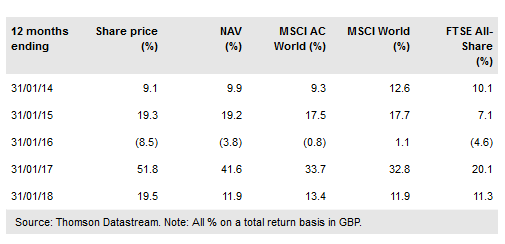

JP Morgan Global Growth & Income (LON:JPGI) has enjoyed a strong period of share price performance since adopting a higher distribution policy in mid-2016.

NAV returns have also kept pace with the benchmark MSCI AC World index, in spite of the trust’s focus on long-term valuations in an environment where market returns have been driven more by ‘growth at any price’.

JPGI is the only UK retail investment product offering access to JP Morgan Asset Management’s (JPMAM’s) global focus investment process, which uses a large team of expert sector analysts to identify undervalued stocks with significant profit potential.

Manager Jeroen Huysinga remains positive on the global economic outlook for at least the next 12-18 months, and has been finding particular opportunities in industrial cyclicals and financials, while being significantly underweight in technology stocks.

Investment strategy: Seeking value with catalysts

JPGI has been managed using JPMAM’s global focus investment process since October 2008. The process is implemented by manager Jeroen Huysinga, backed by a large global team of analysts who use JPMAM’s dividend discount model to rank a universe of c 2,500 stocks into valuation quintiles.

For JPGI, companies in the cheapest two quintiles are subjected to further tests, and must display significant profit potential, and a catalyst for re-rating within six to 18 months, in order to be considered for inclusion in the portfolio of 50-90 stocks. Within broad allocation limits, stock selection is largely unconstrained by geography and sector.

To read the entire report Please click on the pdf File Below: