chinese response as well, now that we are on the other side of this meeting, possibly in the coming week if the USD/JPY pushes above 100. As the USD/CNY has fallen to new lows recently, the CNY/JPY level is banging on the door of 15-year highs.

Chart: CNYJPY

We’re likely to get an escalation in the response from China if the CNY/JPY continues higher from here. The pair has gone almost 30% higher over the last 6 months. Chart courtesy of Bloomberg.

CNY/JPY" title="CNY/JPY" width="455" height="224" />

CNY/JPY" title="CNY/JPY" width="455" height="224" />

Looking ahead

In Italy, there are renewed efforts to find an Italian president, with a failure possibly leading to yet another vote that may only require a simple majority. The question of whether a functioning government can be formed remains unanswered. I’ll not pretend to have a thorough understanding of Italian politics – but one can only note that the bond markets certainly don’t seem to be scared, nor is the EUR/USD. We need to see a 1.3000 break soon, or we risk a squeeze back higher and new highs somewhere between 1.3250 and 1.3350 if we swing above 1.3125 or so. These are great areas to sell strategically if we get there, but we’re in limbo for the moment.

After the Weidmann comments helped to push the euro lower, one would be well advised to watch the press event at 1130 GMT that will feature both the ECB’s Weidmann and Germany’s Finance Minister Schaeuble. Could there be a tipping of hats at a new policy direction from the pair? This looks potentially pivotal.

Stay careful out there. Note that the Fed’s Stein is out speaking at 1600. Mr. Stein is the point-man among the Fed governors on the “reach for yield” issue in credit and asset markets. Any dramatic warnings from this speech that credit markets are excessively complacent/bubbly could serve as a heavy duty warning sign which supports the USD, punishing risk in late trading.

Look out for the IMF/World Bank meeting over the weekend.

Economic Data Highlights

The yen was weaker Friday morning after Japan’s Finance Minister Taro Aso said the G20 participants offered no objections to Japan’s policies. The initial reaction from this development is to jump back into the pro-risk. JPY-short trades as well as JPY crosses jumpedback higher Friday morning. Gold pushed above 1400, and equities in Asia had a positive start. It all looks a bit too easy, thinking we might see some dramatic swings Friday, though not sure of the direction. If 100 falls in USD/JPY and asset markets chime in with their approval, the psychology of the global liquidity trade could mean a further blow-out to the upside in JPY crosses with a swell of support from asset markets – although I remain sceptical after the recent volatility across markets.

The G20 statement will still caution against policies aimed toward competitive devaluation. The South Korean president has complained that Japan’s policies are more of a threat to the country than the situation with North Korea. Look for the Chinese response as well, now that we are on the other side of this meeting, possibly in the coming week if the USD/JPY pushes above 100. As the USD/CNY has fallen to new lows recently, the CNY/JPY level is banging on the door of 15-year highs.

Chart: CNYJPY

We’re likely to get an escalation in the response from China if the CNY/JPY continues higher from here. The pair has gone almost 30% higher over the last 6 months. Chart courtesy of Bloomberg.

CNY/JPY" title="CNY/JPY" width="455" height="224" />

CNY/JPY" title="CNY/JPY" width="455" height="224" />Looking ahead

In Italy, there are renewed efforts to find an Italian president, with a failure possibly leading to yet another vote that may only require a simple majority. The question of whether a functioning government can be formed remains unanswered. I’ll not pretend to have a thorough understanding of Italian politics – but one can only note that the bond markets certainly don’t seem to be scared, nor is the EUR/USD. We need to see a 1.3000 break soon, or we risk a squeeze back higher and new highs somewhere between 1.3250 and 1.3350 if we swing above 1.3125 or so. These are great areas to sell strategically if we get there, but we’re in limbo for the moment.

After the Weidmann comments helped to push the euro lower, one would be well advised to watch the press event at 1130 GMT that will feature both the ECB’s Weidmann and Germany’s Finance Minister Schaeuble. Could there be a tipping of hats at a new policy direction from the pair? This looks potentially pivotal.

Stay careful out there. Note that the Fed’s Stein is out speaking at 1600. Mr. Stein is the point-man among the Fed governors on the “reach for yield” issue in credit and asset markets. Any dramatic warnings from this speech that credit markets are excessively complacent/bubbly could serve as a heavy duty warning sign which supports the USD, punishing risk in late trading.

Look out for the IMF/World Bank meeting over the weekend.

Economic Data Highlights

- Germany Mar. Producer Prices out at -0.2% MoM and +0.4% YoY vs. +0.1%/+0.7% expected, respectively and vs. +1.2% YoY in Feb.

- Eurozone ECB’s Weidmann, Germany’s Schaeuble hold press event (1130)

- Canada March Consumer Price Index (12:30)

- US Fed’s Stein to Speak on Credit Markets (16:00)