The JPY was under some pressure during today’s Asian session as the Japanese second quarter GDP contracted slightly more than anticipated by analysts. The initial estimate was a contraction of 6.8%, while the revised number showed a 7.1% annualized contraction. A worrying sign was that business investment contracted by a larger-than-initially-estimated 5.1% (-2.5% was the initial estimate). The economy’s weak performance was of course due to the sales tax increase on 1st April, but it is an open question now whether the economy can recover during the third quarter. This brought some more speculation about the Bank of Japan eventually deciding to increase its monetary stimulus. In other data about Japan, the country’s current account was also lower than expected at 416 billion yen (444 was expected).

Important Chinese data was also out today, showing exports in August doing slightly better-than-expected, but imports falling as a result of weak domestic demand. According to some analysts, domestic demand is weak due to a property slump in the country.

The pound fell to its lowest against the US dollar since November, retreating below the 1.62 level to fall to as low as 1.6166. The reason was a new poll that showed the pro-independence vote ahead before the September 18 Scottish independence referendum. An independent Scotland would usher in uncertainty about the UK economy and in such a case, the Bank of England could delay hiking up interest rates.

Following the negative August nonfarm payrolls surprise (142 thousand net new jobs versus 225 expected), the US dollar steadied against other majors. Some speculated that the Federal Reserve would now be more cautious in when to raise interest rates, but most saw the data as a one-off sign of weakness that would not sway the Fed. Hence the data is not enough to stop the dollar’s rally but could lead to some consolidation.

USD/JPY rallies to near 6-year highs

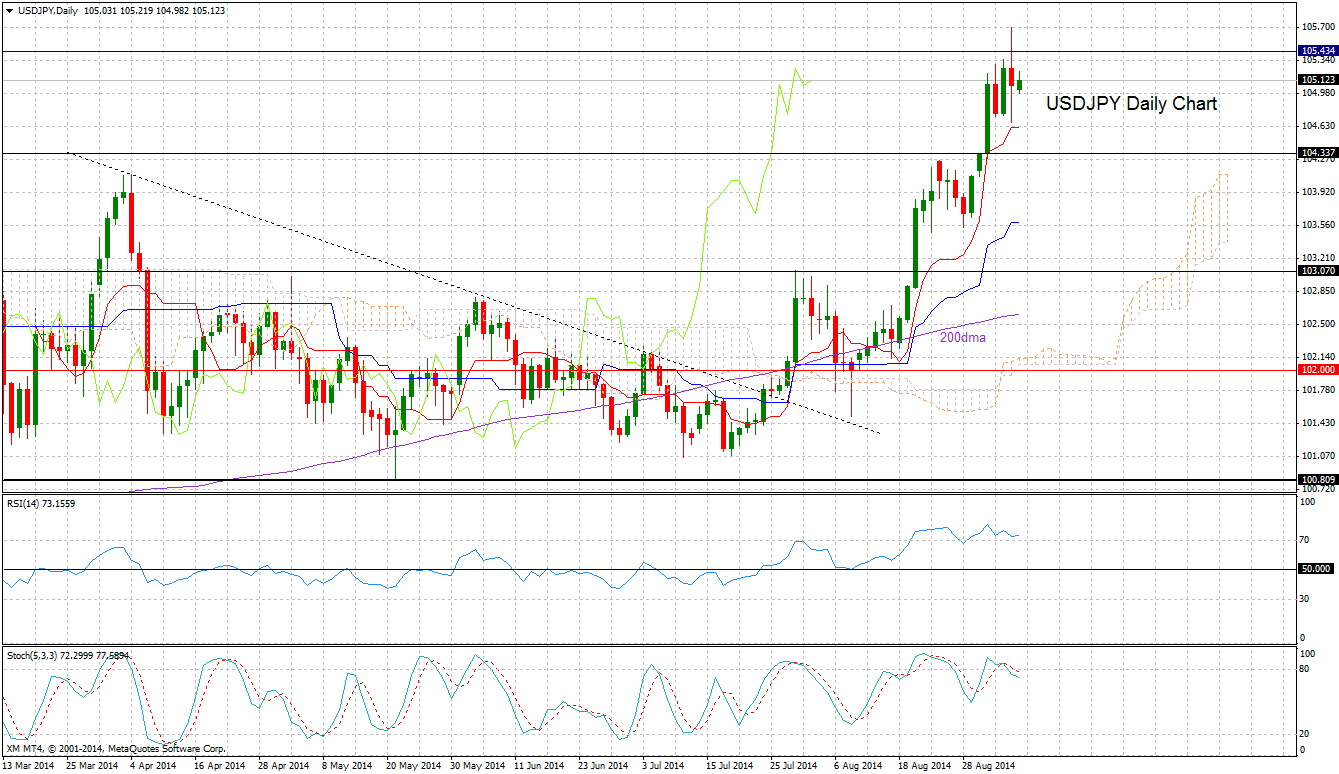

USD/JPY rallied up to new multi‐year high of 105.69 on Friday – the highest since October 2008. The pair broke above the January 2nd high of 105.43.

The short-term daily technicals remain bullish, with most indicators showing upside potential. The tenkan-sen and kijun-sen lines are positively aligned. However the RSI is at extreme levels above 70 warning that the market is overbought. Also prices are well above the Ichimoku cloud.

Support is seen at 104.33 while the next level of resistance is at the psychological level of 106.00.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

JPY Under Pressure Following Disappointing GDP

ByXM Group

AuthorTrading Point

Published 09/08/2014, 03:16 AM

Updated 05/01/2024, 03:15 AM

JPY Under Pressure Following Disappointing GDP

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.