General market sentiment is likely to be the key driver of USD crosses this week, with the focus being IMF's World Economic Outlook (Tuesday) and China’s 1Q GDP (Friday). Any disappointments and subsequent dent to risk appetite should be generally USD supported against EM and most of the G10 FX (bar JPY). On the data front, the key focus will be on the US March retail sales (Wednesday) and March CPI (Thursday). Our economists expect the former to decline due to disappointing car sales (retail sales ex auto and gas should in fact tick higher), while the headline CPI should increase towards 1.1%YoY and core CPI print 2.2%YoY. However, such data outcomes, in isolation, are unlikely to be enough to generate broad-based USD strength.

I expect further flows from various market participants to continue to support JPY. First, Friday’s reluctance for JPY to weaken (indicating de-risking ahead of the weekend) suggests that ‘the Street’ has not traded JPY long in significant amounts last week. Note that CFTC data showed the most net long positions building in the first four weeks of the year. Instead, our client conversations focusing on the BoJ and its ability to weaken JPY are suggesting to us that the market has not fully adopted our view, suggesting JPY strength is staying with us for even longer. Second, Japan’s retail accounts may still need to wind down their JPY-funded carry trades, suggesting more of this ‘P&L’ driven JPY buying in store. Third, pension funds and financial institutions' foreign assets relative to total assets are near historical highs, and most importantly still hugely currency-unhedged. The GPIF had allocated 36% of its portfolio to foreign assets at the end of December 2015.

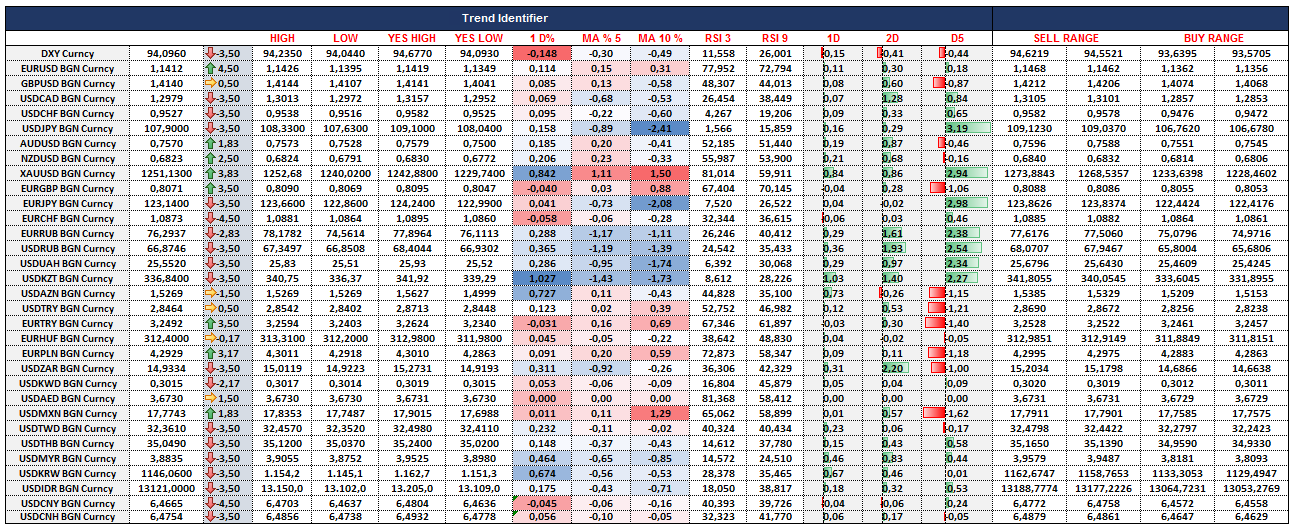

Price action has seen the USD lose ground over the course of last week. Main driver was JPY, but CHF has also been strong. Commodities led by oil have gained ground, with the main gainers being RUB and CAD. AUD and NZD have lagged on weak China inflation data and recent lack of momentum. Asian emerging markets, however, have done much better against the USD. It seems EM strength is kicking back in this week, as almost all Asian emerging markets have gained, though equities remain a tad weaker. Emerging markets are likely to stay relatively strong, with even currencies threatened by rate cuts showing signs of strength. Euro seems to remain strong, with credit indexes drifting lower and chances of aggressive ECB action relatively less now. Gold is in a strong uptrend in this low interest rate environment, trying to break 1250s.