Investing.com’s stocks of the week

Market Brief

The Japanese consumer price inflation slightly retreated from 3.7% to 3.6% year to June, prices ex-food and energy advanced 3.3% y/y (vs. 3.4% last). In Tokyo, the headline CPI decelerated from 3.0% to 2.8% in year to June, while ex-food and energy advanced from 2.0% to 2.1%. USD/JPY and JPY crosses did little in Tokyo as the BoJ has already anticipated and communicated the current slowdown in consumer prices, thus the June inflation report didn’t trigger speculations in favor of additional monetary stimulus. USD/JPY gained to 101.83, offers at 101.80/102.07 (June-July downtrend top and 50-200 dma) region continue capping the upside, stops are mixed above 102.00. EUR/JPY remains ranged with trend momentum marginally bearish. Bids above 136.23 (2014 low) continue giving support, more bids are eyed at 135.80 (Feb-July downtrend channel base).

The significant improvement in July preliminary PMI readings have clearly helped lifting the EUR-complex higher in the second half of the week. EUR/USD remained capped at 1.3485 yesterday as the overall bias remains comfortably negative. We remain seller on rallies. Option related offers trail below 1.3450 due before the closing bell.

GBP/USD deepens correction. The pair retreated to 1.6967 in New York yesterday; option offers at 1.7000/25 intensified the selling pressures at this region. The negative short-term technicals suggest further extension of weakness with first line of support seen at 1.6923/64 (June 18th low / 50-dma). In the mid-run, the pair remains comfortably in its year-to-date uptrend channel (1.6894/1.7367). EUR/GBP advanced to 0.79396, offers pre-21-dma remained intact. We remain seller on rallies as long as resistance at 0.79385/0.79664 (21-dma today & June-July downtrend top) holds.

In New Zealand, the Kiwi consolidates post-RBNZ weakness. NZD/USD retreated to 0.8561 overnight, fresh offers capped the upside pre-0.8600. The kiwi remains an interesting currency for carry strategists, the current weakness is likely to attract dip buyers approaching 0.8546 (year-to-date uptrend base), the market remains net long. In Tokyo, NZD/JPY recovers above 87.000; the pair is expected to head back towards the daily Ichimoku cloud cover (87.578/87.732).

The US 10 Year T-Note government yields tested 2.52% amid supportive US jobless claims decline in week to July 19th. In an interview to CNBC, the US President Obama said Fed’s focus to reduce unemployment has been appropriate while the lower rates have likely boosted the stock markets. The DXY index continue gaining field at the highest levels over a month. We will be closely monitoring June durable goods data before the weekly closing bell.

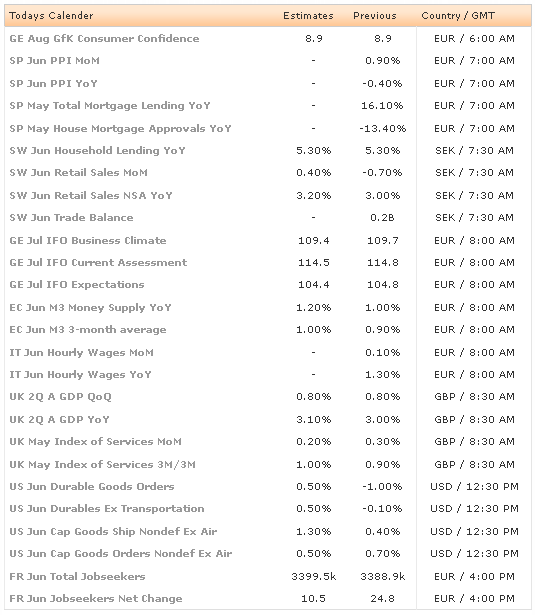

Today, the economic calendar consists of German August GfK Consumer Confidence, Spanish June PPI m/m & y/y, Swedish June Trade Balance, Household Lending y/y and Retail Sales m/m & y/y, German IFO Business Climate, Current Assessment and Expectations in July , Euro-Zone June M3 Money Supply y/y, UK 2Q (Prelim) GDP q/q & y/y, UK May Index of Services, US June Durable Goods and French June Jobseeker change and Total Jobseekers.

Currency Tech

EUR/USD

R 2: 1.3550

R 1: 1.3490

CURRENT: 1.3467

S 1: 1.3400

S 2: 1.3296

GBP/USD

R 2: 1.7105

R 1: 1.7000

CURRENT: 1.6984

S 1: 1.6964

S 2: 1.6923

USD/JPY

R 2: 102.27

R 1: 102.03

CURRENT: 101.77

S 1: 101.07

S 2: 100.76

USD/CHF

R 2: 0.9156

R 1: 0.9038

CURRENT: 0.9026

S 1: 0.9000

S 2: 0.8970