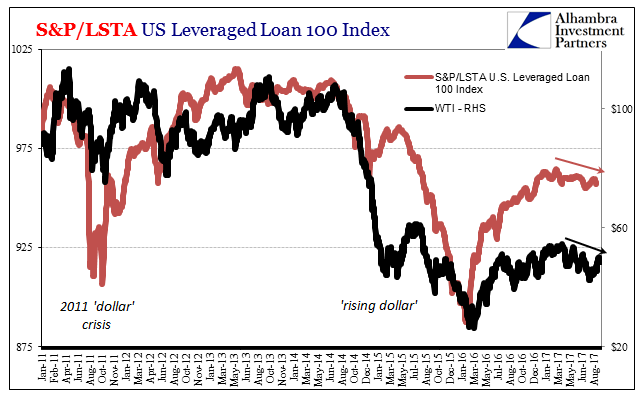

Brexit, Trump’s election, even the Bank of Japan rumored to be thinking helicopter. Last year was the year of thinking differently and therein was hope. No matter how many times some markets and especially media blindly accepted the “stimulus” or “recovery” judgments of economists over the years, by 2016 and the near-recession globally that accompanied a “rising dollar” that nobody seemed able to understand and explain it had become clear there were no solutions to be found in them.

To even have the chance of getting out of this mess there would have to be bold, even radical shifts. On the political front, at least, these seemed possible. In policy terms, it was perhaps always more of a fantasy than of rational expectations.

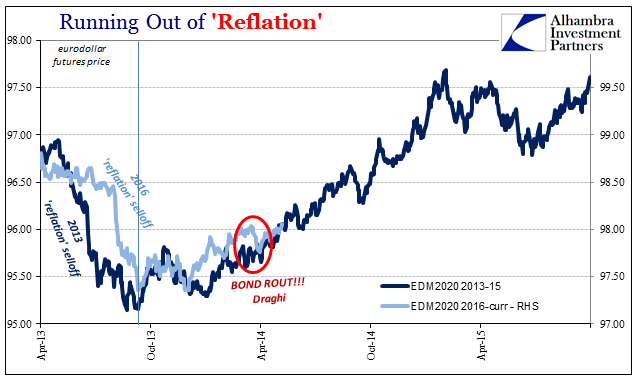

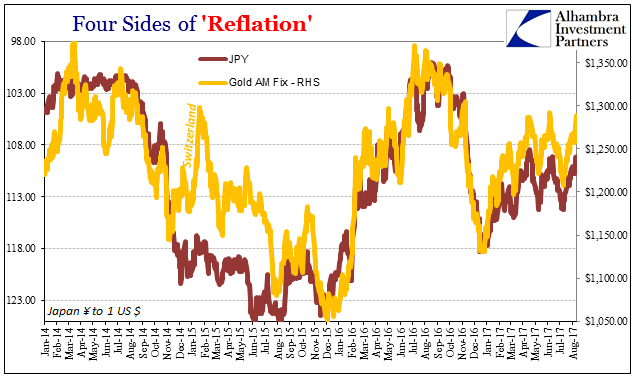

The economy of 2017 has thus far been thoroughly disappointing, only proving this thesis. Without something meaningfully different altering the whole lousy global paradigm, the world can only remain stuck. Markets (except stocks) have been increasingly trading dead against “reflation” as if it was truly 2014 all over again.

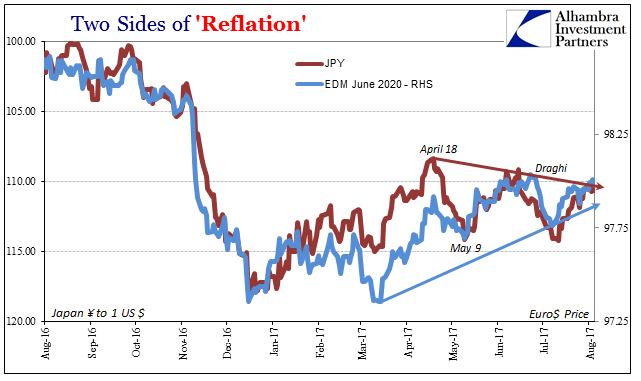

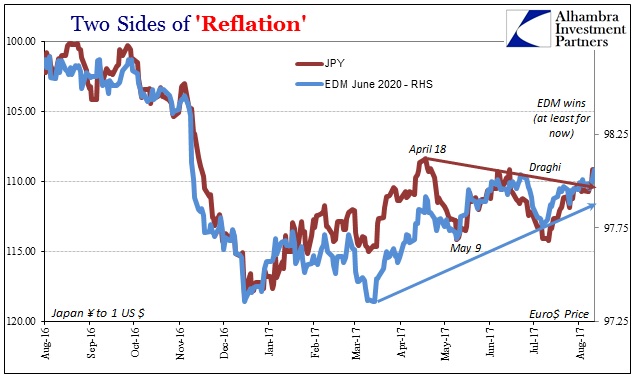

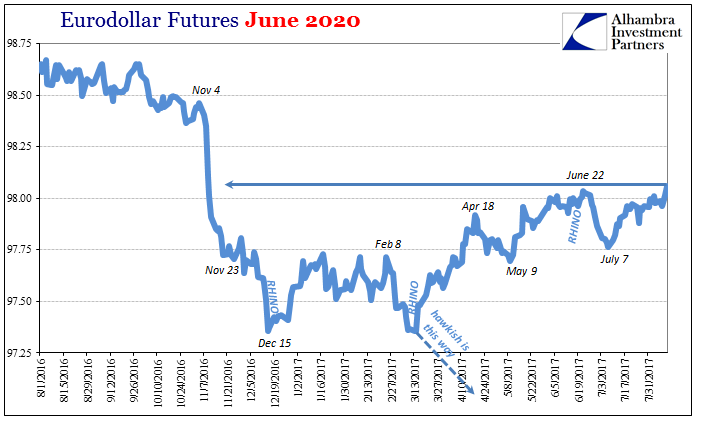

Earlier this week there was something of a test on this count in two important elements. JPY had gained since April a bit of “reflation” emphasis, a slight but noticeable downtrend (devaluation) in the currency exchange. Moving decidedly the other way has been Eurodollar Futures. Prices ever since the March “rate hike” have been rising, meaning expectations for lower future money rates even though the Federal Reserve is supposed to be on track to do however many more.

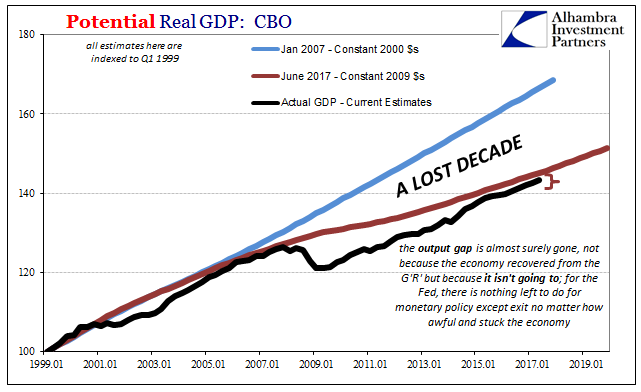

That is a hugely important change in direction for “reflation” overall, meaning that the inflection against how monetary policy is being interpreted explains a whole lot up to and including the reborn “conundrum.” When the Fed acted in March, at Yellen’s press conference after the announcement she essentially stated that to the most optimistic of optimists, as the Fed’s models had been at least until 2016, there was no acceleration forthcoming. That just confirmed that the reason for the Fed’s exit is not what is claimed in the media.

I wrote the day after the policy decision and Yellen’s usual unsteady performance in March:

It seems as if there is a lot of confusion about monetary policy because it is believed monetary policy is tied to economic strength or weakness; therefore it seems contradictory that the Fed would raise rates when there is only weakness (let alone still ten years of no recovery). This is simply a false impression, but one, again, the Fed is allowing to continue for its own reasons. Monetary policy is tied only to the output gap, to which “slack” or its end is an indication. If the output gap is gone, then monetary policy is gone.

As of today, some markets get that, where in others it has been slightly more complicated. This week, however, JPY joined EDM (and UST’s) in anti-“reflation.” It will be labeled as fear over Korea, but this is false. Eurodollar futures have now retraced more than half of the “reflation” selloff.

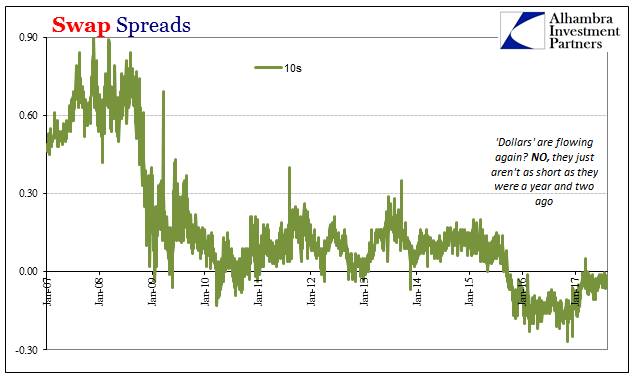

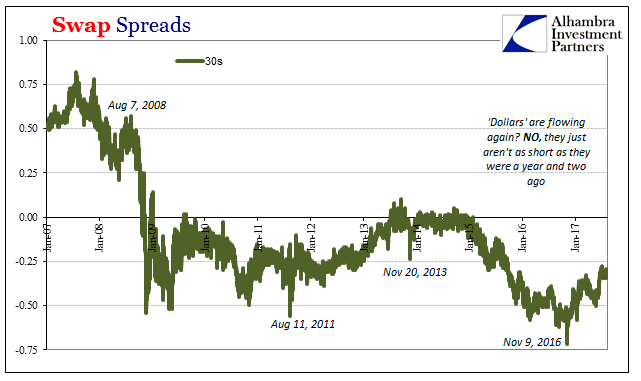

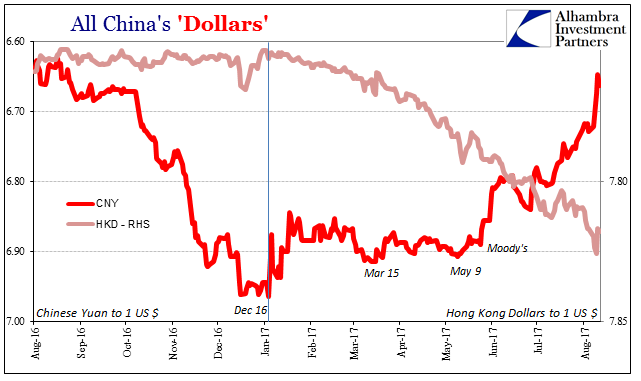

Nothing has really changed even in “dollar” terms. The most charitable description, which happens to be the most accurate, is that monetary pressure is less this year than last. That doesn’t mean, unfortunately, the monetary system is fixed or on its way to being fixed, or that conditions might be actually favorable for the first time in a decade, it only suggests that today isn’t as completely awful as it had been over the past few years leading up to the near-recession of 2015-16.

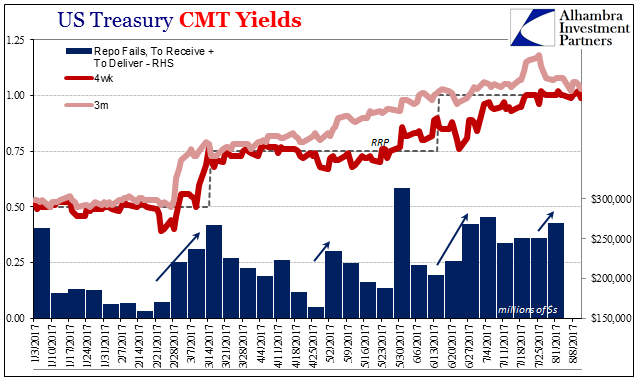

There are plenty of current indications indicating still overall “tightness” in “dollars”, even if the intensity of it has diminished relative to the “rising dollar” period.