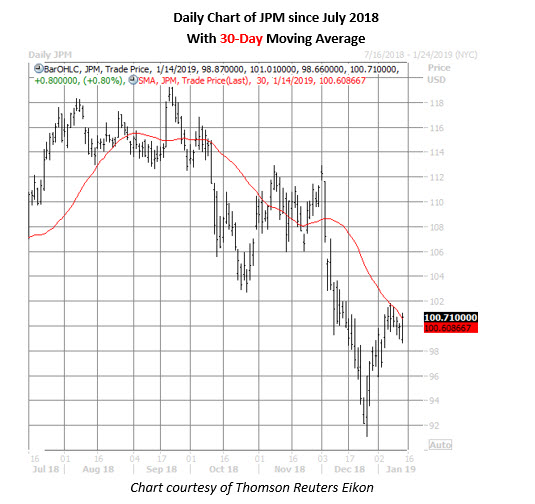

Earnings season gets underway this week, with several big-cap financial names set to report. Citigroup (NYSE:C) took its turn in the earnings confessional bright and early this morning, unveiling a sharp drop in fixed-income trading revenue. While C stock was last seen trading higher, sector peer JPMorgan Chase & Co. (NYSE:JPM) is up 0.8% at $100.71 ahead of the big-cap financial firm's own quarterly results, which are due before the market opens tomorrow, Jan. 15.

Over the past eight quarters, JPM stock has closed lower in the session after earnings six times -- including the last three in a row. Overall, the shares have averaged a 1.2% next-day move in that two-year time frame, while the options market is pricing in a 4.9% swing for tomorrow's trading, based on implied earnings deviation data from Trade-Alert.

Options traders appear to be bracing for another post-earnings move to the downside. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), JPM's 10-day put/call volume ratio of 0.68 ranks in the 80th annual percentile. While this shows calls have outpaced puts on an absolute basis, the rate of call buying relative to put buying has been quicker than usual.

Skepticism is rising outside of the options pits, too, with short interest up 9% in the two most recent reporting periods to 22 million shares -- the most since early November. However, this accounts for just 0.7% of JPM stock's available float, meaning the bearish bandwagon is far from overcrowded.

Meanwhile, analysts have started issuing bear notes on the big-cap bank stock. However, eight of 15 brokerages still say it's a "buy" or better, with not one "sell" on the books. Plus, the average 12-month price target of $115.88 is a 15% premium to current trading levels.

It's been a rough stretch for JPM shares, which came in to today's trading on a four-day losing streak. While the stock is up 10.7% from its late-December low near $91, it's still down 10.4% year-over-year and struggling against short-term resistance at its 30-day moving average.