With today's NFP report and strained US-China trade relations, JPY crosses have continued to garner attention. So today we look at the daily charts of USD/JPY, CAD/JPY and CHF/JPY to highlight key levels and patterns.

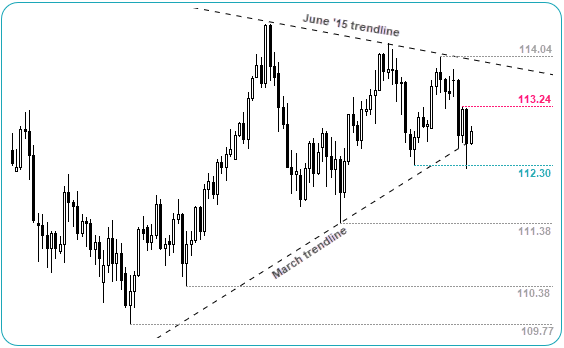

USD/JPY Daily

- After coiling and failing to break above the June ’15 trendline, JPY is attempting to break the March trendline.

- The bias is for a move towards 111.38 whilst 113.24 caps as resistance.

- Expect the pair to be sensitive to today’s NFP report and any US-China trade headlines.

CAD/JPY Daily

- A bearish breakout has invalidated a bullish channel.

- We’d like to see prices consolidate before its next leg lower. Look for 84.61 or the lower trendline to cap as resistance.

- A break beneath 83.63 brings the 82.17 and 80.54 lows into focus. Keep an eye on CAD employment figures alongside NFP.

CHF/JPY Daily

- Near-term momentum favours bullish setups within the ascending channel.

- However, a stronger downtrend has dominated momentum since a bearish pinbar high.

- Target (NYSE:TGT) the 114.41 high or upper trendline whilst within the channel or wait for a break of 112.86 to confirm resumption of its downtrend.