Have you been eager to see how JPMorgan Chase & Co. (NYSE:JPM) performed in Q4 in comparison with the market expectations? Let’s quickly scan through the key facts from this New York-based major global bank’s earnings release this morning:

An Earnings Beat

JPMorgan came out with earnings of $1.76 per share, which beat the Zacks Consensus Estimate of $1.69. Earnings in the reported quarter exclude $2.4 billion or 69 cents per share charge related to the impact of the tax act.

Improved revenues primarily drove earnings beat.

How Was the Estimate Revision Trend?

You should note that the earnings estimate revisions for JPMorgan depicted pessimistic stance prior to the earnings release. The Zacks Consensus Estimate fell by penny over the last seven days.

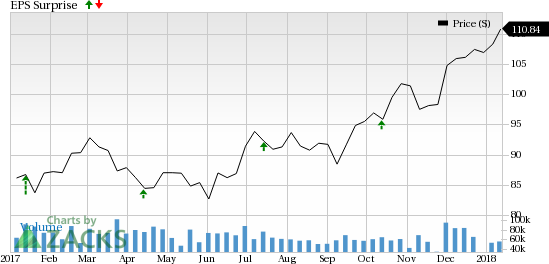

Nonetheless, JPMorgan have an impressive earnings surprise history. Before posting the earnings beat in Q4, the company delivered positive surprises in all prior four quarters, as shown in the chart below:

Overall, the company has a positive earnings surprise of 12.8% in the trailing four quarters.

Revenue Higher Than Expected

JPMorgan recorded revenues of $25.5 billion, which surpassed the Zacks Consensus Estimate of $25 billion. Also, it compared favorably with the year-ago number of $24.3 billion.

Key Q4 Statistics:

- Investment banking fees grew 10% year over year

- Fixed Income Markets revenue plunged 27% year over year

- Provisions for credit losses jumped 51% year over year

- Average Core loans up 6% year over year

- Returned nearly $6.7 billion to shareholders through dividends and share buybacks

- Basel III common equity Tier 1 ratio of 12.1%, as of Dec 31, 2017

What Zacks Rank Says

The estimate revisions that we discussed earlier have driven a Zacks Rank #3 (Hold) for JPMorgan. However, since the latest earnings performance is yet to be reflected in the estimate revisions, the rank is subject to change. While things apparently look favorable, it all depends on what sense the just-released report makes to the analysts.

(You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.)

Check back later for our full write up on this JPMorgan earnings report!

Zacks Editor-in-Chief Goes ""All In"" on This Stock

Full disclosure, Kevin Matras now has more of his own money in one particular stock than in any other. He believes in its short-term profit potential and also in its prospects to more than double by 2019. Today he reveals and explains his surprising move in a new Special Report.

Download it free >>

J P Morgan Chase & Co (JPM): Free Stock Analysis Report

Original post

Zacks Investment Research